The Royal Insurance Group Pension Scheme has reduced its trustee board size and changed the way member-nominated trustees are appointed, saying the move will save costs and make governance more efficient.

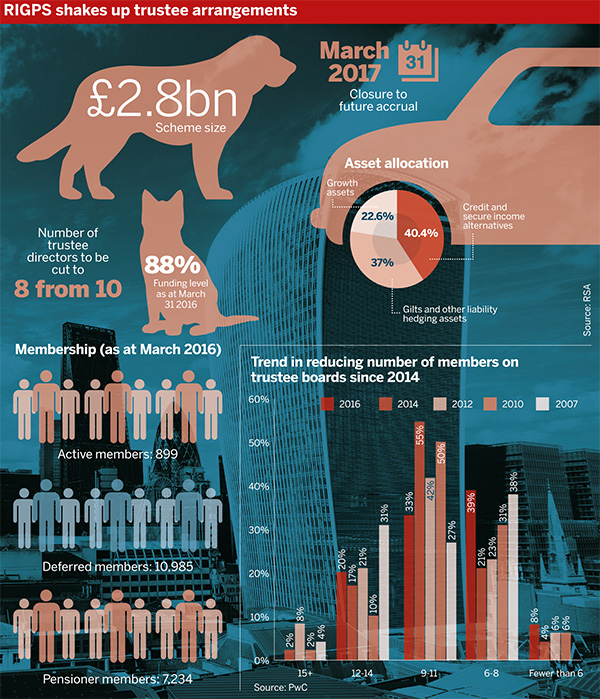

There was a marked change in the overall size of UK trustee boards between 2014 and 2016, with a 22 per cent reduction in the number of boards with nine to 11 members, according to PwC research.

You need diversity in the selection process, as well as diversity on the ultimate board

Richard Butcher, PTL

Following this trend, the £2.8bn RIGPS will now have eight trustees instead of 10.

Trustee chair Keith Greenfield said the decision came after “a very interesting debate at a recent trustee meeting on whether still having 10 trustee directors is appropriate”.

The scheme closed to accrual from March 31 2017. Greenfield said that given this change, the trustee board concluded that having eight trustees would result in “a more focused and efficient governance structure… while also generating some cost savings”.

The reduction will happen naturally once the term of office for one of the MNT directors ends and a company-appointed trustee director will step down at around the same time.

MNT appointment changes

Previously, when an MNT’s term of office ended, nominations were only invited from that trustee’s membership constituency.

Following the closure of the scheme to future accrual, there are no active members. Consequently, constituencies will no longer be used and all members will be invited to apply for any vacancy.

Tim Vaughan, RSA scheme secretary, said it is hoped inviting applications from the whole membership would provide a wider range of candidates.

He said that “the trustee believes it can continue to function efficiently” because of its structure, use of subcommittees and the support provided by the trustee services team.

The RIGPS has also changed its MNT director appointment method. Previously, they were appointed through an election in their constituency, following an initial review of the candidates.

Now a review panel, chaired by the scheme’s independent trustee, will select MNTs from those who nominate themselves. This panel will include an MNT.

The scheme said selection will ensure that successful candidates have the right skills, adding that there is significant cost involved in running an election.

Should you shrink your trustee board?

Wendy Hunter, partner at law firm Squire Patton Boggs, said it is “horses for courses” when it comes to the size of boards. “The size is important, and I would say that there is a tendency or a trend to have less than 10,” she said.

It is not uncommon to have a smaller board if there are sub-committees for extra support. “The real heavy lifting is done at committee level,” while the board sets the direction and gives delegations, Hunter explained.

Alan Pickering, chair of professional trustee company Bestrustees, said: “Less is more.”

Lloyds Banking Group drives efficiency with single trustee board

Lloyds Banking Group merged the trustee boards of three of its defined benefit pension funds in 2016 to boost efficiency, decrease duplication and strengthen its relationship with the schemes.

He noted that the larger the board, the less opportunity there is for everyone to give their opinion. “If you have a trustee board which looks like [a Royal] Albert Hall audience... people can only speak once,” he noted.

“I’ve always wanted the catchment area to be drawn as widely as possible, so that any member of the scheme… has an equal chance,” he said.

To select or elect?

Pickering said he has always been “in the selection camp”.

He says that when trustees are standing for election, neither they nor the electorate always know exactly what the job entails.

Trustee pay falls as workload ramps up

The average pension scheme trustee is being asked to dedicate more working days than ever to the running of a scheme, and is being paid less to do so, a survey released on Thursday has suggested.

Richard Butcher, managing director of professional trustee company PTL, noted there is “a trend towards selection” rather than election.

He stressed the importance of cognitive diversity on a board “to challenge perceived wisdoms”.

Selection is often preferred, he said, as “that gives you the opportunity to fill knowledge gaps”.

But, he noted that with regard to the selection or review panel, there is a need to make sure there is not perceived wisdom in the selection process itself.

“You need diversity in the selection process, as well as diversity on the ultimate board.”