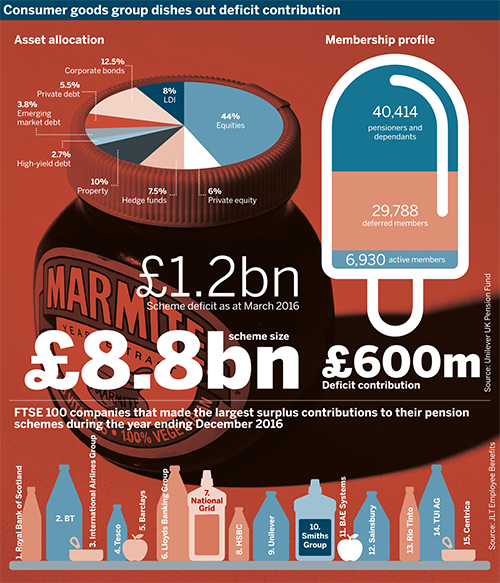

Unilever has contributed £600m to its scheme, after an actuarial valuation revealed a £1.2bn deficit. Meanwhile, the trustees have taken steps to ensure they can act quickly should there be a significant corporate event.

Total deficit funding among FTSE 100 company pension schemes rose to £10.6bn in 2016, up from £6.3bn the previous year, according to JLT Employee Benefits research.

Too many sponsors are still expecting an economic fairy godmother to appear out of thin air and magic their deficit away

Steve Delo, Pan Governance

Consumer goods group Unilever came ninth in the research report’s list of FTSE 100 companies that have made the largest deficit repair contributions over 2016.

The scheme’s latest actuarial valuation in 2016 revealed a deficit of £1.2bn and an equivalent funding level of 86 per cent.

In June 2017, Unilever contributed £600m, approximately half of the deficit.

Negotiating power for trustees

“Clearly it is a very large amount,” said Charles Cowling, director at JLT Employee Benefits, though “it is not uncommon to have large contributions paid in”, he said.

Cowling noted the Royal Bank of Scotland’s one-off payment of £4.2bn into its group pension scheme in 2016.

He explained that a company may pay a one-off lump sum when there is a merger or takeover situation, or when the employer wants to close the scheme, for example. “When an employer wants to get something off the trustees,” the trustees then have some negotiating power, and can “use that to get an extra contribution in”.

Cowling added that “another common scenario is when a pension scheme is planning to do a big buy-in, or even a buyout, and they’re getting ready to negotiate with an insurance company on securing their own pensioners”, but need part of the deficit in relation to those pensioners to be filled.

Steve Delo, managing director of Pan Governance, said it is often difficult to get sponsoring employers to realise the merit of a sizeable contribution and the risk mitigation that can be achieved with it. “But when the penny drops, you can see sponsors decide to commit more to try to more constructively deal with funding,” he added.

“Too many sponsors, however, are still expecting an economic fairy godmother to appear out of thin air and magic their deficit away,” Delo said.

Making use of the money

Trustees of the circa £8.8bn Unilever scheme had started a review of the fund’s investment strategy, but “as an interim step, we decided to invest the £600m deficit contribution in assets which are designed to match our liabilities”, said chairman Tony Ashford in the fund’s latest report.

Over the course of the fund year, between March 2016 and 2017, the scheme’s assets produced “a very healthy return of nearly 22 per cent”.

The report said the funding level did not rise by the same margin, mainly due to the fact that gilt yields – which form the basis for the discount rate used to value the scheme’s liabilities – fell during the year.

However, the fund’s asset performance meant the funding level at March 2017 had improved to an estimated 90 per cent. The £600m contribution boosted this even further to an estimated funding level of 98 per cent.

Richard Farr, managing director of covenant specialists Lincoln Pensions, said deficit contributions are generally used for derisking purposes.

“Having said that, what you may find in some situations is the trustees have been maybe too prudent, in the employer’s mind,” and an employer might say it will give a scheme more money if the trustees agree to change the investment strategy.

