Using more accurate assumptions on longevity could be the key to bringing down defined benefit pension scheme deficits, new research shows.

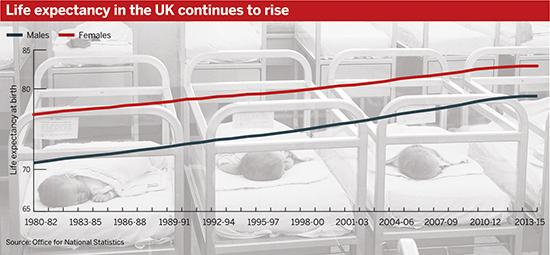

Longevity is seen as one of the biggest threats to companies with widening deficits, while low gilt yields and the threat of interest rate rises will put pressure on many schemes with actuarial valuations due this year.

Be prudent, but not excessively prudent, and think about the scheme’s circumstances

Hugh Nolan, Spence & Partners

Based on the liabilities of UK pension funds, as measured on a buyout basis and standing at around £2.4tn, trustees could decrease the collective UK DB deficit by £25bn, according to analysis by Club Vita, a community of pension schemes established by consultancy firm Hymans Robertson.

It found that trustees are still including unnecessary margins in setting their longevity assumptions, and overly cautious approaches could be affecting important decisions regarding future scheme strategies.

The study states that an overvaluation of how long people are likely to live is equivalent to continuing to pay people’s pensions for four months after they have passed away.

Douglas Anderson, founder of Club Vita, said many trustees are being “unnecessarily prudent” when making assumptions on how long people are likely to live.

Although “they’re doing the best thing that they can possibly do with the tools that they’ve got available to them”, he said that adopting more modern tools could help save money.

Anderson said that a trend which saw many schemes close to accrual, mainly driven by the reduction in interest rates, could have been slowed down with less conservative longevity assumptions.

“If you told everybody that the deficit was actually a bit smaller than they expected by virtue of there being margins in the longevity assumptions that you weren’t aware of, that could be... material enough to postpone a decision to close a scheme to future accrual,” he said.

Anderson mentioned how “getting longevity assumptions as tight as possible” affects, and potentially distorts, trustees’ day-to-day decisions.

Hugh Nolan, director at consultancy Spence & Partners and president of the Society of Pension Professionals, agreed bigger schemes might indeed be able to afford to cut back on unnecessary margins.

However, for smaller pension funds, “that four-month safety margin”, for example, “might not even be enough”, he said.

Market volatility more of a concern than mortality rates

Nolan also pointed to the financial assumptions being made at the moment, particularly post-Brexit. “Those uncertainties are far more significant than mortality rates,” he said.

Any data projecting mortality for the next 30 to 40 years, he said, “is bound to be uncertain, so agonising about exactly where it is is not the most helpful thing to do. You want to be there or thereabouts, but you’ll never get it exactly right.”

Longevity risk anxiety overshadows subtler threats

New research has shown that a quarter of pension professionals consider longevity risk to be the biggest threat to pension schemes, but some say it should not take priority.

Nolan added: “When you’re funding a pension scheme, all you’re doing is putting some money aside for what might happen in the future. You’re not actually paying it out.”

He advised to “be prudent, but not excessively prudent” and to “think about the scheme’s circumstances”, such as the strength of the employer, when making assumptions.

The advantages of detailed data

Andrew Gething, managing director of data collection company MorganAsh, agreed with Anderson that estimating longevity better would result in a “big saving in deficits”.

Gething said “using actual data on individuals” including health data through medical underwriting, for example, could help with this.

“If you understand someone’s health, and their lifestyle, then you can make a reasonable prediction of their longevity,” he said.

He said the difficulty with regard to actuarial tables was how to apply a big volume of data to an individual scheme. “If your scheme is not very large, that is problematic,” he said.