ESG investing has improved over the years, but it still has some way to go before it is considered a default option.

While the majority responded by saying they were taking steps to manage climate risk, a small number were deemed “worryingly complacent”.

We just want ESG to be part and parcel of the investment process

Lydia Fearn, Redington

In June, the committee called for a requirement for schemes to actively seek the views of their members when producing their statements of investment principles

More recently, the Department for Work and Pensions proposed that trustees should publish a statement on how they take account of members’ views on financial and non-financial matters that may be relevant to the trustees’ investment and stewardship decisions.

The consultation, however, made it clear that trustees would not be required to act on any particular concern.

There is clearly a push to move environmental, social and governance matters further up the agenda. Defined contribution schemes have made progress, particularly over the past few years. The question is, how much more is needed?

Appetites growing for ESG action

Mark Jaffray, head of DC investment at consultancy Hymans Robertson, says that, particularly in the past two years, “there has been a growing awareness of ESG, and a growing appetite… to do something more concrete about it”.

This is due to several factors, including a greater focus globally, and in the pensions industry, on issues such as climate change.

He says more products have come to market, resulting in more fund options for trustees – enabling them to compare and contrast.

“The more solutions you get from asset managers… the easier I think it is for the trustee to then implement something,” Jaffray notes.

“We’ve seen more funds available, [but] in terms of including it in the default, that’s still at quite a low level,” he says.

While there are still relatively few schemes that have embedded ESG in their default, “a lot of trustees are now beginning to think about it”, he adds.

Lydia Fearn, head of DC and financial wellbeing at investment consultancy Redington, says that ESG progress has come on in “leaps and bounds” in the past year or so than ever before.

Some well-known examples include HSBC’s use of a fund with a climate tilt for its DC default option, and Nest’s addition of a climate aware strategy to its default last year.

More opportunities available

While there have been no high-profile ESG default launches since then, Fearn highlights that new funds are becoming available.

“These things take time, you’ve got to go through a process in order for someone to be able to invest in them,” she notes.

“I think we’ll see a lot more movement later this year, into next year.” She adds that “hopefully we’ll [then] have a reasonable amount of opportunity” for smaller and mid-sized clients to think about how ESG might fit in within their own default.

“From a default perspective, it’s really important for trustees… to really think about where ESG fits within the whole glidepath,” she says.

A 2018 report by the Defined Contribution Investment Forum showed that 79 per cent of 22 to 34-year-olds feel more strongly about making sure companies are well-managed than they did five years ago.

Moreover, 80 per cent of this age group said they are more interested in environmental issues than they were five years ago.

But despite savers feeling strongly about certain issues, there are still low levels of pensions engagement. Just one in 10 firms are happy with current levels of employee engagement, according to research by provider Aegon and the Confederation of British Industry earlier this year.

Fearn says efforts to gather member views are hamstrung due to a general lack of engagement: “You just don’t get the numbers.”

While DC trustees and providers may like the idea of surveying their members more, the results are unlikely to be statistically significant. “Member views are so varied as well, and taking everybody’s views into account is incredibly difficult,” says Fearn.

Stuart O’Brien, partner at law firm Sackers, says DC providers and trustees running a DC pension scheme need to consider whether they are giving members the right choices.

Gathering some member views can help inform schemes as to the range of funds they offer, says O’Brien.

However, he advises caution, noting that schemes sometimes end up running comprehensive member engagement exercises and surveys, and launch funds on the back of the research, only to find out that there is very low take-up.

Could ESG boost DC engagement?

Getting member views on ESG with regard to the default fund “is much harder”, says O’Brien.

“This is a fund for people who by definition have made no choices themselves... [so] how meaningful engagement are we going to get from a group of members who by definition are not engaged?” he asks.

O’Brien also highlights problems for trustees that run both DB and DC sections. “You might well think about ESG and document all sorts of far reaching and wonderful policies about engagement and how important you think it is and all sorts of other things within your DB portfolio, but then your DC default is just some passive tracker,” O’Brien says.

This means that there is a danger for trustees that run both a DB and a DC section of the same scheme of creating internal inconsistency.

Some trustees “focus on ESG within their DB section, but they’re not giving it the same weighting or airtime within their DC default, and I think that potentially opens them up to criticism” from members, O’Brien says.

There is an argument that ESG can actually help boost pensions engagement, with research showing that millennials tend to be much more engaged in ESG issues.

Caroline Escott, policy lead for investment and DB at the Pensions and Lifetime Savings Association, says there is “a growing body of evidence to suggest that savers would like their investments to have a positive impact on the environment and society”.

She adds: “It is therefore possible that increasing ESG investment could boost savers’ engagement with their pensions.”

Similarly, Jaffray notes that “it might be really positive for a trustee board or fiduciary to get members involved in the ESG issues, because they might get them more involved in saving for retirement”.

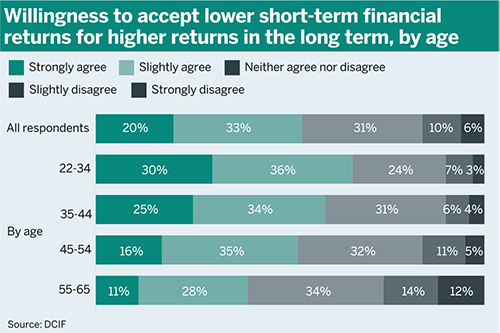

He adds that many people are prepared to give up a little bit of return to follow a more responsible approach.

Short-term pain for long-term gain

But previous views that responsible investment approaches could be a negative towards returns have changed – with a widespread acceptance that well-governed companies tend to outperform poorly governed companies, Jaffray notes.

Fearn agrees that people are often happy “to pay a bit more to get something that, actually, they believe in”.

She highlights that, while there may be some short-term shock, “you have to take the long-term view and say... ‘If our belief comes through, then these stocks we’re holding will gain better value in the long term’”.

Many savers with this view are those who are likely to be saving for a very long time, “so they’ve got that time to see it through”.

In terms of costs and charges related to ESG investments, Fearn says that fund managers are well aware of the charge cap and the remit they have got to work with.

“Cost is always an issue within DC, but I don’t think it’s a barrier here at all,” she says.

Ultimately, “we just want [ESG] to be part and parcel of the investment process – we don’t want it to be this ‘special’… thing” on the side.