Employers’ additional contributions to defined benefit (DB) pension schemes have fallen to well below the historical average as overall funding levels have improved, according to recent data.

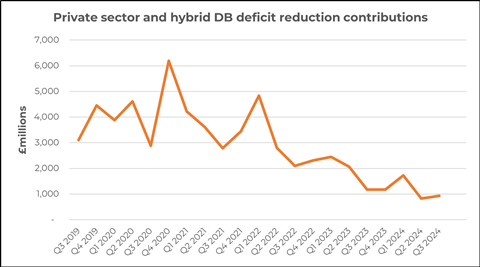

The Office for National Statistics’ (ONS) latest survey showed that £932m was paid into DB pension schemes in the third quarter of last year through deficit reduction contributions – payments made in addition to regular contributions aimed at improving funding levels.

Consultancy group Broadstone said that, while this marked a small increase compared to the second quarter when £828m was paid out, this figure was “substantially” lower than the historical average.

This reflects the improving nature of private sector DB funding, with the Pension Protection Fund’s 7800 Index showing aggregate funding level of 124.7% at the end of March 2025, on a section 179 basis.

David Brooks, head of policy at Broadstone, said more should be made of employers’ ability to reallocate resources due to the strength of DB funding.

He highlighted that well-funded DB schemes mean employers do not have to divert billions of pounds to deficit reduction contributions.

He said: “The good news story of improved funding for pension schemes has predominantly been focused on the potential for either greater security via risk transfer or improved member benefits via discretionary increases.

“However, these headlines have missed the extra bonus of DB schemes ceasing to be a drain on employers running these arrangements.

“This finance can now be invested back in their own business – possibly driving wage increases, supporting economic growth or research and development among other beneficial uses of capital.”

Brooks argued that DB pension scheme members’ benefits “have never been more secure and trustees have never had more options for protecting pension benefits”.