Data crunch: Thirty leading asset managers have pledged net-zero emissions by 2050 or sooner, on the heels of a landmark divestment announcement by the $226bn New York public pension. But a key datapoint suggests companies’ capital expenditure does not yet match managers’ sustainability rhetoric.

Fund houses with $9tn under management, including Legal & General Investment Management, Fidelity International, Schroders, UBS Asset Management, Wellington Management, Axa Investment Managers, BMO Global Asset Management, DWS, M&G and Asset Management One, all founded the Net Zero Asset Managers initiative on Friday.

Commitments the signatories must make include reducing carbon emissions “consistent with a fair share of the 50 per cent global reduction in CO identified as a requirement in the Intergovernmental Panel on Climate Change special report on global warming of 1.5C” by 2030, with net-zero expected by 2050.

Across the globe, we are seeing a wave of commitments from pension schemes to align their funds with their values in order to build a better world

Tony Burdon, Make My Money Matter

An interim target must be reviewed every five years, taking account of Scope 1, 2 and 3 emissions if possible, while an investment engagement strategy should be developed and implemented, including an escalation policy where voting does not have the desired effect. Suitable products should be launched where necessary.

Stephanie Pfeifer, chief executive of the Institutional Investors Group on Climate Change and founding partner of the initiative, said: “We talk a lot of tipping points in our sector, but 30 of the world’s leading asset managers with assets under management of more than $9tn committing to the goal of net-zero by 2050 really can help tip the balance in favour of the global economic transition to net-zero. This is action — not simply words.”

Others have questioned how robust these commitments are, however. As reported by Pensions Expert’s sister title Ignites Europe, campaigners have said the commitments are too “vague”.

Capex conundrum

Data on what companies are actually doing supports these calls for a tougher stance from fund managers.

