The Pearson Pension Plan is encouraging members of its auto-enrolment section to switch to its money purchase section, where it says they will be able to pay in lower contributions but save more.

Minimum auto-enrolment contributions for employers increased to 2 per cent from 1 per cent in April last year, while minimum employee contributions rose to 3 per cent from 1 per cent.

We undertake regular communication to members of the AE section detailing the differences between the sections

Stephen Beaven, Pearson

More recently, earlier this month, contribution levels rose again. Employees now have to pay a minimum of 5 per cent, while employers are required to put in a minimum of 3 per cent – bringing total minimum contributions up to 8 per cent.

Consultation leads to contribution hike

The Pearson Pension Plan has highlighted on its website that some defined contribution members may be able to save more while contributing less, by switching from the auto-enrolment section of its DC scheme to the Money Purchase 2003 Section of the plan.

Members in the MP03 section previously paid a minimum contribution rate of 2.5 per cent of pensionable salary.

“To make sure that the MP03 Section continues to meet the auto-enrolment requirements, Pearson undertook a consultation regarding amendment to the Rules of the Plan so that the minimum level of contributions in the section was increased from 2.5% to 3%,” according to an update in April.

Stephen Beaven, group pensions director at Pearson, says the proposal to raise minimum contribution rates in the MP03 section was agreed by the company, members and the trustees. The increase to both member and company contributions took effect in the April payroll.

Previously, total minimum contributions in the MP03 section were 7.5 per cent – with Pearson paying a minimum of 5 per cent and employees paying a minimum of 2.5 per cent.

This total minimum contribution level in this section has now risen to 9 per cent – with employees paying a minimum of 3 per cent of pensionable salary and the employer contributing a minimum of 6 per cent.

This is one percentage point higher than the 8 per cent total minimum contributions in the auto-enrolment section, where employees pay a minimum of 5 per cent of qualifying earnings.

Members could switch to save more

In its April update, the scheme reminded members that if they are a member of the MP03 section they have the opportunity to pay a higher amount.

Members in that section can pay in a higher percentage depending on their age. In addition, the company doubles the member’s contribution subject to certain limits.

Total maximum contributions for members under 30 are 15 per cent, while total maximum contributions for 33-44 year olds and those over 45 are 18 per cent and 24 per cent respectively.

The plan has informed members that if they would like to switch from the auto-enrolment section to the MP03 section they can complete an online form.

“We undertake regular communication to members of the AE section detailing the differences between the sections,” says Mr Beaven.

He adds that during the consultation “we visited the Pearson office sites nationwide where Pearson pension team members were available to answer questions and provide information”.

During the remainder of the year there is a programme of communication planned, including face-to-face, virtual and written methods.

The auto-enrolment section makes up around 30 per cent of the active membership. “Approximately 10 per cent of AE members made the switch. Although we expect more to do so in the future,” Mr Beaven notes.

Some companies keen to manage contribution costs

Jon Parker, director of DC and financial well-being consulting at Redington, says: “We’ve had a few clients think pretty carefully about what they do around their contribution design in light of AE.”

Anything that gives a personalised view is really important

Karen Partridge, AHC

As the auto-enrolment default rates have gradually crept up – moving closer to non auto-enrolment scheme rates – “they’ve all had big debates around the merits of continuing to run two structures, because it adds complication”, say Mr Parker.

Some schemes have decided to offer the opportunity for those on the auto-enrolment rate to voluntarily go into the higher non auto-enrolment rate.

However, some pension plans have moved in the other direction, where the auto-enrolment rates have become the single structure for all members and schemes have brought the employer contribution down.

