Climate change is one of the greatest challenges of our time, with significant implications for investors, including pension schemes.

Fixed income investing also presents one of the best ways of influencing companies with a high carbon footprint, as for many institutions access to finance from the bond market is an ongoing necessity, either to fund new projects or roll over existing debt.

Furthermore, due to the more regular issuance of securities, the opportunities for dialogue are often regular and fixed income investors can pursue precise sustainability targets and demand changes to the structure and terms.

Until recently, the surest way of reducing carbon emissions from fixed income portfolios has been to exclude those issuers with significant revenue from fossil fuel generation, thermal coal mining, or controversial oil and gas extraction.

Engagement with issuers can encourage the inclusion of interim, science-based targets, which will support the company in reaching net zero, and engagement on carbon accounting can encourage issuers to be complete and accurate in their external disclosures

However, a policy solely based on exclusion is not likely to be the most effective way to bring about reductions in carbon emissions in the real world — it simply moves the problem from one portfolio to another.

Where high carbon-emitting issuers have meaningful and credible reduction targets, engagement can hold them to account and supporting them on the transition.

For example, engagement with issuers can encourage the inclusion of interim, science-based targets, which will support the company in reaching net zero, and engagement on carbon accounting can encourage issuers to be complete and accurate in their external disclosures.

Issues with carbon data

Another reason for not relying solely on carbon emissions is that the data set on all issuers is not complete. This is for several reasons.

Private companies have not been under the same regulatory pressure to publish their carbon emissions numbers, and so there are some issuers in the market where data is not yet available.

Again, it is worth engaging with those issuers to encourage them to calculate and publish numbers.

Second, where issuers are reporting on emissions today, it is typically only Scope 1 and 2; we calculate that only 50 per cent of the issuers in the sterling corporate bond index are providing Scope 3 numbers*.

When building forward-looking portfolios trained on 2050, we would not only like to see better emissions disclosure from issuers overall, but Scope 3 emissions data too. This data can have a significant impact when applied to a low-carbon fixed income portfolio.

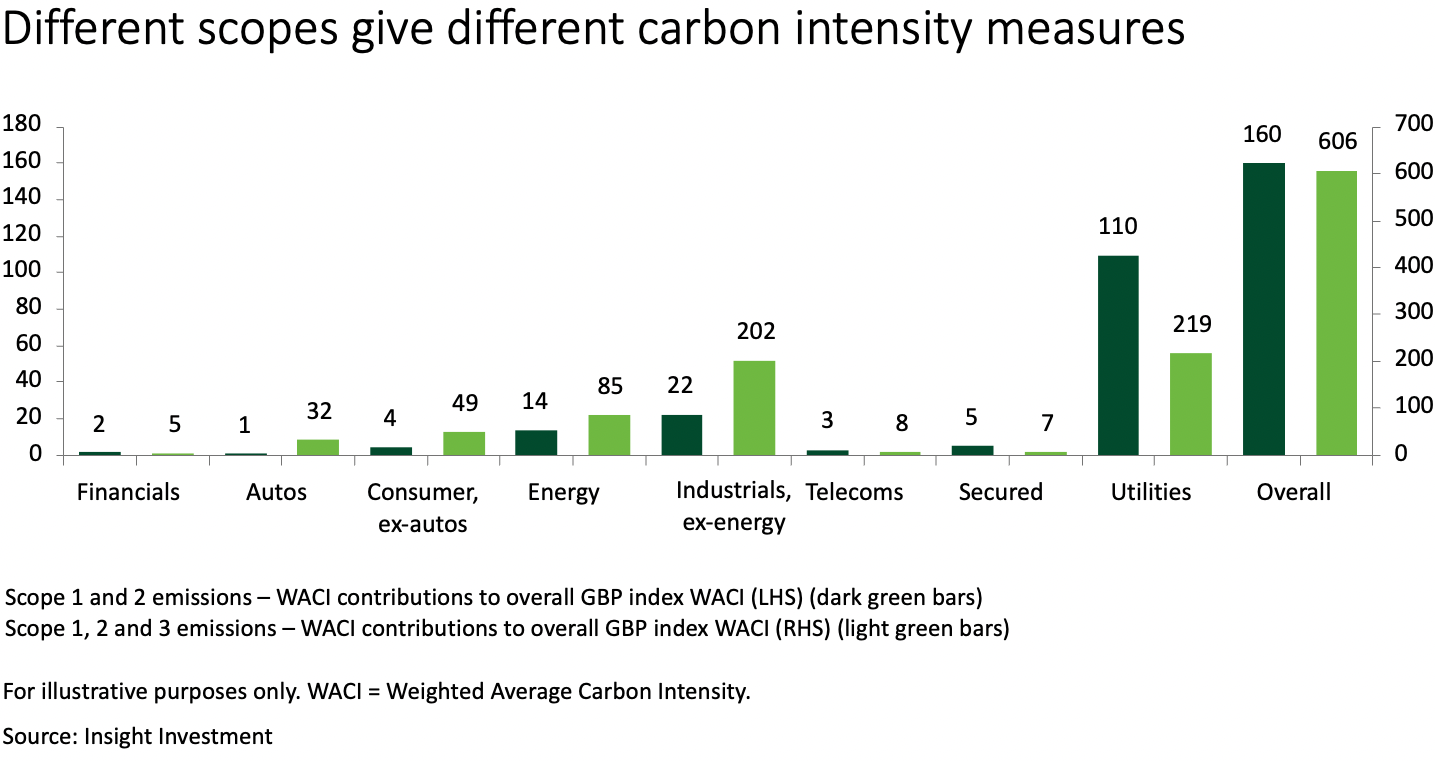

The problem of only relying on Scope 1 and 2 emissions data can be explained by looking at the index for sterling-dominated bonds.

Here, utility companies make up approximately 20 per cent of the index, but roughly 70 per cent of the carbon emissions based on Scope 1 and 2 emissions. So, a portfolio based solely on Scope 1 and 2 data could simply cut its carbon footprint by not investing in utilities.

However, the inclusion of available Scope 3 data brings the carbon emissions of utilities down to only 36 per cent of the index, while raising the emissions of industrials and carmakers — Scope 3 emissions partly relates to the emissions occurred from those that use the products and services created by the issuer.

This highlights the problems of creating such portfolios today, although the rate of progress on issuers starting to produce Scope 3 figures is very encouraging.

Some hurdles remain: for example, within a portfolio, one company’s Scope 1 emissions might also qualify as another company’s Scope 3 emissions, and avoiding such double-counting is a challenge to overcome.

However, the market is well aware of such issues, and it is encouraging that there are widespread initiatives to drive and develop comprehensive and detailed reporting of emissions and related data, with the recommendations of the Task Force on Climate-related Financial Disclosures helping to shape approaches worldwide.

*Scope 1 covers emissions from controlled sources such as boilers and vehicles. Scope 2 is indirect emissions, such as from the generation of purchased electricity. Scope 3 emissions is an estimate of all other emissions in a company’s value chain, such as those associated with purchased goods or released when a consumer consumes the product.

Claire Bews is a credit portfolio manager at Insight Investment