One of the UK’s ‘big four’ banks Lloyds Banking Group has made a £710m saving by halting pensionable pay increases, as it looks to reduce the cost of its defined benefit arrangement.

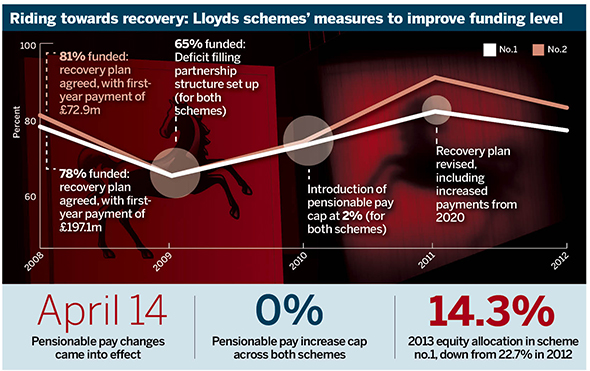

The partially state-owned bank has reduced its cap on pensionable pay increases to 0 per cent from 2 per cent after a consultation with unions, in what market experts have seen as an aggressive move to contain its liabilities.

Changes began to take effect from April 2 this year during pay reviews, and will be in place for all active members by April 1 next year.

Lloyds said in its most recent interim management statement: “The group made a number of changes to its DB pension schemes in the first half of the year. These changes and other actions resulted in a £710m credit which was recognised in the second quarter.”

Last year Lloyds Bank Pension Scheme no.1 increased its allocation to bonds, while backing away from equities in an effort to take risk out of the scheme.

Hugh Nolan, chief actuary at consultancy JLT Employee Benefits, said capping pensionable pay was commonly used to stop accrued liabilities growing further. “Most people just close the scheme,” he said. “Zero per cent is quite an aggressive way of doing it.”

Nolan added the saving was contingent on the number of active members in the scheme and may therefore be less significant as schemes cut back on their DB provision.

In 2010, BBC employees went on strike after the broadcaster capped future pensionable pay increases at 1 per cent.

Alan Collins, director at consultancy Spence & Partners, said: “Mechanisms such as freezing pensionable salary or capping it at 1 per cent, as in the case of the BBC, can reduce the employer’s overall liability to the scheme and actually end up costing the employer less than closing the scheme entirely.”

In a factsheet explaining the changes, the bank said: “The trustee of the scheme has been advised that the rules prevent amendments which adversely affect past-service benefits. As a result, for those particular schemes, based on current case law, it would not have been possible for the group to implement a cap simply by amending the scheme rules.

“Instead the group has chosen to introduce a cap through the salary award process which allows the group, by imposing terms and conditions on any offer of a pay award, to implement the cap other than by changing the rules.”

Bob Scott, partner at consultancy LCP, said schemes carrying out a cap or freeze on pensionable pay should do so with careful consideration. “There are certainly complications and things to watch out for with that sort of change,” he said. “You can get disaffected members.”