Pension schemes will have to boost transparency and detail under reporting requirements in the revised statement of recommended practice by the Pensions Research Accountants Group, which comes into force next year.

Scheme trustees, asset managers and those responsible for preparing accounts will be tasked with putting systems in place to enhance the relevance and transparency of their disclosures.

Launched at the Prag annual general meeting last week, the revised Sorp lays out the requirements for pension schemes’ financial reporting following the revision of the FRS 102 reporting standards by the Financial Reporting Council last year.

The stated intention of the Sorp is “to recommend particular accounting treatments and disclosures with the aim of narrowing areas of difference and variety between comparable entities.”

The revisions will affect accounting periods for pension schemes commencing on or after January 1 2015 and so will impact on documents for the year ending December 31 2015.

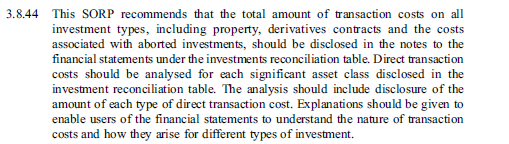

Schemes must provide enhanced disclosures on their investment risk, break down transaction costs in much more detail and provide a fair-value hierarchy of their assets.

Source: Prag

Under FRS 102, schemes must now also provide a valuation of their annuities unless they are deemed to be immaterial to the value of the scheme.

Gerard Weide, head of pension fund accounting at Towers Watson, who worked on the document, said: “This will likely bring out some element of debate, as it is difficult to foresee how accurately the value of annuities could be deemed immaterial without an in-depth calculation.”

Plan ahead

Industry experts said that early planning would be crucial to ensure the new Sorp requirements are implemented smoothly.

A working party has been formed between the Investment Managers’ Association and Prag to assist investment mangers in gathering the information necessary to produce investment risk disclosures.

Its chair Shona Harvie, partner at consultancy Crowe Clark Whitehill, said: “Fund managers and custodians need time to make sure they have the systems in place to provide the valuation hierarchy for schemes; [in turn] schemes will need to provide them with notice of their requirements to help them plan ahead. “

Schemes must ensure their disclosures are relevant and clearly lay out their investment strategies and hedging activity. Harvie said it was crucial for schemes to prevent their disclosures becoming “boilerplate compliance documents”.

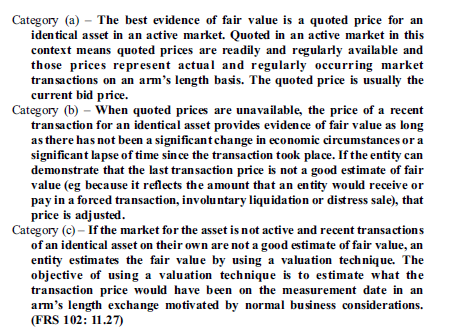

Harvie also saw potential issues arising from managers trying to create valuation hierarchies. Fund managers and scheme custodians don’t currently have systems in place to analyse and value assets in categories A, B and C as laid out under the FRS 102:

Source: Prag

The IMA has been pushing for greater transparency in the reporting of these costs and managers must ensure they are geared up to provide more in-depth rundowns of their transactions.

Harvie said she would encourage pensions managers¹ to use the statement of investment principles and fund factsheets as a starting point to improve their transparency, although the factsheets currently lack consistency in their formatting.

Kevin Clark, head of pensions assurance at consultancy KPMG, who also worked on the document, said: “The revised Sorp will signal the start of a new era of pension scheme reporting, filling in the gaps of the new FRS 102 principle-based framework, and providing principal users of statements with a more relevant set of data.”

Clark said the new Sorp stems from a broader review and planned overhaul of the legislation underpinning pension scheme financial reporting, which was first drawn up in 1986. The Department for Work and Pensions has delayed the revision of this legislation to Autumn 2015, after the general election.

¹The original version of this article read "asset managers" rather than "pensions managers". This has been updated.