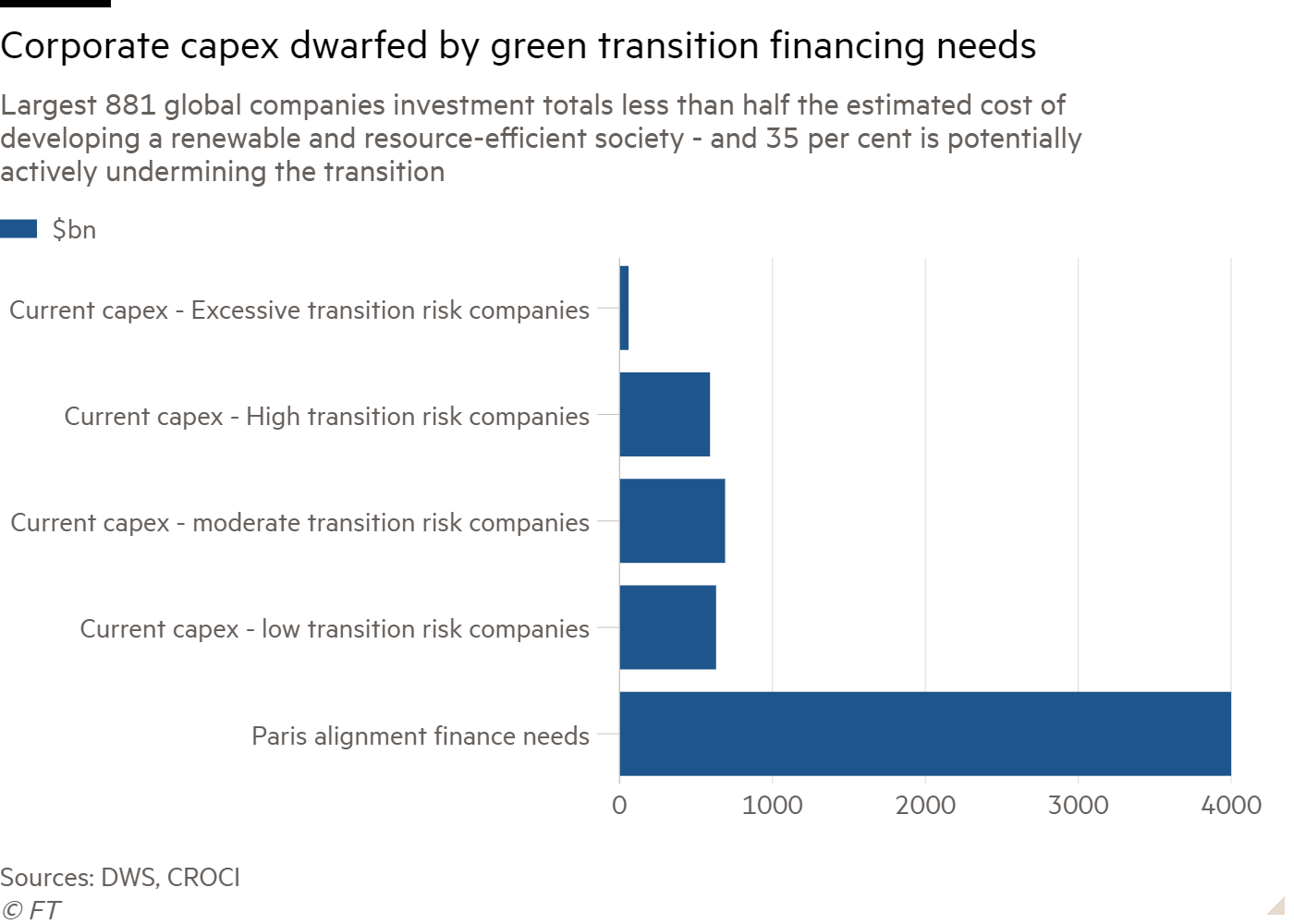

Analysis by German asset manager DWS shows that the total capital expenditure by the world’s 881 largest companies is less than half of what is needed to align the world with the goals of the Paris agreement signed five years ago.

To make matters worse, 35 per cent of this capex relates to companies with a high or excessive transition risk, so may in fact be undermining the Paris goals. These investments have an economic life of roughly 22 years.

There are still reasons for optimism. The Climate Policy Initiative has tracked $579bn of climate finance from development banks, financial institutions, governments and households along with $183bn from corporates.

DWS’s note also pointed to an aggressive engagement push from Climate Action 100+, a collaboration of 545 investors with $52tn in AUM. From next year, around 160 companies are to be publicly assessed on their emission reductions, and other factors including capex and governance.

Hitched or ditched?

If companies are unable to meet more exacting standards on the transition to a green economy, they may now risk falling out of the portfolios of some of the world’s largest asset owners.

The New York State Common Retirement Fund announced on December 9 that it will begin to divest from companies that do not meet requirements on effective transition away form fossil fuels.

In June, it rid itself of 22 thermal coal producers that had not managed to reduce this activity below 10 per cent of their revenue, leaving behind just five in the sector. At the time, it promised to revisit the oil sands sector, but has now decided to employ similar tactics across its portfolio.

Tom DiNapoli, the plan’s comptroller, told the Financial Times that companies that are not “transition ready” pose too great a risk to long-term returns to remain in the portfolio.

Back to the future: How pensions can revolutionise the next 10 years

Whether for winding forward to a post-vaccine economy or back to reverse deletion of guaranteed minimum pension transfers, time-travelling machines are in high demand in pensions and the wider society. The truth is that no one can guess what the future looks like, but several pensions experts were brave enough to risk predicting what the next decade holds for the pensions industry.

The plan will start by shale oil and gas companies, integrated oil majors and fossil fuel exploration, servicing, storage and transport companies, and hopes the threat of divestment will spur executives to make faster changes.

Unsurprisingly, the move was popular with climate campaigners. Tony Burdon, chief executive at Make My Money Matter, said in a statement: “Across the globe, we are seeing a wave of commitments from pension schemes to align their funds with their values in order to build a better world. It is reassuring that supersized schemes such as the NYSCRF have begun to take action, as they can trigger real change and help to tangibly reduce our carbon emissions worldwide.

“In taking further steps to improve its environmental output by committing to sell its shares in other companies contributing to global warming by 2040 should they fail to transition their businesses, the fund joins the likes of Nest and the BT Pension Scheme here in the UK in furthering the net-zero pension agenda.

“As one of the world’s largest investors, NYSCRF’s decision to exercise its influence could help to increase momentum among investors as they move their money away from harmful oil and gas companies on a global scale,” he added.