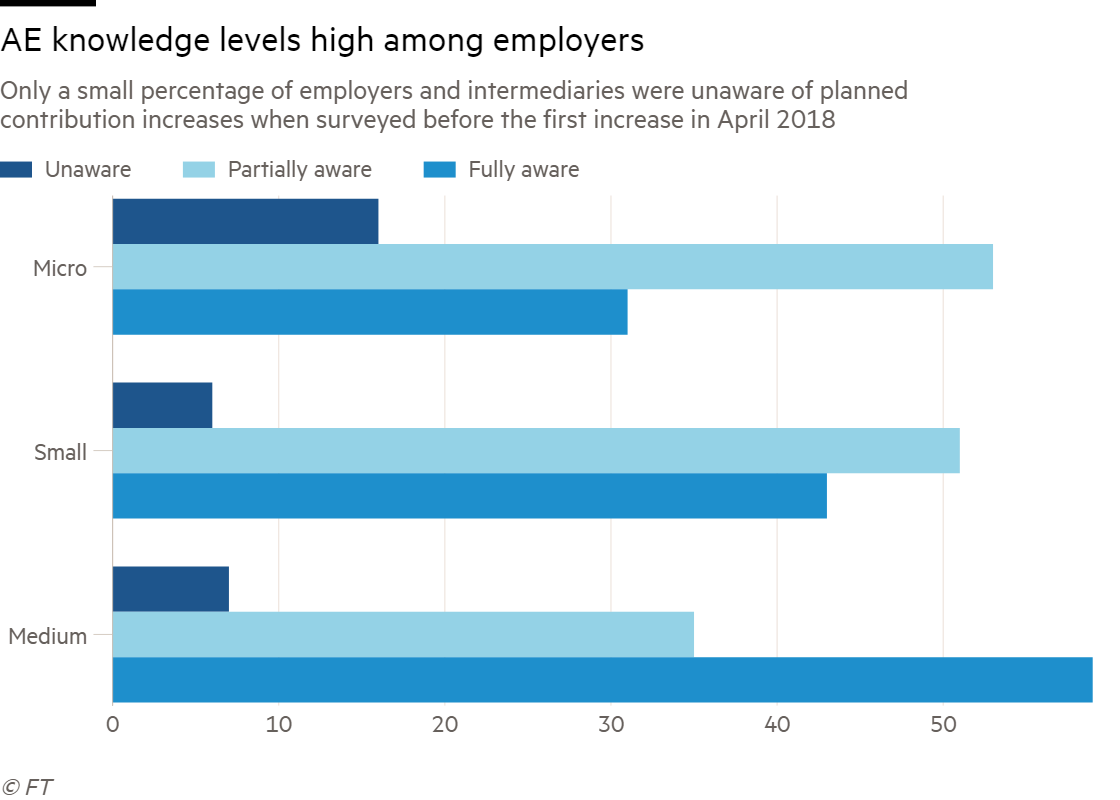

Source: The Pensions Regulator

Mr Parker says as an example that one client had a structure where the minimum employer contribution was 6 per cent and the minimum employee contribution was 3 per cent.

They decided to change this to be in line with the auto-enrolment structure, switching to a minimum 3 per cent employer contribution and a minimum 5 per cent employee contribution.

The main reason for this change was the fact that the company was under financial pressure.

While the development did not dramatically affect end outcomes, with the aggregate amount only coming down by one percentage point, “the balance of responsibility shifted quite substantially on to the employee”, Mr Parker notes.

More than 10m workers have been brought into workplace retirement saving by auto-enrolment since 2012.

Rates of cessation and opt-out at the end of June 2018 remained consistent with levels before the planned contribution increase last year, according to the Department for Work and Pensions’ December 2018 auto-enrolment evaluation report.

While some employers have welcomed the auto-enrolment increases, some have been less favourable due to the increased company cost, says Paul Leandro, partner, workplace health and wealth at consultancy Barnett Waddingham

“I suspect there are some employers out there that haven’t really thought this through, and the increased contributions could impact on them more than they expect, and there might be some sort of retrospective change,” he adds.

However, the DWP has said that the emerging findings from its research with new employers – due to be published this year – suggest that the reality of implementing auto-enrolment tended to be less burdensome than companies had expected.

Range of comms methods most effective

Karen Partridge, head of client services for UK and Australia at communications specialist AHC, points out that the contributions in the two different scheme sections in Pearson’s case are based on a different salary measure.

Auto-enrolment contributions are based on qualifying earnings, and the MP03 section contributions are based on pensionable pay.

“That’s an important differentiator,” she says, adding: “That’s the case in quite of a few of the companies that we’ve dealt with.”

From an employee point of view, the main thing they will want to know is what it is going to cost them.

This is where online calculators or modelling tools can come in useful for members, so they can work out what it means for them.

“Anything that gives a personalised view is really important, whether that’s a modern tool or whether you give them an illustration that’s personalised to their figures, or even if you do some targeted case studies that cover significant salary bands within your organisation,” Ms Partridge suggests.

If a company wants to encourage members to make a decision, a combination of different communication methods can be effective, according to Mr Parker. This can include emails, company intranet updates and paper communications, he notes.

But Mr Leandro says that “apathy reigns, as it always does with pensions”, so not everybody will proactively make a decision to switch.

He suggests that a better option would be that rather than the employee having to proactively say they want to go into the other section, the company could do it on a “negative affirmation basis”.

This means that, if possible, the default would be that employees move into the better non auto-enrolment section, unless they say they do not want to. “That would be a better outcome,” Mr Leandro notes.

A bulk transition was not an option for the Pearson scheme, according to Mr Beaven.

“We cannot move all AE members into the MP03 Section due to legacy issues and benefit design aspects relating to this section being previously ‘contracted out’ of the second state pension,” he says, adding that it is likely the auto-enrolment section will be fully replaced with a new DC section in future.