Equity market returns helped fiduciary managers post strong overall performance last year, according to new analysis from XPS Group.

The analysis, which covered 17 model portfolios from 14 fiduciary managers, found that all portfolios produced a positive net return during 2024.

However, the model growth portfolios submitted by managers to XPS often did not represent the actual returns experienced by clients, the consultancy group said.

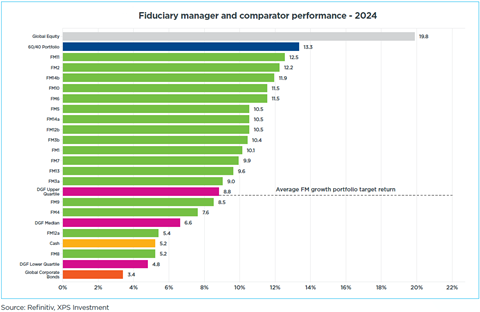

The 14 managers’ growth portfolio returns ranged from 5.2% – marginally underperforming cash – to 12.5%. The research anonymised the providers.

The majority (15 of 17 portfolios) beat the average performance from diversified growth funds over the year of 6.6%. None could keep pace with global equities or a 60/40 model portfolio, but all were less volatile.

XPS’s global equities measure, the FTSE All World Total Return index, gained 19.8% in sterling terms last year.

How did fiduciary managers really perform?

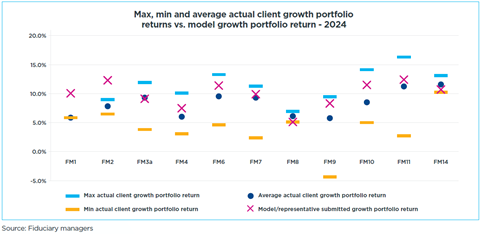

XPS obtained data on actual experienced returns from pension schemes using some of the fiduciary managers in the report.

While the data was anonymous, it showed a wide range of outcomes for clients of the same firm – sometimes in excess of 10 percentage points.

Two fiduciary managers reported a model portfolio return higher than any of their clients actually experienced, while another six had model portfolios that outperformed their average client outcome.

XPS said the data showed that “schemes’ growth portfolios can be materially different from the fiduciary manager’s model growth portfolio approach”.

“It should be taken into account that actual scheme growth portfolios can be different from a model growth portfolio in terms of asset allocation, levels of liquidity, return and risk targets,” the consultancy group said.

André Kerr, head of fiduciary management oversight at XPS, said: “Despite 2024 being a favourable market for most growth assets we still have seen a divergence in performance from fiduciary managers and a wide range of outcomes for pension schemes.

“Since the end of February 2025 markets have been exceptionally volatile, with the volatility expected to continue through 2025.

“We expect that the performance of fiduciary managers and the experience of clients to be vastly different and may see a reversal of some of the performance of fiduciary managers seen in 2024.”

Getting value from fiduciary management

Relative to stated targets, fiduciary manager performance was mixed, XPS said. Five managers’ model portfolios underperformed relative to their stated targets, while 10 outperformed. However, outperformance ranged from 0.1 percentage points above the target to 5.3 percentage points.

Longer term, XPS said that most fiduciary managers outperformed diversified growth funds over five years on a risk-adjusted basis.

“However, not all [managers] added value, emphasising the importance for trustees to carefully assess the cost-benefit of active management and tactical asset allocation,” XPS’s report stated.

Three providers had two portfolios featured in the XPS report. These reflected lower-cost options typically offered to smaller pension schemes.

The model growth portfolios for two of these providers showed marginal outperformance from the lower-cost model relative to the regular model. However, the third provider saw its lower-cost model produce a return almost double that of the regular model portfolio.