The Vauxhall pension plan has restructured its asset allocation by increasing exposure to liability-driven investments and diversified growth funds, as experts agree these are “sensible” steps to take.

In March this year, US-based car manufacturer General Motors announced it was selling Vauxhall to PSA Group while retaining responsibility for the company’s UK pension obligations, giving rise to concerns over member protection.

Reducing risk

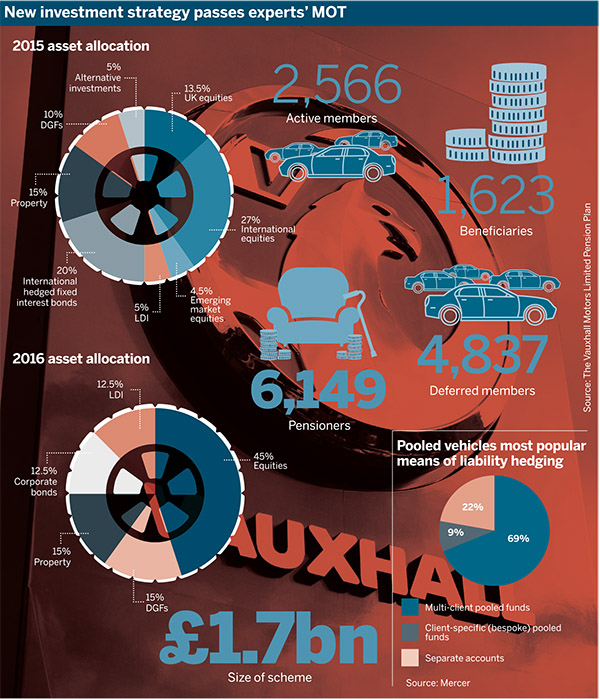

The £1.7bn pension plan’s latest report to members shows that in 2016 – before the news of the sale – the scheme’s investment strategy was revised. In the new allocation, “the assets are split between two classes – risk return assets and matching assets”, reads the report.

When you combine a diversified growth fund with an LDI strategy, it works particularly well

Jignesh Sheth, JLT Employee Benefits

The split starts at 75 per cent return-seeking assets and 25 per cent matching assets, and the matching assets will be gradually increased, with a corresponding decrease in the return-seeking assets.

“Trigger points for derisking have been set by the trustee in agreement with the principal employer,” the report adds.

The previous investment strategy’s 5 per cent allocation to LDI was bumped up to 12.5 per cent, and there was a corresponding 7.5 per cent decrease to bonds, now targeting 12.5 per cent. The scheme’s exposure to DGFs was upped to 15 per cent from 10 per cent.

Combining LDI and DGFs

Experts praised the scheme for its derisking plan. Jignesh Sheth, director at consultancy JLT Employee Benefits, said: “I’d certainly be supportive of the increase in hedging.”

He added that when a scheme reduces its allocation to fixed interest bonds, LDI is generally “a more efficient way to hedge those risks, and you can free up that allocation to target a slightly higher return” given that the expected return for bonds has fallen. “It’s a sensible thing to do,” he said.

“When you combine a diversified growth [fund] with an LDI strategy, I think it works particularly well,” Sheth noted. He explained that the majority of schemes will have a medium to long-term target that is linked to either cash or inflation.

Sheth said that when investing in leveraged LDI, schemes get a bond return for more than the amount invested and have to pay for the leverage with close to a cash rate.

“Your target return goes from needing to be gilts plus something – and gilts are very volatile – to becoming cash plus something… and because DGFs have that target, there’s a nice sort of symmetry to putting those two strategies together,” Sheth said.

However, he added that the performance of DGFs has been scrutinised in the past few years. As a result, he highlighted the importance of making sure the investment consultant is regularly assessing whether any changes need to be made.

A well-trodden path

Rod Goodyer, partner at consultancy Barnett Waddingham, noted that the increased risk reduction frees schemes up to target returns with the rest of the assets.

DGF growth expected to continue despite challenges

Experts have predicted the continued growth of the diversified growth fund market, even as the asset class comes under increased scrutiny over performance and competition from advisers.

“I think it’s a fairly well-trodden path that they’re on… using a combination of equities and diversified growth funds to try and get those returns” and “it does look like quite a sensible strategy”, he said.

Quite a few schemes are making similar changes at the moment, as they look to do more with their LDI by making their defensive assets work harder, Goodyer noted.

“It allows you to hold more in riskier assets in the short term” or to “have a plan to gradually reduce the allocation to return-seeking assets as you actually reach the point where it’s affordable”, he explained.

Goodyer added that delegating an alternatives allocation to DGF managers can enable trustees to “focus their governance time on the big questions, like the LDI, the hedging level, the derisking triggers – the things where the trustees can add more value”.

DGFs are a good option for pension schemes looking to diversify easily and quickly, said Danny Vassiliades, managing director at consultancy Punter Southall.

However, “once the DGF’s in place you don’t stop work there. You keep looking for interesting types of assets or products which will get you more diversification”.