Private sector pension schemes will see their general levy bill increase by £4.9m in 2020-21 as the government has confirmed a hike of 10 per cent to overcome a shortfall in funding in future years will go ahead.

However, after much criticism from the industry, the Department for Work and Pensions decided to speed up the timetable of the structural review of the levy to 2020, instead of the initial deadline of 2021.

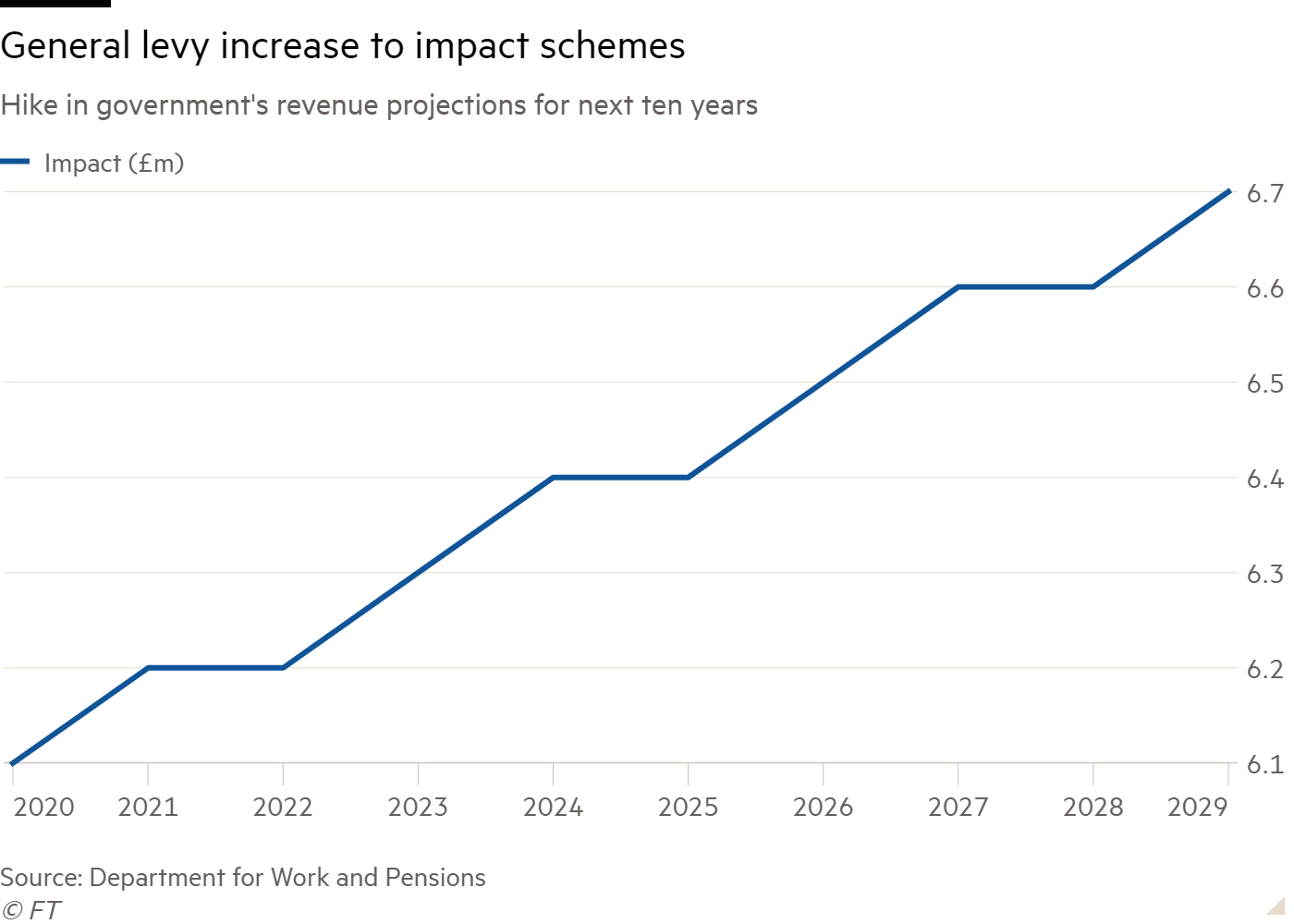

In a consultation published in October, the DWP stated that the general levy will need to rise to plug an estimated gap of £540m by 2029-30 under current rates. At the time, several pensions experts criticised the government’s proposals, arguing that DWP proposed ‘knee-jerk solutions’ that are not fit for purpose.

