The global financial crisis gave rise to a record-long bull run, but in recent years many DB pension funds have been preparing for the inevitable end to these highs by reducing their reliance on equities.

Pension schemes in the UK have turned their backs on equities over the last quarter of 2018, our analysis of recent asset flows shows.

Trustees have cut allocations gradually, and in some cases substantially – trimming their equity exposure over time in favour of greater diversification, less volatility, and more predictable cash flows.

Recent research by Camradata revealed volatility in equities. Positive performance for global equities decreased in Q3 2018, with 89.5 per cent of products achieving a break-even or positive return, compared with 98 per cent in the previous quarter.

That’s what’s driven a lot of the drive away from equities – it’s been a lot of schemes taking the performance, locking in those gains and then deploying those assets into assets that are maybe more predictable in terms of providing income

Ross Fleming, Hymans Robertson

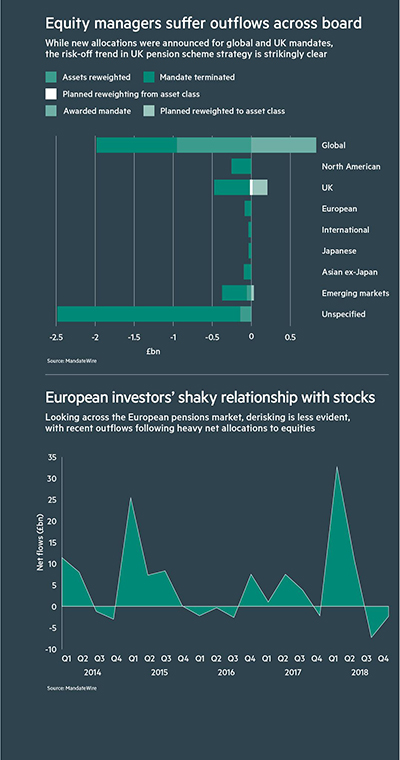

Data gathered by Pensions Expert’s sister publication MandateWire show that corporate pension plans have been actively reducing their allocations to equities over the past year, with many shifting their focus to risk reduction.

In Q4 2018, the newswire service logged 57 asset outflows for UK corporate pension funds. Twenty-seven of these related to equities, compared with 11 instances of asset outflows recorded by MandateWire in Q3 2018.

In Q4 2017, only six instances of corporate pension scheme asset outflows relating to equities were recorded by MandateWire.

As corporate pension schemes have moved money out of equities, the amount hedged through liability-driven investing has increased.

MandateWire recorded one awarded LDI mandate in Q4 2017, and this rose in Q4 2018 to six records of assets inflows or planned increases to LDI allocations, as well as one awarded LDI mandate.

The £16.5bn BBC Pension Scheme was a prime example. In response to outperformance it slashed its equity exposure and reallocated to a range of matching assets, including traditional LDI and alternatives, which provide similar inflation-proofing.

Total shareholdings fell from 26.5 per cent to 16.1 per cent of its assets, while 40.9 per cent of the scheme’s portfolio is leveraged to hedge 62.3 per cent of liabilities.

Risk reduction has also taken centre stage for the £2.5bn Thales UK Pension Scheme, which stepped away from listed equities and increased the scheme’s exposure to investments with more predictable cash flows, including private debt and unlevered infrastructure equity mandates.

Corporates lock in gains

Ross Fleming, senior investment consultant at Hymans Robertson, notes that pension funds have been reducing their equity exposure “partly based on the back of the equity bull run that we’ve had for the past five, 10 years, where equities have performed so stormingly”.

Defined benefit pension funds want to make sure they secure members’ benefits in full and on time. As they become better funded due to equity performance, their deficits have decreased and many trustees take a view that they no longer need to take as much risk.

“That’s what’s driven a lot of the drive away from equities – it’s been a lot of schemes taking the performance, locking in those gains and then deploying those … into assets that are maybe more predictable in terms of providing income,” Mr Fleming says.

This could include debt or credit-type assets, or schemes may increase their level of interest rate and inflation protection through LDI strategies. Schemes may then look to try and transfer risk to an insurer through buy-ins and buyouts.

Local authority pension funds have not been cutting equity exposure to the same extent as their private sector counterparts. In fact, MandateWire logged only six equity divestments in Q4 2018 among public schemes, five of which involved cutting global equity exposure.

With few instances of equity divestment, equities also proved popular among public pension funds in terms of mandate awards reported in Q4 2018. Individual mandate wins reported on Mandatewire suggest that Local Government Pension Scheme pooling played a big part in this.

New equity allocations also reflect the changing philosophies of public sector schemes. The Merseyside Pension Fund last month announced a £400m allocation to a multi-factor equity index fund, incorporating a tilt along environmental, social and governance lines.

Trustees must prepare for new ESG regulations

Responsible investment has become an increasingly salient subject for institutional investors, and the industry is no longer viewing ESG investments as a ‘nice-to-have’.

New regulations coming into force have given fresh impetus to the argument. In 2018, the Department for Work and Pensions announced new regulations, which will require schemes to publish more-detailed statements of investment principles from October 2019.

These will specifically address financially material ESG risks, including climate change.

For all corporate pension schemes, this “will be an item on their first meeting of the year in terms of agenda items”, Mr Fleming says.

Ralph McClelland, partner at law firm Sackers, agrees this has pushed ESG higher up the agenda. “We have seen a significant increase in requests for training and other input on ESG issues over the last 12-18 months, much of it driven by the need to update statements of investment principles before the October 2019 deadline,” he says.

High-profile initiatives like the Environmental Audit Committee’s approach to larger schemes have also been a key factor, according to Mr McLelland.

Public sector schemes in general seem to be particularly active when it comes to ESG investing. In Q4 2017, the eight ESG-related manager tenders, asset outflows or planned allocations recorded by MandateWire were all carried out by public sector funds.