Nearly two fifths of eligible pensioners in a scheme sponsored by Phoenix Group have accepted a pension increase exchange offer, which has shaved about £20m from the bulk annuity insurer's liabilities.

Trustees of the £2.7bn Pearl Group Staff Pension Scheme’s scheme have also sold the fund’s equity allocation and continue to focus on bringing the portfolio up to the target level for exposure to infrastructure equity.

The company worked closely with the trustee and its advisers, including oversight by a joint trustee-company steering committee, to ensure a robust structure for the successful delivery of the PIE exercise

Richard Zugic, Phoenix Group

PIE exercises allow eligible members to trade their non-statutory pension increases for a one-off increase to the amount they are receiving as a pension – giving them a higher income in their early years of retirement.

The £2.7bn Pearl Group Staff Pension Scheme’s sponsoring employer is Pearl Group Holdings (No.2) – which is part of the Phoenix Group.

In April, the trustees wrote to members to inform them that a pension increase exercise had lead to a reduction of around £20m in the scheme’s liabilities.

Joint steering committee oversees exercise

Eligible pensioners were contacted in June last year. According to the April update, “approximately 39 per cent of eligible pensioners contacted by the company accepted the PIE offer”.

Richard Zugic, head of group actuarial at Phoenix Group, says the 2018 Pie exercise was the third bulk member option exercise undertaken on the Pearl scheme since 2011.

“As per previous exercises, the company worked closely with the trustee and its advisers, including oversight by a joint trustee-company steering committee, to ensure a robust structure for the successful delivery of the PIE exercise,” he says.

All eligible members received a written invitation to participate in the offer. This included terms of the offer and the steps that would need to be undertaken to accept the offer.

“One of the key steps was receipt of independent advice from an IFA [independent financial adviser] in support of accepting the offer,” Mr Zugic adds.

Giving members more flexibility

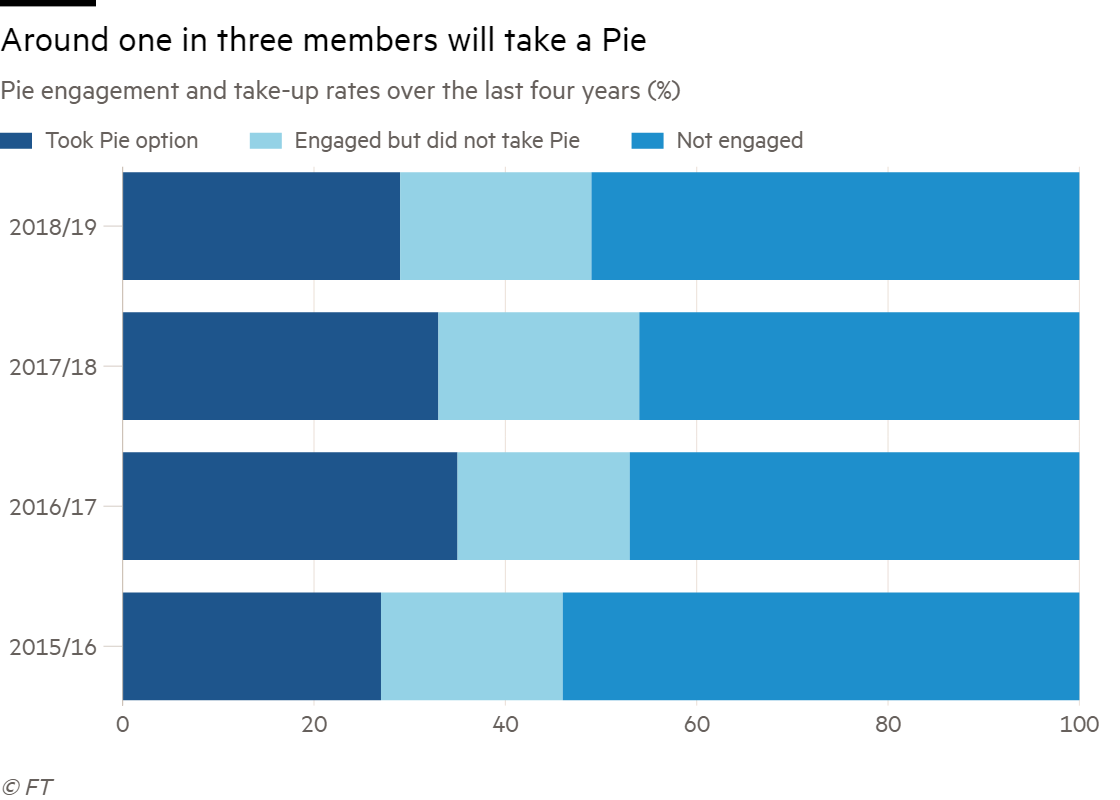

According to Willis Towers Watson’s 2019 DB member choice survey, there is likely to be a strong appetite for PIEs for years to come, at least where scheme rules continue to award pension increases above a level required by law.

