All articles by Maxine Kelly – Page 6

-

News

Interest rate uncertainty a concern for employer covenants

Interest rate rises could have a negative effect on covenant strength as some companies are forced to refinance at higher rates, advisers have said, and trustees should keep a watching brief to mitigate any resultant impact on their sponsors' ability to pay scheme contributions.

-

News

Tenth of employers weigh up medium-term DC drawdown offering

One in 10 UK employers have said they will offer members post-retirement drawdown facilities within their defined contribution scheme in three to five years, according to a poll, but advisers still doubt trustees’ desire to govern such provision.

-

News

Covenant-lite market expands as small schemes digest DB code

Small and medium-sized employers’ pension schemes are finding greater access to pared-down, lower-cost covenant assessments following the Pensions Regulator’s revised defined benefit code of practice, which has increased focus on employer strength.

-

News

NewsReturning volatility could threaten illiquid fixed income holdings, experts say

Pension scheme investors holding illiquid fixed income assets should beware the effects should increased volatility in global financial markets return, bond experts have urged.

-

Opinion

Checking the price tag: evaluating the charges obsession

Data analysis: The Budget reforms signal an age of greater plurality in retirement possibilities for members.

-

News

Fifth of smaller employers failing to prepare for AE

One in five small businesses are not currently preparing for auto-enrolment, research has shown, as concern grows around smaller employers’ ability to comply with the legislation.

-

News

NewsAMNT: Oz-style 'supers' could emerge from latest UK reforms

The Association of Member Nominated Trustees has said ‘to-and-through’ retirement options could pave the way for Australian-style superannuation schemes, if employers are willing to take on any additional governance burden that a post-retirement commitment could create.

-

News

PPF assesses out-of-cycle valuations for schemes affected by 'money purchase' definition

The Pension Protection Fund launched a consultation last week to assess the material change in risk to the lifeboat brought about by the changes to the definition of money purchase benefits, which will come into force later this year.

-

News

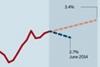

NewsGilt yield falls confound expectations and depress funding

Investment advisers have been taken by surprise by the recent drop in government bond yields which have inflated schemes’ liabilities and delayed derisking strategies.

-

News

Disclose hidden transaction costs, report urges asset managers

Asset managers should disclose the full transaction costs rather than just the headline annual management charge, the Pensions Institute has urged, to allow investors to assess the value of their investments.

-

News

NewsSPC president-elect Buchanan makes historic DC changes a priority

The Society of Pension Consultants has announced Duncan Buchanan as its president-elect, succeeding Pan Trustees director Roger Mattingly, who has been in the role since June 2012.

-

News

SME 'genuinely worried' about Budget impact on engagement

A British manufacturer has raised concerns about how the greater retirement flexibility announced in the Budget will impact the success of workplace saving and auto-enrolment, saying employees will need more help to navigate the system.

-

News

NewsBattle to plug deficits continues as FTSE 100 see £8bn deterioration

The total pension deficit of FTSE 100 defined benefit schemes worsened by an estimated £8bn, bringing the total to £57bn at the end of 2013, according to research, but experts maintain larger schemes are managing their risk exposures effectively.

-

News

Pension funds drive property surge as index linkage takes off

Schemes are looking towards property for further diversification, having expanded alternative property investments fivefold last year, as experts predict improved economic sentiment and a lack of development sites could stimulate rental growth.

-

News

Experts call for smart beta credit to meet diversification demand

Alternative fixed income indices could be the next frontier in smart beta investing for pension schemes, industry experts have said, calling for a shift in focus away from equity strategies.

-

News

Multi-asset exposure surges as schemes focus on volatility

The proportion of pension schemes with multi-asset fund exposure has risen to 83 per cent, up from 70 per cent just six months ago, as schemes look to control volatility and mitigate macroeconomic risk.

-

News

NewsOnly a third of workers alerted to AE by employer

Data analysis: Nearly two-thirds of workers heard about auto-enrolment through the media rather than from their workplace, sparking concerns that employers are not playing a strong enough role in communicating the reform.

-

News

Civil partner rule uncertainty poses questions for trustees

Schemes may want to consider holding off adjusting their spousal benefits, after a tribunal overturned a previous ruling that deemed entitlements should take into account membership pre-dating the Civil Partnership Act 2004.

-

News

Consultant-provider collaborations create AE quandary

News analysis: Employers and schemes approaching auto-enrolment face a unique governance challenge as consultants and providers club together to provide off-the-shelf products, with industry commentators raising questions on independence and cost.

-

News

NewsRSPB sees 17.5% opt-out in 'mixed' AE response

The bird protection charity RSPB has revealed a 17.5 per cent opt-out rate since auto-enrolment in November, as smaller organisations start to push up the proportion of workers declining workplace saving.