Network Rail expects to save around £19m annually following a swath of amendments to two of its schemes to mitigate the increased costs of contracting-out cessation, as many schemes either absorb the cost or close.

The end of contracting-out of the state second pension from April 6 this year – brought about by the introduction of the new state pension – means companies and their employees face higher national insurance contributions, making the provision of defined benefit schemes open to accrual more expensive.

Some companies, such as Royal Bank of Scotland, have chosen to move the entire extra cost to employees. Network Rail has taken different steps to address the cost increase, having run a consultation from January to March this year before implementing the changes on April 1.

The company reduced both employer and employee contributions for the career average revalued earnings scheme, and the basis for the scheme’s inflation indexing is switching from the retail price index to the consumer price index.

It also reduced employer contributions for both the RPS65 and RPS60 parts of the Railways Pension Scheme, while a decision about protected persons’ contribution changes has been postponed until July this year.

In addition, Network Rail reduced the annual pensionable pay cap for the Railways scheme to RPI only, from RPI +0.5 per cent.

“In terms of RPS company contributions, the employer will achieve savings of approximately £16m per annum in relation to RPS members,” against increased national insurance contributions of £24m, a spokesperson for Network Rail said.

“In relation to Care scheme members, the employer contribution savings are expected to be [around] £3m per annum, approximately equal to the increase in employer NI contributions as a result of the loss of contracted-out NI rebate,” the spokesperson added.

In an announcement to scheme members, the company said: “The changes are primarily to mitigate the significant additional national insurance bill that the company will have to pay as a result of government changes to state pensions that come into effect from the first pay date in April 2016.”

In a statement to members, Chris Hannon, head of pensions at Network Rail, said: “We acknowledge that the nature of these changes is complicated and some individuals will now have choices available. We will therefore be looking for opportunities to brief staff on the practical implications of these changes where possible in the coming weeks.”

All or nothing

Network Rail’s approach of making changes within the scheme while maintaining the schemes overall is an unusual one, as most employers have either used the increased costs of contracting-out cessation as a reason to close the scheme, or simply absorbed it and continued as usual.

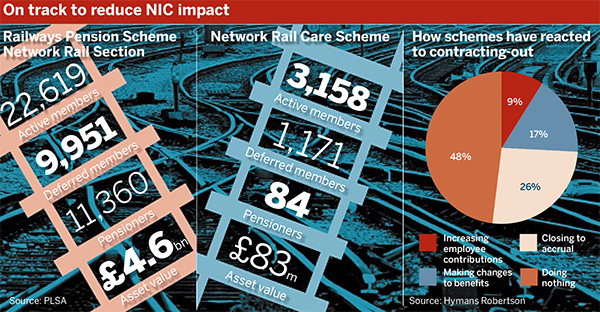

Research from consultancy Hymans Robertson showed almost half of DB scheme respondents had absorbed the increased cost, while a little over a quarter were closing to future accrual.

However, experts have warned that where employers are absorbing costs, members could yet face changes to or closure of the scheme as the employer has a statutory override power to take action for the next five years.

Calum Cooper, partner at Hymans Robertson, said: “The majority of the schemes I work with have taken it as an opportunity to kick off the process of closing the scheme.”

Despite this, he added that the cost increases were dwarfed by costs associated with the effect of low interest rates on scheme funding.

Nick Griggs, head of corporate consulting at Barnett Waddingham, said many DB schemes had too few active members to make closing the scheme worth the cost.

“[In] a lot of schemes, the number of active members has got down to a small enough level so the extra cost is not massive,” he said.

However, he added: “For many, this has been the final nail in the coffin, so they said, ‘Let’s close the scheme to future accrual’.”