Source: Willis Towers Watson

John Martin, principal at Mercer, says many PIE exercises are company-driven, but they can also be led by trustees.

“Firstly, there is the opportunity to offer members flexibility in how they’re receiving their pension – I think that’s often seen as a good thing,” he says.

Secondly, Mr Martin adds that it is a way to manage risk by reducing both liabilities and inflation and longevity risk exposure.

Pie generates £23m for Centrica

Utilities provider Centrica saved £23m on future pension liabilities after a pension increase exchange was taken up by a quarter of retired participants across three of its defined benefit sections.

PIEs “have become common market practice; that’s not to say there aren’t a lot more schemes that will think about them and could do them – there will be plenty out there”, he says.

“If you can make the offer and it is reasonable to do so, then I think that companies and schemes should be exploring it,” Mr Martin adds.

Is your data up to date?

PIE exercises can help pension funds manage liabilities, but schemes should start off by making sure their underlying data is correct.

“Any liability-management exercise presents an opportunity to cleanse and review the underlying data,” says Daniel Taylor, director at third-party administrator Trafalgar House.

Providing the option based on incorrect underlying data can be risky. Mr Taylor says that if a scheme does use incorrect data for a PIE “the error has an inflationary effect because of the nature of the offer”.

“The more you pay out incorrectly, the harder it is to recover that overpayment and to correct, and the more costly it becomes,” he adds.

Mr Zugic says a data cleansing exercise was not necessary for the Pearl scheme, as it "already had high-quality and robust membership data to support the exercise.”

Trustees slash equity exposure

While the PIE wiped off £20m of the Pearl scheme’s liabilities, trustees have also been working on the pension fund’s investment strategy to reduce risk.

The April update to members shows that, in line with the scheme’s long-term funding plan, the trustees sold their equity holding in December 2018.

According to an update from February 2018, the scheme had a 5.9 per cent allocation to global equities in its return-seeking assets bucket as at December 31 2017.

Mr Zugic notes that the trustee, in consultation with the company, has an established long-term derisking strategy – first established in 2011.

This strategy anticipates, amongst other things, shifting to a lower-risk investment strategy as the scheme’s funding ratio improves.

“Divesting from equities last year, therefore, served to partially lock in the recent improvements in the funding position, consistent with the investment strategy,” Mr Zugic says.

He adds that the trustee continues to work closely with the company to make sure the investment strategy for the Pearl scheme remains appropriate, “both on a standalone basis and in the context of the company's wider group balance sheet”.

In line with the strategy, Mr Zugic says that proceeds from the equity divestment were reinvested primarily into investment-grade corporate credit.

Funding levels on the rise

“The company anticipates that the trustee will continue to divest away from return seeking assets (in favour of assets that provide a better match for the duration of the underlying pensioner benefit profile) as the Pearl scheme funding ratio improves,” he adds.

The April update states that the scheme's most recent full valuation, as at June 30 2018, is currently in progress.

"Early indications suggest the results will show that the funding level has increased since the previous valuation as at 30 June 2015 (and since the estimated update as at 30 June 2017)," it adds.

Data gathered by Pensions Expert’s sister publication MandateWire show that corporate pension funds have been actively cutting their exposure to equities over the past year. Instead, many are turning their attention to risk reduction.

MandateWire logged 57 asset outflows for UK corporate pension schemes in Q4 2018. Twenty-seven of these related to equities, compared with 11 instances of asset outflows recorded by the newswire service in Q3 2018.

Sebastian Schulze, managing director at consultancy Redington, says that one driver for equity reduction is improvements in scheme funding levels.

“The returns that they need to earn to close the deficit by their target date have come down quite noticeably,” he says, adding that other diversifying assets can feature similar expected return.

Infra equity on the agenda

The Pearl scheme is currently working to reach its target level for investment in infrastructure equity. It has a 1.6 per cent allocation currently, up from 0.2 per cent in December 2017. It also has a 13.7 per cent infrastructure debt allocation.

Mr Schulze says that investing in infrastructure equity could be described as trying to get the best of both worlds, "on the one hand to get a decent level of return from this investment, but on the other hand to know that this investment is backed by real assets to provide a certain service and therefore produce certain cash flow streams”.

Infrastructure equity investors acquire the remaining cash flows from projects after the operating costs and income used to service debt investors is deducted.

Mr Schulze points out that when investing in infrastructure equity, “you are at the bottom of the capital structure”.

He says: “Lots of people have been looking at buying infrastructure debt, for example, rather than infrastructure equity, and clearly debt will always have the first call on the cash flows that come through from an infrastructure asset.”

However, “as an equity investor you will have the last call on the cash flows that are produced by that asset” he adds.

“You just have to be very aware that although it’s infrastructure, because it’s equity that doesn’t mean it’s riskless.”