The industry has broadly rejected a wholesale shift of the current pension tax system towards an Isa-style approach, but some have woven together several ideas in an attempt to better incentivise saving.

The government’s pension tax relief consultation, which closed last week, was seen by many in the industry as a first push towards a ‘taxed-exempt-exempt’ system, where savings are taxed at the point of contribution, rather than when withdrawn.

Prior to chancellor George Osborne launching the consultation in July’s Budget, there was general consensus that pension tax relief as an incentive was in need of reform.

However, despite this desire, there has been cynicism across the industry about the motivations behind the green paper, with some believing Osborne was using the proposals to generate savings to help flatter the Treasury’s coffers.

Mark Futcher, partner and head of defined contribution at consultancy Barnett Waddingham, criticised the premise of the paper. “We were not given a problem to solve,” said Futcher.

The government sought a range of views from the industry but tabled three main options: stick with the status quo, move to a flat rate of tax relief and, the most controversial, a flipping of the current exempt-exempt-taxed system to reflect that of Isas.

Many of those who fed into the consultation have made public their responses since Wednesday’s deadline, with the broad consensus being in favour of sticking with upfront tax relief.

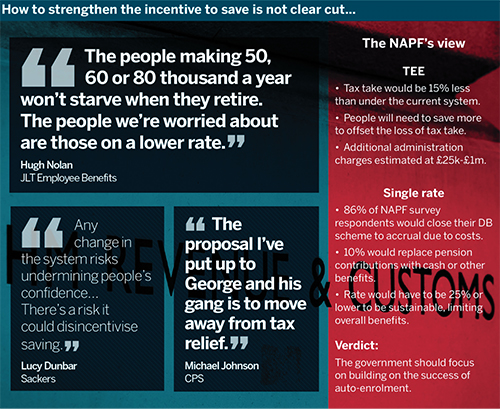

Jackie Wells, head of policy and research at the National Association of Pension Funds, said: “There are inherent tensions between strengthening the incentive to save and the implicit intention that the Treasury needs to reduce what it spends in tax relief.”

She added a shift to a TEE regime would generate short-term cash but ultimately reduce the tax revenue pensions contribute to the Treasury.

Stick with the status quo

Companies objected to major changes to the system mainly on the basis of regulatory fatigue, and the potential damaging effects of further profound change.

Lucy Dunbar, senior associate at law firm Sackers, said: “Any change in the system risks undermining people’s confidence. What we want to do is encourage engagement. There’s a risk it could disincentivise saving.”

Others objected to the lack of clear, immediate incentives to saving under a TEE system.

There are inherent tensions between strengthening the incentive to save and the implicit intention that the Treasury needs to reduce what it spends in tax relief

Jackie Wells, NAPF

Mark Jackson, partner at consultancy LCP, said: “Change like that is very risky and unnecessary. One of the big problems is if you ask people to lock away pension savings, you need to offer a clear incentive.”

Richard Parkin, head of retirement at provider Fidelity Worldwide Investment, said he supports the introduction of TEE only as a top-up arrangement for those who want to make extra contributions into a ‘retirement Isa’. He said the provider’s research had shown “tax relief doesn’t necessarily affect savings levels. Culture, attitude and employer are big drivers of saving”.

Despite this, Fidelity proposed a flat rate of tax relief at 25 per cent in its response, lower than the Treasury average rate of 33 per cent.

However consultancy JLT Employee Benefits said the Treasury average should form the basis of the flat rate.

Hugh Nolan, chief actuary at JLT Employee Benefits, said the flat rate would increase the incentive for people on low wages to save by giving them proportionally higher tax relief than they currently receive.

“The people making fifty, sixty or eighty thousand a year won’t starve when they retire,” he said. “The people we’re worried about are those on a lower rate. If you want them to save you should really give them a bigger slice of that tax relief.”

Nolan said the government should change how it frames tax relief when promoting it. “If you say ‘every pound you [save] the government tops up 50 pence’ that’s more effective than saying ‘tax relief’.”

Concentrate on auto-enrolment

Tony Stenning, head of UK retail for provider BlackRock, said recent policies such as auto-enrolment had been successful in increasing participation and the government should focus on fixing problems within the existing system.

He said: “Last year the average contribution was less than a tenth of [an individual’s] wages. For Europe it’s more like 15 [per cent].”

He said compulsion to save at higher contribution levels than the current auto-enrolment minima would act as a good foundation, with “nudge” policies – such as contribution levels increasing with pay rises – then being used to boost those levels.

“If you can get people to around the 12-15 per cent [contribution level], with a ‘save more tomorrow’ nudging we could get people up to that 20 per cent level.”

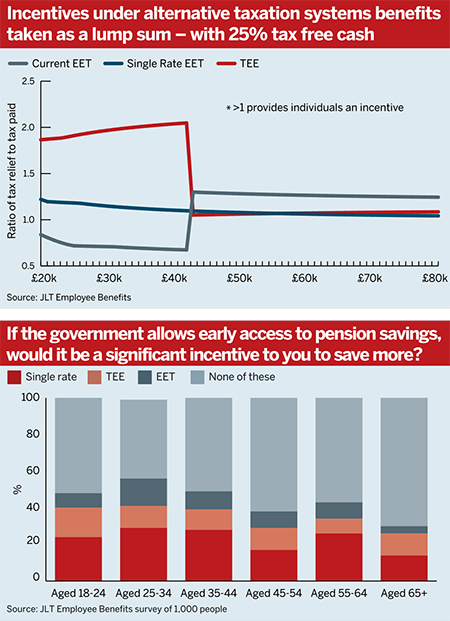

Consultancy Aon Hewitt proposed allowing members under the age of 35 to withdraw their contributions, but not their employer’s, from the scheme as an incentive to save.

Kevin Wesbroom, principal consultant at Aon Hewitt, said: “If they know they could take their money out, we think they’d be quite happy to save in and you wouldn’t see people opting out. That’s a recognition that they have other priorities than paying for pensions.”

This would be accompanied by staggering access to the tax-free lump sum. It would be still be 25 per cent of the total pot at the state retirement age, but members would receive a smaller lump sum if they cashed in earlier and a larger one if they cashed later.

Sack tax relief

Speaking before delegates at Barnett Waddingham’s DC conference this week, Michael Johnson, research fellow at think-tank the Centre for Policy Studies, rejected all forms of tax relief on pensions savings, deeming the present structure “illogical” and “riddled with inconsistencies”.

“The proposal I’ve put up to George and his gang is to move away from tax relief,” said Johnson.

If they know they could take their money out, we think they’d be quite happy to save in and you wouldn’t see people opting out. That’s a recognition that they have other priorities than paying for pensions

Kevin Wesbroom, Aon Hewitt

Instead, Johnson proposed a radical overhaul of the entire pensions landscape and the introduction of a “lifetime Isa” to replace current defined benefit and defined contribution provision.

Under the proposed “Lisa” structure, Johnson said the British public could be incentivised to save with a government contribution of 50p for every post-tax £1 saved into the vehicle from birth.

However, Johnson said he had garnered little backing for his vision from within the pensions industry and delegates at the conference breathed an audible sigh of relief.

Johnson said he anticipates the outcome of the consultation will maintain the EET structure, combined with a move to a flat rate of taxation across all pensions saving. Around 85 per cent of conference delegates agreed with this prediction.

“On balance that’s the most likely outcome but the chancellor will get nowhere balancing the books,” he said.

The government's response is expected later this year.

In the original version of this article, we reported that Michael Johnson said he had garnered little backing for his vision. We have since clarified that this was from within the context of the pensions industry. The article has since been updated.