This levy, which was last increased in 2008-09, recovers the funding provided by the department for the core activities of the Pensions Regulator, the Pensions Ombudsman and part of the activities of the Money and Pensions Service.

A more phased increase would have been fairer and allowed schemes to take action in the interim to minimise the levy they have to pay

John Wilson, Dalriada Trustees

The government proposed four options to increase the levy, favouring the first option, which would see a rise of 10 per cent in 2019-20 rates on April 1 2020, with further increases informed by a wider review of the fee.

“The requirement to bear down on the levy deficit is pressing, and to delay the start of corrective action until 2021 would not be appropriate,” it said.

Costs might be passed to members in DC

According to government estimates, the 10 per cent hike in the levy will increase costs of private sector schemes in 2020-21 by £4.9m, while the government will have to pay £1.3m more on behalf of public sector pension funds.

Overall, the aggregate impact of the proposed change is estimated to be £64.1m over the 10-year period.

While the government expects defined benefit schemes to absorb the costs of the increase, it stated that defined contribution plan providers may choose to pass them to employers or members.

Currently, the levy is paid according to the number of members in the pension scheme, with different values for occupational schemes and personal/stakeholder plans.

Ten master trusts will pay at least 25 per cent of the total general levy, despite only holding two per cent of assets, according to analysis by The People's Pension.

The master trust, which holds assets under management of around £9bn, estimates that it will pay approximately £3.1m a year. This compares with the £68bn Universities Superannuation Scheme, which will only be liable for about £430,000 in across 429,000 DB members.

This mismatch is one of the topics that could be addressed in the levy review, which will be conducted this summer. The DWP said the review will inform a subsequent consultation exercise in autumn 2020, which will, in turn, inform decisions about the levy from April 2021 and for subsequent years.

One proposal from consultation respondents suggested that the structure of the levy could be amended to reflect the position of master trusts more generally; for example, by taking account of the existence of the authorisation regime and of the reported proliferation of members with small pots.

Industry reacts to ‘disappointing’ announcement

Several experts are unhappy about the government’s decision to hike the general levy.

Darren Philp, director of policy and communications at Smart Pension, classified the outcome of the consultation as “unfortunate and unwelcome”.

“To fill a black hole of its own creation, the DWP is hitting hardest those providers that are in the vanguard of delivering auto-enrolment, and this levy increase has a disproportionate impact on those providers serving low-to-moderate earners.”

For Adrian Boulding, director of policy at Now Pensions, the “disappointing levy announcement” demonstrates once again why the government “must take urgent action to support the industry to get to grips with the growing number of deferred members”.

Master trusts forced to up reserves due to levy increase

Master trusts will be hit twice by a general levy increase, since in addition to a cost hike these schemes will also have to boost their reserves in case of a wind-up, and face added scrutiny from the regulator as a revised business plan could be expected.

Gregg McClymont, director of policy at The People’s Pension, said: “While we welcome the commitment to a structural review, it can’t come quickly enough. The starting point needs to be a clear breakdown of the rising regulatory costs by pensions sector, so it’s clear why the general levy is rising.”

For John Wilson, head of technical, research and policy at Dalriada Trustees, the hike in the levy is not ideal.

“A more phased increase would have been fairer and allowed schemes to take action in the interim to minimise the levy they have to pay. In particular, trustees of well-run schemes may be disappointed and feel that the hike is unnecessary.”