From the blog: It’s an important time for retirement savings. The introduction of freedom and choice has brought with it references to a ‘brave new world’ for pensions and the ‘biggest pensions shake-up for a generation’.

There’s no underestimating the level of change we’re experiencing, certainly for DC, and the impact this will have on trustees, employers and members.

But with change we are also seeing greater choice of DC provision – and with that, a chance to do better for retirement outcomes. The three Cs of DC perhaps? Change, choice and chances.

Mastertrusts are a growing piece of the market

Mastertrusts, in particular, have been receiving a lot of attention in recent years, not least for their ability to adapt to recent changes and provide choice and opportunity for better member outcomes. Auto-enrolment has driven growth for mastertrusts and the number available in the market is estimated by the Pensions Regulator at between 70 and 100.

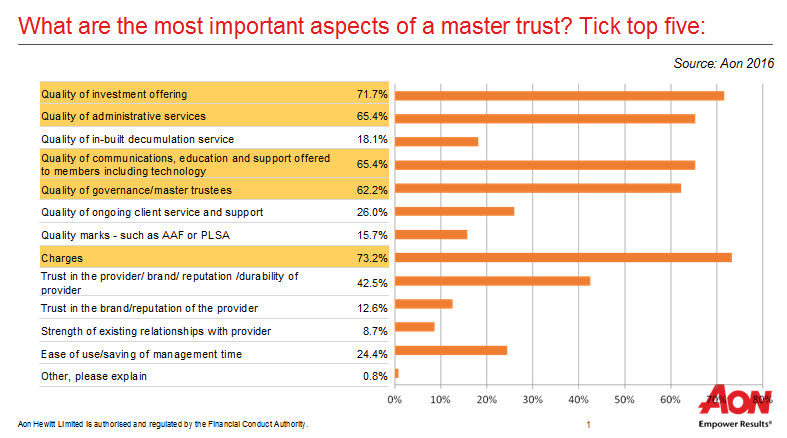

There’s good reason for this growth: a good mastertrust will bring scale to bear on charges for members, offer quality investment options, serve members well through communications and administration and provide strong governance. They also offer a flexible setup to be able to incorporate pension freedoms.

For employers, a good mastertrust enables them to outsource some of the regulatory burden, while remaining in control of the scheme design and contribution levels, and setting and monitoring objectives for member outcomes.

They are able to use their understanding of employees’ needs to inform matters such as the optimum investment design, the styles and methods of member engagement and to confirm the scheme is delivering value for money for members.

Pension changes demand flexibility

Many of the employers I speak to see the introduction of pension freedoms, and the advent of lifetime Isas, as a great opportunity for their employees to have a lot more flexibility and choice around their retirement saving – and they see a need for it.

Are mastertrusts financially stable?

A couple of years ago Andrew Warwick-Thompson, executive director of defined contribution and public service pension schemes at the Pensions Regulator, was quoted as saying: “There are 70 mastertrusts and that’s 60 too many.”

After years of trying to increase engagement, the new freedoms in particular have propelled this rather quickly.

A good mastertrust that is able to offer value, a quality investment offering, rich communications and strong governance is also well placed to respond to a developing market and deliver good member outcomes. If that means more people can afford to enjoy their retirement, then that is something we should all be passionate about.

Tony Britton is head of delegated DC consulting at Aon Hewitt