Trustees of the Combined Nuclear Pension Plan have dropped Prudential as their defined contribution provider in favour of Aegon, after member-borne charges for the default and other options were rated "below average" in an assessment of value for members.

An online statement from the CNPP trustee for members of its GPS section, published last month, shows the trustee has decided to transition members’ investment pots to Aegon, excluding investments in Prudential’s With-Profits Fund.

After a lot of thought and advice the trustee concluded that other providers could offer a better service, more suitable investment funds and greater value for money

CNPP Trustee

“After a lot of thought and advice the trustee concluded that other providers could offer a better service, more suitable investment funds and greater value for money for members than the Prudential. The trustee therefore had a duty to change the funds and/or the provider,” the statement reads.

Following a public procurement for new providers, Aegon was appointed as DC administrator of the CNPP.

“Aegon will provide an enhanced service to all members (with better communications including member online access and services) at a member charge significantly less than that of the Prudential,” the trustee statement notes.

Annual management charges paid by members will fall from Prudential’s fees of between 0.65-0.75 per cent per annum to Aegon’s 0.26 per cent (for their default funds) a year, the statement adds, highlighting that “this is a significant saving for members”. Prudential has declined to comment.

Watchdog zones-in on default governance

Value assessments have come under increased regulatory scrutiny in recent years.

Ninety-five per cent of members in DC schemes with 12 or more members are invested in the scheme’s default strategy, according to the Pensions Regulator’s DC trust data published in January, which means that properly assessing the value and suitability of default arrangements is crucial.

The watchdog recently announced it is scrutinising trustees in a new drive to make sure they are meeting their legal obligations and properly governing default arrangements.

More than 500 DC pension plans have been contacted as part of the regulator’s pilot. They will have to confirm whether the performance and strategy of their plan’s default have recently been reviewed and remain appropriate.

If a scheme’s default strategy has not been recently reviewed, trustees are being taken through simple steps to comply with the law, including assessing the performance of the default arrangement, reviewing the current strategy and taking members’ needs into account.

The regulator has highlighted that trustees struggling to meet the expected standards should consider whether value for members would be improved by transferring them into a better-run pension plan.

Prudential given 'below average' rating

The CNPP section's move to Aegon sees it consolidate its relationship with the Dutch multinational. Three other DC sections – the CPS New Joiners DC Structure, the GPS New Joiners DC Structure and the CNPP CPS SPPP – have been provided by BlackRock, which transferred its DC platform and administration business in the UK to Aegon last year.

Member charges were listed as 0.46 per cent a year for these default arrangements. This included a 0.25 per cent administration charge, which was subsequently reduced to 0.215 per cent in April 2018. The new Aegon appointment achieves a further discount – to 0.26 per cent total cost for members.

In comparison, the Prudential contact's charges ranged from 0.675 per cent to 0.75 per cent a year, a level of charging the CNPP chair rates as "poor". The charges for Prudential's With-Profits Fund, "while lacking transparency, which makes assessment difficult" were rated "average to good".

The value assessment, reported in the chair's statement on March 31 2018, has also raised concerns about the three former BlackRock contracts, although these appear to have been addressed. While investment-related charges for these sections were rated "good", "the level of administration costs have in recent years become less competitive” compared with peers, and so were rated "below average". Administration charges have since been reduced.

Overall, member-borne charges for the plan were rated "below average" by the trustees.

It’s a good approach to test the market every so often, just to see what’s out there

Maria Nazarova-Doyle, Mercer

Keep an eye on the market

Before making the big decision to switch providers, trustees can try to negotiate better value.

Lydia Fearn, head of DC and financial wellbeing at consultancy Redington, says: “Negotiation is really important for trustees to think about on a regular basis." However, while “the first port of call is to talk to the provider”, trustees should also “look at the wider market and see where it’s moving”.

Maria Nazarova-Doyle, principal at Mercer, agrees. “It’s a good approach to test the market every so often, just to see what’s out there, because services are constantly developing [and] propositions are constantly developing," she says.

She adds that trustees can become complacent and assume their current offering provides value for money, and she praises the CNPP assessment as an example of DC governance working properly, resulting in “action... being taken where action is needed”.

