All Mercer articles – Page 12

-

Opinion

Managing the impact of political shifts

Moments of uncertainty can both pose threats and create opportunity, and elections are no exception.

-

News

IBM adds cat bonds to mix as it diversifies return-seeking assets

IBM Pension Plan has invested £60m in catastrophe bonds as it decreases its exposure to higher-risk assets and focuses on investments that will provide a diversified source of return.

-

News

Budget flexibilities fail to spur DB transfer interest

Predictions that the Budget flexibilities would lure members out of defined benefit pension schemes have so far proved unfounded, as data show no uplift in the proportion requesting transfer value quotations.

-

Features

Nationwide builds inflation hedge, ups matching assets to derisk

Nationwide Pension Fund has reduced its exposure to return-seeking assets and carried out its first significant inflation hedge, as capital adequacy rules drive banking and building society sponsors to reduce funding volatility.

-

News

Schemes eye forward rates to time hedge moves

Larger schemes are showing greater interest in using forward rather than spot rates to assess whether to increase their interest and inflation hedges, in order to gain a more accurate picture of fair value.

-

News

Tenth of employers weigh up medium-term DC drawdown offering

One in 10 UK employers have said they will offer members post-retirement drawdown facilities within their defined contribution scheme in three to five years, according to a poll, but advisers still doubt trustees’ desire to govern such provision.

-

News

Schemes have scope to delve deeper into illiquids, but confidence lacking

Defined benefit schemes are showing increased interest in illiquid alternatives as they hunt greater yield and diversification, but many lack sufficient resources and the confidence needed to execute such investments.

-

News

Covenant-lite market expands as small schemes digest DB code

Small and medium-sized employers’ pension schemes are finding greater access to pared-down, lower-cost covenant assessments following the Pensions Regulator’s revised defined benefit code of practice, which has increased focus on employer strength.

-

Opinion

Checking the price tag: evaluating the charges obsession

Data analysis: The Budget reforms signal an age of greater plurality in retirement possibilities for members.

-

Opinion

In defence of the regulator’s DC code, six months on

In the latest edition of Informed Comment, Mercer’s Rachel Brougham mounts a robust defence of the quality features enshrined in the Pensions Regulator’s DC code.

-

Features

FeaturesTrinity's second bite of comms cherry gets 60% hit rate

The £100m Trinity Mirror Pension Plan’s second attempt at a communications exercise to encourage additional contributions, to make up for the employer's decision to reduce payments, resulted in a 60 per cent take-up among the 1,000 members targeted.

-

News

NewsAMNT: Oz-style 'supers' could emerge from latest UK reforms

The Association of Member Nominated Trustees has said ‘to-and-through’ retirement options could pave the way for Australian-style superannuation schemes, if employers are willing to take on any additional governance burden that a post-retirement commitment could create.

-

News

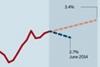

NewsGilt yield falls confound expectations and depress funding

Investment advisers have been taken by surprise by the recent drop in government bond yields which have inflated schemes’ liabilities and delayed derisking strategies.

-

Features

Mercer parent shuts DB scheme to equalise benefits

Marsh & McLennan Companies, the US-based parent of global consultancy Mercer, has decided to close its UK defined benefit scheme to future accrual in a stated attempt to create a level playing field between employees.

-

News

Disclose hidden transaction costs, report urges asset managers

Asset managers should disclose the full transaction costs rather than just the headline annual management charge, the Pensions Institute has urged, to allow investors to assess the value of their investments.

-

News

Schemes up proxy matching assets to avoid low-yield bonds

Schemes are seeking proxies for traditional matching assets, investment data have shown, as low yields in fixed income make some investors reticent about implementing liability-driven investment strategies.

-

News

Schemes consider currency overlay to mitigate fluctuations as economies recover

Schemes are considering implementing currency hedges on risky assets as investment experts predict currency adjustments after a long period of relative stability in the developed world.

-

Opinion

Why buy-ins/buyouts are not always the right answer

Bulk annuity contracts such as buy-ins can actually increase a pension scheme’s overall risk, argues Mercer’s Andrew Ward, who looks at the alternatives to these deals in the latest Informed Comment.

-

News

Micro scheme membership slumps as market consolidates

Data analysis: The total membership of small schemes with between two and 11 members has fallen by two-thirds over recent years as the market consolidates and auto-enrolment beds in.

-

Features

Encouraging trustees to embrace sustainability

News analysis: Industry experts are coming up with inventive ways to help schemes allocate more of their assets towards sustainable and responsible investments, but pension funds are lagging behind.