The way in which trustees make use of a lump sum “depends on any conditions attached to it” because the employer may say, “I’ll only give you the cash if you do certain things”.

Takeover approach prompts governance review

In February 2017, Kraft Heinz revealed that Unilever had rejected a takeover approach. This prompted a strategic review of Unilever and its operations by Unilever management.

The pension scheme has now reviewed its governance “to make sure we would be able to act in a quick and nimble fashion should there be a significant corporate event”, such as a change of ownership or major disposal.

Trustees also took more general steps to improve the approach to running the scheme. They looked at how they organised themselves, how they interact, management of various suppliers and what they expect from their in-house pensions team.

Communicate with the company

Tom Lukic, director at Dalriada Trustees, said trustee boards need to be able to act quickly in a merger-and-acquisition situation to get the best outcome for the scheme and its members.

As a starting point, “the trustee board should have an open dialogue with the corporate to understand the likelihood of corporate activity. That said, sometimes things happen and trustees need to have processes in place to be able to respond appropriately,” he added.

Lukic highlighted the importance of planning ahead to make sure the scheme is prepared, as well as having a covenant adviser and a covenant-monitoring framework in place. This will allow trustees and advisers “to be up to speed so they can quickly understand what’s happening to the covenant in the transaction and act quickly in the scheme’s and the employer’s best interests if anything is asked of them”.

When becoming aware of a potential transaction, the first thing trustees should do is speak with the employer.

The trustees should ask about the transaction timetable, the nature of the proposed transaction and the impact on the employer covenant.

“While many transactions will allow for an orderly consideration of the position, there may often be genuine reasons driving an accelerated timetable, and in such circumstances it is key that trustees are aware such that they can engage early and prioritise adviser input,” Lukic said.

Subcommittees and scenarios

Using subcommittees to report into the trustee board on progress and key decisions can help with the challenging timetable and dynamics of a transactional situation, said Lukic.

Farr agreed that trustees can use a subcommittee, members of which “are told either days before, weeks before or hours before – either way it is given a kind of preferential treatment on notification”. However, he warned that telling trustees of a potential takeover too far in advance could create all sorts of issues.

Delo also highlighted how some trustee boards may have “pre-agreed ‘fast reaction’ subcommittees established, or alert protocols if they are concerned that their sponsor is likely to be subject to a takeover situation or short-notice trade sale”.

He said that doing ‘what if?’ scenario testing is a good way for trustees to prepare themselves for a significant corporate change.

“I have gone through this process with several boards whereby a potentially significant scenario is analysed during trustee training away days or standalone strategy days,” he said.

Delo explained that “by gameplaying the scenarios, you can flush out issues that would be a problem – or would be acutely time-sensitive to react to – and with a bit of work get some broad contingency actions in place”.

Gearing up for corporate change

Set up a clear line of communication with the company

Ensure that a covenant monitoring programme is in place

Establish a subcommittee to report to the trustee on key updates and decisions

Organise training and scenario testing to prepare the scheme for potential change

Consider the views of the Pensions Regulator

Trustee boards will struggle to move swiftly and coherently enough to get a seat at the negotiating table without having thought through the issues beforehand, Delo said.

Trustees should strategise by considering possible situations, and how they would deal with them, said Delo. He suggested they could think about what they would ask for, how the sponsor would react, and what a good ultimate outcome could look like.

He added that “the covenant advisory process should be an ongoing one – not simply a burst of activity around the actuarial valuation – to enable the trustee board to be alert to changes in the business dynamics”.

TPR reaction should be considered

The Pensions Regulator has recently taken Dominic Chappell, who bought retailer BHS for £1, to court for failing to provide information and documents it requested during its investigation into the sale.

High profile cases such as this have led to an increased focus on the role of the pensions watchdog when it comes to corporate transactions.

Delo said the possible views of the regulator should be considered in the context of certain prominent cases.