Surrey County Council Pension Fund has put a liability-driven investment platform in place to capture rises in the funding level, after falling gilt yields wiped out last year’s gains.

LDI has grown steadily for UK schemes, with £517bn of liabilities currently hedged, according to consultancy KPMG’s most recent LDI survey. But low gilt yields have increased the cost of matching liabilities.

Surrey set up the LDI platform on February 13 2015, having brought it to the board a year ago.

Phil Triggs, strategic manager at the scheme, said the funding level had improved over the course of 2014, but economic conditions at the start of this year stunted progress.

Risk management may be more of an issue than it might have been previously

Colin Cartwright, Aon Hewitt

“We had improved quite drastically [in] 2014 and then the situation since the start of the year has knocked us right back,” he said, adding that the funding level at April 30 was around 70-75 per cent.

In April 2014 the scheme was estimated to have a funding level of around 80 per cent.

He added the scheme had increased its allocation to diversified growth funds by £60m, bringing its allocation to £140m in Standard Life’s GARS fund, and £60m in another fund with a global focus. The scheme is also considering an allocation to infrastructure debt.

Setting triggers

The scheme set triggers to begin derisking when either the real gilt yield reaches 0.27 per cent, or the funding level reaches 85 per cent.

The 15-year real gilt yield was at -0.75 per cent as of May 14, while the 20-year real gilt yield was -0.73 per cent on the same date.

Simeon Willis, principal consultant at KPMG, said yields were unlikely to reach 0.27 per cent soon.

“I’d consider a trigger like that to be an aspirational trigger,” he said. “This is looking for a step change in the market.”

He added: “Compared to triggers that were in place, say, four years ago, this is more realistic – but those triggers were unrealistic at the time, let alone now.”

Low gilt yields have led to schemes failing to hit their triggers in recent years, leading to many changing the levels at which they begin hedging.

“Schemes have had to say, ‘Are these triggers realistic?’” said Mike Johnson, principal consultant at Aon Hewitt.

“Having triggers is the right choice for some; for private schemes we’ve seen more of a move to funding-level triggers.”

He added private sector schemes in particular were increasingly moving towards triggers based on funding level, because “price sensitivity is more acute the worse funded you are”.

The public sector

However, public sector pension schemes have a different focus with LDI due to a stronger sponsor covenant and the fact that they are still open and accruing funds, said Colin Cartwright, principal investment consultant at Aon Hewitt.

He added such schemes have less need to lock-out risk than legacy or private sector defined benefit schemes, but LDI could still be useful in certain circumstances.

“Risk management may be more of an issue than it might have been previously,” he said, “LDI can be a more efficient management of bond portfolios.”

LDI on the up

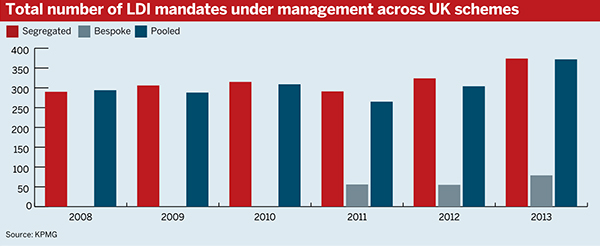

KPMG’s most recent LDI survey found the UK LDI industry grew by 21 per cent from 2013-2014 with 142 mandates.

The report stated: “Today, the total market exposure of the UK LDI market is over half a trillion pounds at the end of 2013, making it arguably the largest single-investment exposure that UK DB pension schemes have.”

It attributed the growth in the asset class to its ability to “permit significant risk mitigation without the need to tie up large amounts of capital”, freeing up assets to help fund the pension scheme.