Trustees struggle to assess value

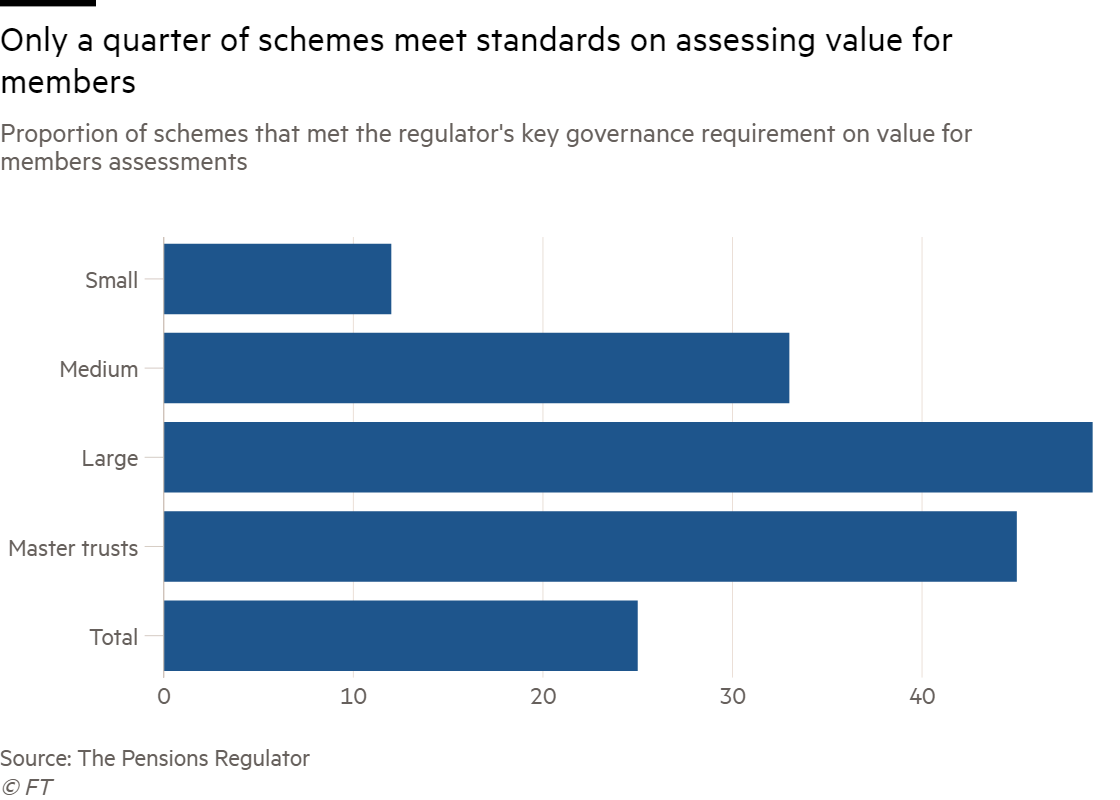

Research into DC governance in 2018 by TPR found that assessing value for members was challenging for schemes of all sizes, despite having issued guidance on how trustees can carry out these processes.

“The problem at the moment is there is no clear benchmark, there is no clear way to measure what value for money, or value for members, is,” Ms Fearn notes. “Because there is no consistency across the view, it’s very hard for a trustee to determine what ‘good’ might look like.

“On the other side of it, if you did get some sort of benchmark, you don’t want to end up with a league table, and everybody [saying], ‘Well my scheme’s better than your scheme because of this’,” she adds, explaining that members’ needs vary widely and value is also impacted by whether the employer picks up some of the costs.

“It really comes down to the individual trustee to create clarity on what they consider value for money... Sometimes it can be really hard because it can feel like it’s changing from year to year,” Ms Fearn notes.

In 2015, the 0.75 per cent charge cap was introduced – bringing fees into focus for many DC schemes.

However, Broadridge’s UK DC Monitor found that pensions communications has overtaken fees in the last couple of years as the most important feature of a good DC plan, according to trustees and pension managers. Investment design came third.

As part of its value assessment, the CNPP considered that investment services have the greatest impact on DC members’ retirement benefits.

The employer bears the costs of communication and governance, so the scheme weighted their assessment 75 per cent to investment services – split equally between charges and the quality of the investment options – and 25 per cent to administration services.

Ms Nazarova-Doyle says that while communications play an important role in terms of ensuring contributions are at the right level, investments are also extremely important.

“At the end of the day, DC is a pot of money that you invest over the longer term, so if you invest enough and if you invest it well, then that’s your DC outcome sorted,” she says.