The Pensions Regulator has issued a draft improvement notice to the London Borough of Barnet to tackle deficiencies in the pension fund’s administration processes and controls.

The scheme has until the end of August to implement improvements in three areas. Barnet has threatened to sack Capita if certain improvements are not made in the time required.

Meanwhile, a recent internal audit report has identified a number of “high risk-rated issues” in relation to the scheme’s administration, which is outsourced to Capita.

You cannot just throw the service over the fence and expect it to work

John Reeve, Cosan Consulting

The regulator issued the draft improvement notice on June 19, demanding improvements in three main areas by August 31 2019.

This is not the first time the scheme has been in trouble over administrative shortcomings.

In 2017, TPR fined the pension fund for failing to submit its 2016 scheme return. And last year, the council reported itself to the watchdog after failing to produce hundreds of pension benefit statements on time.

TPR zeroes in on benefit statements

In the draft improvement notice, the regulator has stipulated that the scheme manager must have monthly monitoring of contributions in place by August 31 and show that an analytical review is being carried out in line with actions agreed in the scheme’s March 2019 internal audit report.

The scheme must also demonstrate to the watchdog that it has put in place a series of checks on the data received in end-of-year certificates, and that the checks have been carried out, according to an agenda document for an upcoming Local Pension Board meeting on July 18.

TPR has also asked the scheme to make sure the first two phases of a conditional data-cleanse plan, which was provided to the regulator in January, are completed.

Moreover, by August 31 the scheme manager must have taken all steps necessary to implement and operate suitable internal controls to provide accurate annual benefit statements for the 2018-19 financial year.

It will have to show that a process is in place to test the quality of calculations used to populate annual benefit statements.

The scheme will also need to demonstrate that this process was utilised and that corrections were made where calculation inaccuracies were identified.

Councillor Dan Thomas, leader of Barnet Council, says: “We welcome this improvement notice and we’re happy to work with the provider to deliver the required improvements.”

He adds: “At the same time, we’re leaving nothing to chance. That is why we are also putting in place contingency plans to plan to find an alternative pension fund provider, if these improvements are not made in the time required. We are determined to get things right.”

A service improvement plan has been agreed with Capita and has already delivered some improvements.

A Capita spokesperson says: “All actions agreed in our jointly developed service improvement plan are underway and on track. We are committed to getting this right.”

Checking process must be ‘expanded’

The agenda document states that “the required actions set out by TPR have been the subject of discussions between the council and Capita for some time”.

Capita has redesigned the forms employers send every month reporting contributions, to include pensionable earnings. This will enable checks to be performed, the board has noted.

Barnet in TPR breach as Capita misses payments

The London Borough of Barnet Council reported itself to the Pensions Regulator last year after failing to produce 447 pension benefit statements on time.

The provider has also carried out a review of contributions received. “A review of the process indicates that 37 of the 88 employers used the new forms for April contributions and that the checking process needs to be expanded in some areas,” the document states.

Work carried out on the scheme’s March 2018 data meant the number of critical errors was reduced by more than 90 per cent.

This phase of the plan was completed, and phase two involves March 2019 data. “This is currently being evaluated through the Actuary’s portal and in addition it is planned to validate through Capita’s independent checking system. An update on progress will be given at the meeting,” the document states.

Scheme plans independent admin review

According to the board’s meeting document, the council is in talks with Capita about undertaking an independent review of its administration processes later this year. This will “provide assurance that all appropriate controls are in place and working effectively”.

Capita has put together a plan for the production and issue of annual benefit statements by August 31.

This includes additional data quality checks, “and has been robustly scrutinised” according to the board. It adds that “Capita remain confident that the timetable will be achieved”.

But John Burgess, branch secretary at Barnet Unison, says he is not convinced. He points out that administration problems have been going on for some time.

