Equity markets have endured significant volatility over the past two weeks since the US introduced international trade tariffs on most of its trading partners. Jon Yarker looks at how pension schemes have reacted and helped their members understand the situation.

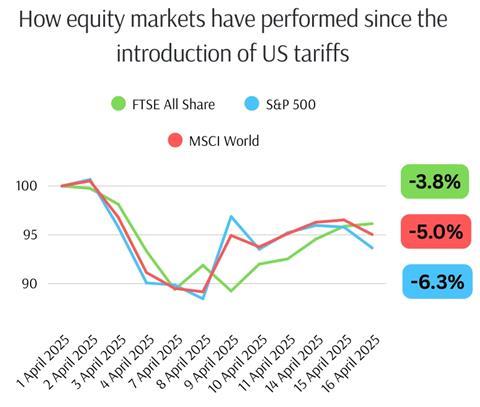

On 2 April 2025, US president Donald Trump signed executive order 14257 to mark what he called “Liberation Day”, with tariffs introduced against a range of countries, ranging from 10% to highs of 49%. In the ensuing days, markets went into freefall with an estimated $5trn (£3.8trn) wiped off the global stock market.

Defined contribution schemes, by their nature, are long-term investors, so many have refrained from making knee-jerk reactions in the past two weeks.

Keeping calm through the chaos

“None of our clients have sought to conduct any ‘ad-hoc’ rebalancing in the past week,” says Christopher Inman, partner at Aon. “Lower liquidity levels and generally higher trading costs during periods like these can detract from such endeavours. Moreover, human biases often lead to many investors ‘buying high and selling low’ which leads to ruin.”

At Nest, chief investment officer Liz Fernando explains that the strategy’s design to span multiple market cycles has been beneficial. However, as is the case for many institutional investors, such severe market volatility led to a “drift” in some of the scheme’s target allocations.

“We’re focused on thoughtful rebalancing to maintain alignment with our long-term objectives, while avoiding hasty, reactive decisions that could compromise long-term outcomes for our members,” explains Fernando.

“We’re proactively looking for opportunities to capitalise on these market dislocations, allowing us to rebalance member portfolios at attractive valuations.”

WTW’s LifeSight is another scheme where the team is refraining from wholesale reactions. Andrew Doyle, senior director of investments at WTW, says: “We have not felt compelled to make strategic changes as a result of the volatility.

“Over the last couple of years we have used our scale and influence on design and implement innovative equity solutions at very low fees, and these have contributed positively to performance and helped protect members.”

“We’re focused on thoughtful rebalancing to maintain alignment with our long-term objectives, while avoiding hasty, reactive decisions that could compromise long-term outcomes for our members.”

Liz Fernando, Nest

Staying the course may be the consensus view but some schemes found themselves in compromising positions when Liberation Day hit.

“We had some schemes already in the process of implementing changes as part of long-term strategic decisions, and they’ve now had to think very carefully about whether or not to proceed,” says Hugo Gravell, investment consultant and principal at Barnett Waddingham.

“Some have cancelled trades as they didn’t want to be caught out, while others designed their trades well enough to avoid problematic buying and selling.”

Calming the crowds

Investment professionals may not have been distressed by Liberation Day, but this would have been a different experience for members – many of whom would have frantically checked their portfolios and likely been alarmed.

“To reassure members, our contact centre is also prepared to help explain to members who have any concerns about potential dips in their pension pots,” explains Fernando.

“We want to reassure members that Nest’s investment strategy is carefully designed to try to protect our members’ money from these sort of market fluctuations and encourage them to try not to be overly concerned by short term gains or losses.”

“We briefed our member-facing teams to ensure they have the tools and information to be able to explain and manage these circumstances with members.”

Andrew Doyle, WTW

A similar approach was followed at WTW, where member accounts hosted upfront ‘alert’ messages with information about how LifeSight is prepared for such eventualities.

“We also briefed our member-facing teams to ensure they have the tools and information to be able to explain and manage these circumstances with members,” adds Doyle. “Finally, we are also reviewing our benefit statement wording to reflect the market circumstances appropriately.”

Many other pension schemes across the country posted similar messages on their member-facing websites in an effort to reassure them as markets fell and headlines told of major investment losses.

What now for investors?

Despite the ‘stay calm’ mentality, questions are naturally raised as to whether or not this is the beginning of something even long-term investors cannot ignore.

“There’s no doubt that these recent market developments are prompting many investors to reassess the risks associated with certain regions,” concedes Fernando. “However, we don’t believe that a single geopolitical development, even something as significant as a trade war, is likely to fundamentally disrupt the principles of global diversification in the long run.”

Barnett Waddingham’s Gravell argues it is simply too early to say and that the unpredictability of the policies themselves – with Trump already repealing some tariffs as quickly as he announced them – warrants further analysis.

“If someone says they know the answer they are deluded,” says Gravell, when asked what will happen next. “Ultimately there are potentially signs of a positive feedback loop, in terms of reversals and pauses in the tariffs has suggested the market reaction has not gone unnoticed and the underlying economics of it all will out. We will keep closely monitoring the situation.”