PwC's two defined benefit pension schemes have removed property from their investment strategies and made a number of changes to their fixed income allocations.

The average scheme allocation to real estate in the UK has ranged from 5 per cent to 8 per cent over the past 20 years, according to research by UBS. In 1981, it was as high as 18 per cent.

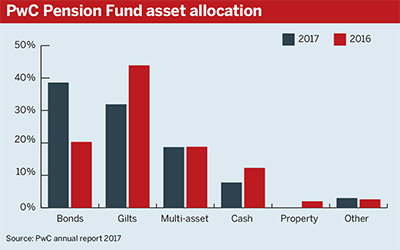

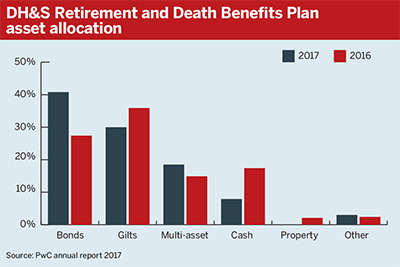

The company’s two DB pension schemes – the £1.7bn PwC Pension Fund and the £903m DH&S Retirement and Death Benefits Plan – respectively held 2 per cent and 2.1 per cent of their portfolios in property at the end of June 2016.

There’s probably a view that whilst you can still get a nice income from UK property, there’s limited potential for capital growth

Jignesh Sheth, JLT Employee Benefits

PwC's latest annual report stated: “As part of their ongoing strategy, the schemes invested in a portfolio of directly held investment grade bonds during the year. This investment was funded by transfers out of pooled bonds, gilts and cash.”

It continued: “Property holdings were also disposed of during the year as they were considered inconsistent with the schemes’ requirements given their long-term illiquid nature.”

Brexit is causing concerns for UK property

Jignesh Sheth, head of strategy at consultancy JLT Employee Benefits, said the decision to move out of property runs counter to current investment trends.

“I think in general we’re almost seeing the opposite, at least in terms of illiquid asset classes,” Sheth said, citing the current expense of assets such as government bonds and corporate bonds.

Sheth expressed concerns over the prospects of UK property following the UK’s exit from the EU in March 2019.

“I think over the next few years, there’s probably a view that whilst you can still get a nice income from it... there’s limited potential for capital growth and some risk that you may see capital falls,” he said.

Property investment carries large governance requirements

There exists a range of possible reasons for exiting property, according to Daniel Banks, director at consultancy P-Solve.

These include the potential for a risk transfer, dissatisfaction over the current illiquidity premium in those assets, or the amount of governance required for property investment in relation to the return on the asset class. “Potentially they might be interested in being able to realise those assets relatively easily,” he said. “One reason you might do that would be if you were considering a buyout in the near future,” Banks said.

“I’d be surprised if they were going to do a buyout immediately... because I would have thought that the deficit would be too big on a buyout basis,” he added.

The schemes’ last actuarial valuations as at March 31 2014 indicated a combined deficit of £275m on a fully funded valuation basis.

Banks pointed to the insignificance of the schemes’ prior property holdings in relation to the size of their portfolios. Combined, the schemes held £51m of property out of £2.5bn of assets.

“It’s a very small allocation. The governance, amount of time looking at property funds, versus the fact that you’ve only got [circa] £50m in this out of £2.5bn might lead you to say, ‘Since this is a small allocation, why are we bothering?’”

Use direct holdings to control duration

The investment in directly held investment-grade bonds sees the PwC Pension Fund’s allocation to bonds grow to 38.6 per cent from 20.3 per cent. The DH&S Retirement and Death Benefits Plan’s bonds exposure increased to 40.8 per cent from 27.4 per cent.

Andrew Wauchope, senior investment director at Psigma Investment Management, said: “It’s possible that they’ve done this to control the maturity of their investment-grade holdings.”

Teesside invests in energy storage ahead of pooling

The £3.9bn Middlesbrough Borough Council Teesside Pension Fund has invested in operational grid-scale energy storage assets, through the British Strategic Investment Fund.

“In a pooled fund you might have a longer duration. So by having actual holdings you may be able to shorten your duration, which would be in line with where we would be positioned,” he said.

“On absolute or relative basis, corporate bonds don’t look good value. However, there are some pockets of opportunity… we certainly are maintaining our exposure, though we do use some boutique managers which keep the duration quite short,” he added.