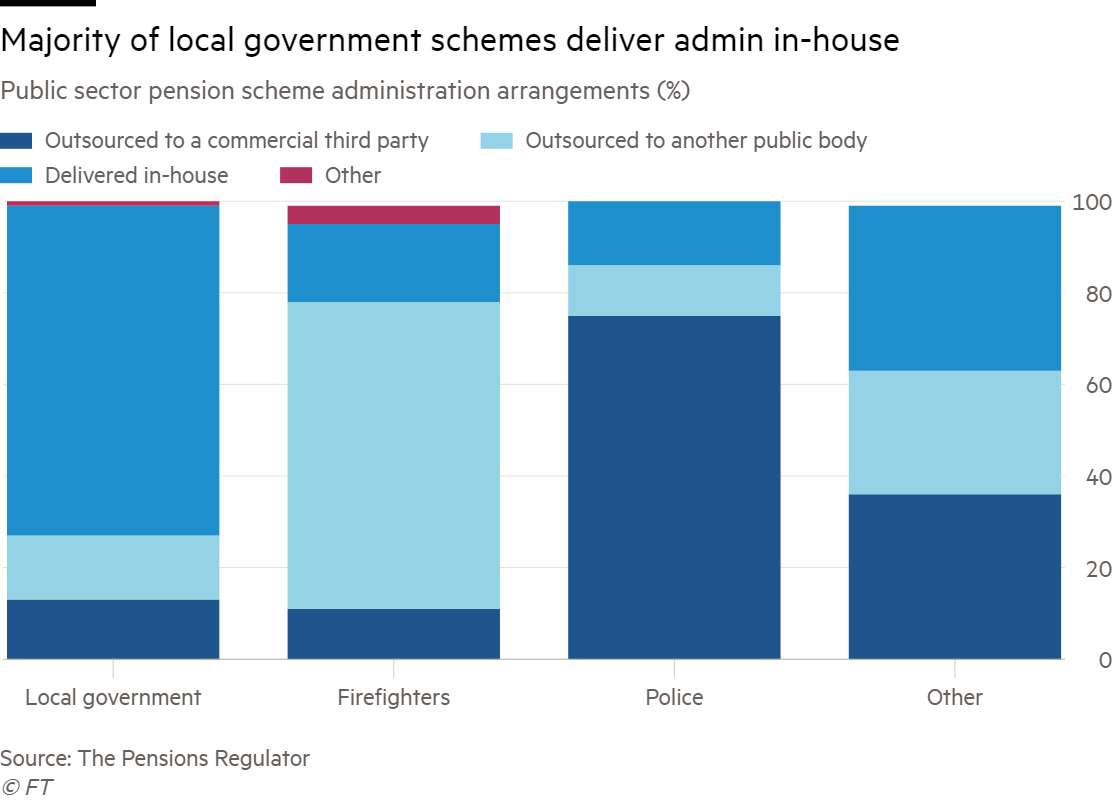

“The council seems either trapped or not willing to just say, ‘This just doesn’t work for us’,” he notes, adding that the administration of the scheme needs to either be hauled back in-house or moved to a different provider.

A July 2019 internal audit report has recently flagged up a “limited assurance” level for the scheme’s design and effectiveness of controls in place.

The review found weaknesses in monitoring the contributions due to the scheme, as well as a number of outstanding agreements with admitted bodies – including 13 admission agreements, five cessation agreements and the renewal of 10 admission bonds.

It identified two high, one medium and one low-risk issues. One of the high-risk findings relates to monitoring of contributions.

The review found that the Capita administration team could not check whether contributions had been deducted in line with the scheme’s “rates and adjustments certificate”.

This is because it did not gather information that would allow it to do so, and did not track whether lump sum contributions required under the certificate have been paid, “leading to an annual, manual exercise being required to review this”, the report states.

It adds that this could lead to contributions due not being received. Work is being carried out to fix this.

The other high-risk issue is that there is a backlog of admission agreements, bonds and cessation arrangements.

“This means that the fund may be exposed to financial risk as a result of not entering agreements with new or former employers,” the internal audit report warns.

‘No confidence’ in admin service

Mr Burgess describes the review’s findings as “shocking” – adding that his main concern is problems with annual benefit statements.

“We have no confidence in anything that comes out of that service, so we have to check everything,” he says.

The backlog of agreements with employers is something that should have been sorted long ago, Mr Burgess argues.

“What are the committees’ responsibilities? Because this hasn’t just snuck up… this is being recorded after each committee that it’s outstanding”.

He adds: “It’s one thing to say, ‘Capita you’re a poor performer’ – and they are a poor performer – but they’ve been allowed to get away with it because the committee system… doesn’t seem to be able to hold them to account.”

Lack of investment in automation

John Reeve, director at Cosan Consulting, says it is crucial to have a suitable reporting and oversight process in place to make sure tasks are completed as required.

“Whilst it is a concern that these issues have arisen, one must also ask why they were not identified sooner,” he notes.

“Often, various providers are left to do their ‘bit’, with no-one having visibility and responsibility for the whole. This leaves open the possibility of things falling between stools, or changes in one area having an unforeseen effect in a different area,” Mr Reeve says.

Capita has been in the centre of several well-publicised pensions administration stories highlighting the potential pitfalls of outsourcing.

Outsourcing has its merits, from reducing reliance on key individuals to providing access to expertise and systems that might be difficult to develop in-house, says Mr Reeve.

Nevertheless, “you cannot just throw the service over the fence and expect it to work”, Mr Reeve warns.

“Local government plans are very complicated, and the funds need to actively engage with the provider to ensure that all requirements are understood and the provider can carry these out,” he says.

At the same time, Mr Reeve says providers need to take some responsibility to make sure they are meeting the needs of the scheme and can prove they are doing so.

He also notes that some providers struggle because they are not investing in automation, leaving schemes more exposed to human error.

Daniel Taylor, client director at Trafalgar House Pensions Administration, says that in this case “it looks like there’s not fully established automated processes between data feeds from the employers to the schemes”.

He adds that this is a persistent problem in the market. With automated processes in place, data comes directly from the employers and into the pension scheme.

However, “we often see schemes where they haven’t established automated links between the core data feed – which is the sponsor – and the scheme”, Mr Taylor says.