Pension schemes in Wales have backed new investment opportunities as pressure mounts on local authority schemes to channel more money into local investments.

In Swansea, a £51m social infrastructure fund has been launched by Newcore Capital in partnership with the City and County of Swansea Pension Fund - a constituent member of the Wales Pension Partnership, one of the Local Government Pension Scheme (LGPS) asset pools.

The Newcore Swansea Social Infrastructure Partnership will invest in social housing, care provision and community infrastructure across the region, according to a press release. The fund has a 10-year life and targets returns of 8% to 10%, net of fees.

The portfolio will focus on value-add and core-plus investments, including refurbishment of existing assets and strategic development opportunities. Newcore Capital has waived performance fees and is also marketing the fund to other investors.

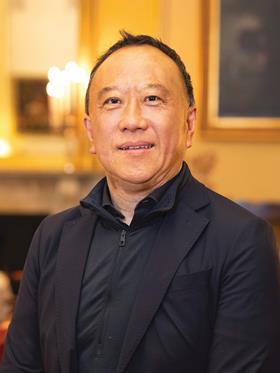

Jeff Dong, head of finance at the Swansea fund, said: “This partnership presents us with a unique opportunity to enhance and expand social infrastructure, social housing and social care provision in the Swansea City region, while generating strong and steady returns for the Swansea LGPS.”

Hugo Llewelyn, chief executive at Newcore Capital, added: “There is a clear opportunity for local government pension schemes to commit to investments in local social infrastructure, which can deliver sustainable returns while improving the scale and quality of much-needed local services.”

Pluto announces residential investments

Meanwhile, Pluto Finance has completed two residential development loans in Ceredigion and Pembrokeshire using capital from a Wales Pension Partnership “investment sleeve”. Together, the loans are worth £8.9mn.

The loans will support the development of 56 low-carbon homes by Obsidian Homes. The first, for £4.35m, will finance the first phase of a 37-home site in Llanarth, Ceredigion, which includes affordable homes priced at 70% of open market value for eligible local buyers. The second, a £4.57m facility, is funding a Kilgetty development in Pembrokeshire, with four affordable apartments to be acquired by the local council.

Both developments prioritise affordability and strong environmental performance, including EPC A ratings, solar panels, timber-frame construction and low-carbon heating. The developer estimates suggest lifetime carbon savings could reach 92%.

Back in May, the Wales Pension Partnership announced its ambition to use pooled LGPS capital as a vehicle for economic growth across Wales.

The £25bn pool, which represents all eight Welsh LGPS funds, said it would prioritise investments that support local jobs, infrastructure and the net zero transition.

At the time, the pool highlighted its £6.5m investment in the redevelopment of Uskmouth Power Station as an example of what this strategy could look like in practice. This is expected to create 300 full-time jobs and bring a disused rail line back into service, reducing heavy vehicle traffic on local roads.

Both the Newcore and Pluto Finance investments reflect the kinds of opportunities now being brought to market as pension pools face pressure to invest more domestically. The forthcoming Pension Schemes Bill is expected to formalise this direction, requiring LGPS pools across England and Wales to allocate more capital to UK-based and regionally focused projects.