All London Pensions Fund Authority (LPFA) articles – Page 2

-

News

LGPS pooling puts in-house investment in the spotlight

News Analysis: Local authority pension fund pooling activity is gathering pace ahead of an upcoming government consultation on criteria for cutting costs, bringing with it a push towards greater in-house investment capability.

-

Opinion

LPFA: Forging working groups with common goals

Talking Head: The LPFA’s Susan Martin considers the tangible goals and timetable for LGPS change that could come out of the Autumn Statement.

-

News

GMPF-LPFA venture closes first infra deal amid 'frothy' market

FT European Infrastructure: Greater Manchester Pension Fund has made the first investment of its joint venture with the London Pensions Fund Authority, but said high demand for the UK infrastructure market makes finding deals challenging.

-

News

LPFA confronts employer risk through covenant monitoring

Keeping a constant eye on the financial strength of employers has brought the London Pensions Fund Authority £310m worth of guarantees, assurances and cash since its 2013 triennial valuation.

-

News

NewsOsborne's wealth funds target LGPS cost savings to boost infra

Chancellor George Osborne pushed local authority scheme collaboration forward this week by declaring they would be pooled into six 'British Wealth Funds' as part of a plan to ramp up infrastructure investment and reduce scheme running costs.

-

News

NewsAsset insourcing saves LPFA 75% on fees

FT Investment Management Summit: The London Pensions Fund Authority could run as much as half of its assets in-house within the next three years, cutting the fees charged on those assets by three-quarters.

-

Opinion

OpinionLPFA: Seize the opportunity

The LPFA’s new chair, Sir Merrick Cockell, says the argument for change across the LGPS is undeniable and schemes should seize the opportunity.

-

Opinion

OpinionScheme fragmentation more stark in private sector than public

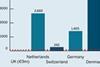

Data Crunch: The appointment last month of Edi Truell as the London Mayor’s new adviser on pensions and investments is part of an initiative, we are told, to amalgamate some of the country’s numerous public sector pension funds and aims to save billions of pounds through greater efficiencies, lower fees and improved returns.

-

Opinion

Global infrastructure investment for smaller pension funds

Infrastructure investment has been the preserve of larger funds, but the LPFA’s Susan Martin says more collaboration will open up the market.

-

Opinion

OpinionTime for more infrastructure incentives

Talking Head: Infrastructure assets offer a strong alternative to index-linked gilts but pension funds need more encouragement from the top, says PIP’s Mike Weston.

-

News

LGPS sharpens focus on collaboration as consultation looms

News analysis: Local authority schemes are poised for the outcome of a consultation on collaboration which could compel them to pool their investment assets to save on costs.

-

Opinion

LPFA: Government gives vote of confidence to proactive LGPS funds

Talking Head: The government’s decision to reward ambitious funds that deliver savings and strong investment performance is a marker in the sand in addressing LGPS deficits, says LPFA’s Susan Martin.

-

News

Havering struggles to find local infra for growth

The £506m London Borough of Havering Pension Fund is looking to invest in local infrastructure projects, but the need to balance this with strong returns is hampering its search.

-

Opinion

LPFA: How proper governance can boost fund returns

Talking Head: As more local authority pension schemes join forces, the LPFA’s Susan Martin talks about the importance of independent oversight.

-

Opinion

How collaboration could save LGPS £80m a year in fees

Talking head: LPFA’s Susan Martin says collaborating to reduce investment fees plays an important role in the bigger picture of securing members’ benefits.

-

News

Consultants and managers back hedge funds despite high-profile criticism

Consultants and hedge fund managers have predicted increasing pension scheme allocations to the asset class, despite recent stiff criticism of perceived high fees and a lack of transparency.

-

News

LPFA: £500m GMPF tie-up not limited to infra

The chief of the London Pensions Fund Authority has said the £500m tie-up with the Greater Manchester Pension Fund, announced las week, will consider “infrastructure in a broad definition”.

-

Features

Scheme managers raise doubts on joint LGPS governance boards

Local authority schemes have raised concerns over whether incoming pensions boards can be combined with their existing section 101 committees, one of the options in the government’s consultation on governance in the Local Government Pension Scheme.

-

News

Schemes have scope to delve deeper into illiquids, but confidence lacking

Defined benefit schemes are showing increased interest in illiquid alternatives as they hunt greater yield and diversification, but many lack sufficient resources and the confidence needed to execute such investments.

-

Features

Local government schemes reject forced passive CIV proposals

Local authority schemes have rejected government proposals to mandate pooling assets into a passively managed common investment vehicle, but did see benefits in other suggestions put forward.

- Previous Page

- Page1

- Page2

- Page3

- Next Page