The Rentokil Initial Pension Scheme has set up an escrow account to prevent employer contributions becoming trapped in the scheme, after its funding level reached surplus.

Escrow accounts and similar vehicles are becoming increasingly popular for sponsors wishing to remove the risk of locking away cash in an overfunded scheme.

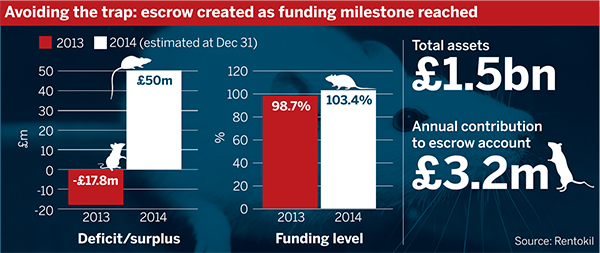

The pest control and facilities specialists set up the account last year following its 2013 valuation, which showed a funding level of 98.7 per cent and a deficit of £17.8m.

Since then, the £1.5bn scheme’s funding position has improved. On December 31 2014 it was calculated at 103.4 per cent on a technical provisions basis, with an estimated surplus in excess of £50m.

“In finalising the valuation the company and trustee agreed that it was likely that the returns generated on the scheme’s assets would probably be sufficient to meet current liabilities, negating the need for further contributions into the scheme,” said Debra Hayes, group pensions manager for the scheme.

“It was therefore agreed that annual payments of £3.2m would be paid to an escrow account and if the scheme was over 100 per cent funded at the next triennial valuation, the funds held in escrow could be released back to the company,” she said.

Rentokil: Retaining investment returns

Rentokil expects to remain in surplus until 2019, but if it should fall back into deficit the money from the escrow account can be used to fund the scheme.

The company said in its annual results that the scheme was estimated to have a surplus in excess of £50m at December 31 2014. Hayes said the scheme is targeting fully hedging interest rate and inflation exposure.

“Improvements on funding level are therefore primarily driven by the returns on the scheme’s equities and diversified growth funds relative to the return on cash. Both of these asset classes outperformed cash significantly in 2014,” said Debra Hayes, group pensions manager at Rentokil's scheme.

The company made the first contribution of £3.2m to the account in October 2014. It will continue to make annual contributions until a review in October 2019.

Escrow accounts are not always reported on pension scheme accounts and do not always count as scheme assets, making it difficult to know the total number set up during the year.

Vicky Carr, partner at law firm Sackers, said there has been a growing trend among schemes for escrow accounts.

She said: “Over the past year we’ve seen quite a lot. Where asset-backed funding structures have been less popular, escrow has increased in popularity.”

Consultancy KPMG’s 2015 asset-backed funding survey reported an anecdotal rise in the use of escrows especially as the number of complex asset-backed funding structures being set up fell.

However, David Fripp, partner at consultancy KPMG, said the popularity of escrow accounts over other structures may be short-lived, leading to a rekindled interest in asset-backed funding.

He said: “Everything unwound in the last quarter [of 2014] and the fuller, more optimal solution will make a comeback as a result.”

Darren Masters, head of covenant consulting at Mercer, said interest was being driven by fears over unpredictable markets.

“A number of people are concerned that, whether they’re in surplus or deficit, some form of correction of market conditions could lead to money being trapped in the scheme,” he said. “There’s a general concern that ploughing money into the scheme may not be the best approach.”

Jennifer Chambers, partner at law firm Burness Paull, said while more schemes were interested, take-up was not rising in tandem. “We’ve had some queries, but some of them have much smaller surpluses [than the Rentokil scheme],” she said.