Data analysis: Nearly two-thirds of workers heard about auto-enrolment through the media rather than from their workplace, sparking concerns that employers are not playing a strong enough role in communicating the reform.

The auto-enrolment process is about to enter a critical stage, with some 28,000 employers expected to stage during the peak period this year.

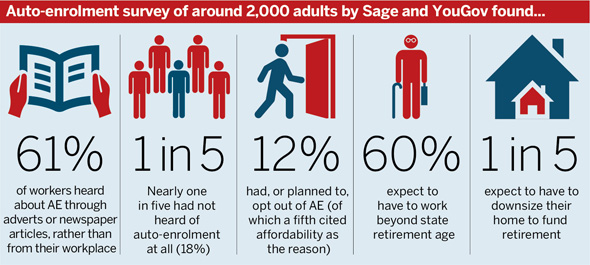

But the study released this week by payroll services company Sage, which surveyed more than 2,000 working adults over the age of 22, revealed nearly one in five had not heard of auto-enrolment at all.

Lee Perkins, managing director of Sage’s small and start-ups business division, said employers play an “absolutely crucial” role in making auto-enrolment a success.

“The obligation is with them to ensure it is properly understood by employees and that their workforce understands their own commitments,” he said. “Without the buy-in of employers, auto-enrolment cannot be the success it needs to be to plug the pensions gap."

Paul Macro, UK defined contribution and savings client leader at consultancy Mercer, agreed the onus should be on employers. “Not just because it’s the right thing to do… but the employer is putting money into the scheme and they should be getting value and recognition from these contributions,” he said. “This could be viewed as self interest, but which leads to the right result for members.”

Employers are equally responsible for AE communications – it’s a workplace pension after all

Alex Thurley-Ratcliff

The survey also found that 60 per cent of people expect to have to work beyond the state retirement age in order to fund their later years, while around a fifth believe they will have to have to downsize their home to cover the cost of retirement.

Of the 12 per cent of respondents who said they had opted out or plan to opt out, a fifth cited affordability as the reason, while two-fifths said it was because they already paid into a private pension.

Sharing the burden

Alex Thurley-Ratcliff, head of research and development at communications company Shilling, said the comms burden should be shared equally between employers and government, and the process could also benefit staff relations.

“Employers are equally responsible for AE communications – it’s a workplace pension after all,” he said. “Those that simply defer communications to a third party are missing out on an opportunity to build trust and engagement with their employees.”

Thurley-Ratcliff added that supportive employers who are engaged with auto-enrolment will boost understanding and subsequent retirement outcomes for their staff.

He said companies should ensure communications are in line with their workforce’s needs and “not relying on the same old standard approach”.

“Bring your employees into the process – find champions and real-life employees who can help explain the process in a positive way,” added Thurley-Ratcliff.

Jon Pearce, group creative director at communications company Ferrier Pearce, said an engaged workforce has a positive impact on loyalty and retention.

He added that employers should take the time to ensure communications are as specific to their own brand to achieve maximum staff engagement.

“Where possible, avoid using generic unbranded material provided by the government or the provider,” he said.

Research by consultancy Towers Watson, highlighted by Pensions Expert last week, suggested a disparity between many employers’ pension goals and the expected member outcomes, with seven in 10 employers saying they considered it their duty to provide services that enable employees to retire, compared with nearly two in 10 who believe their defined contribution plan will deliver an 'adequate' income.