Data crunch: Institutional investors across the world are concerned that high levels of debt could spark the next market crisis, according to recent research by Invesco.

The asset manager’s 2019 Global Fixed Income Study surveyed fixed income specialists and chief investment officers across Europe, North America and Asia-Pacific.

Think about the different types of risks that you’re running and try and quantify them in some way

Ian Mills, Barnett Waddingham

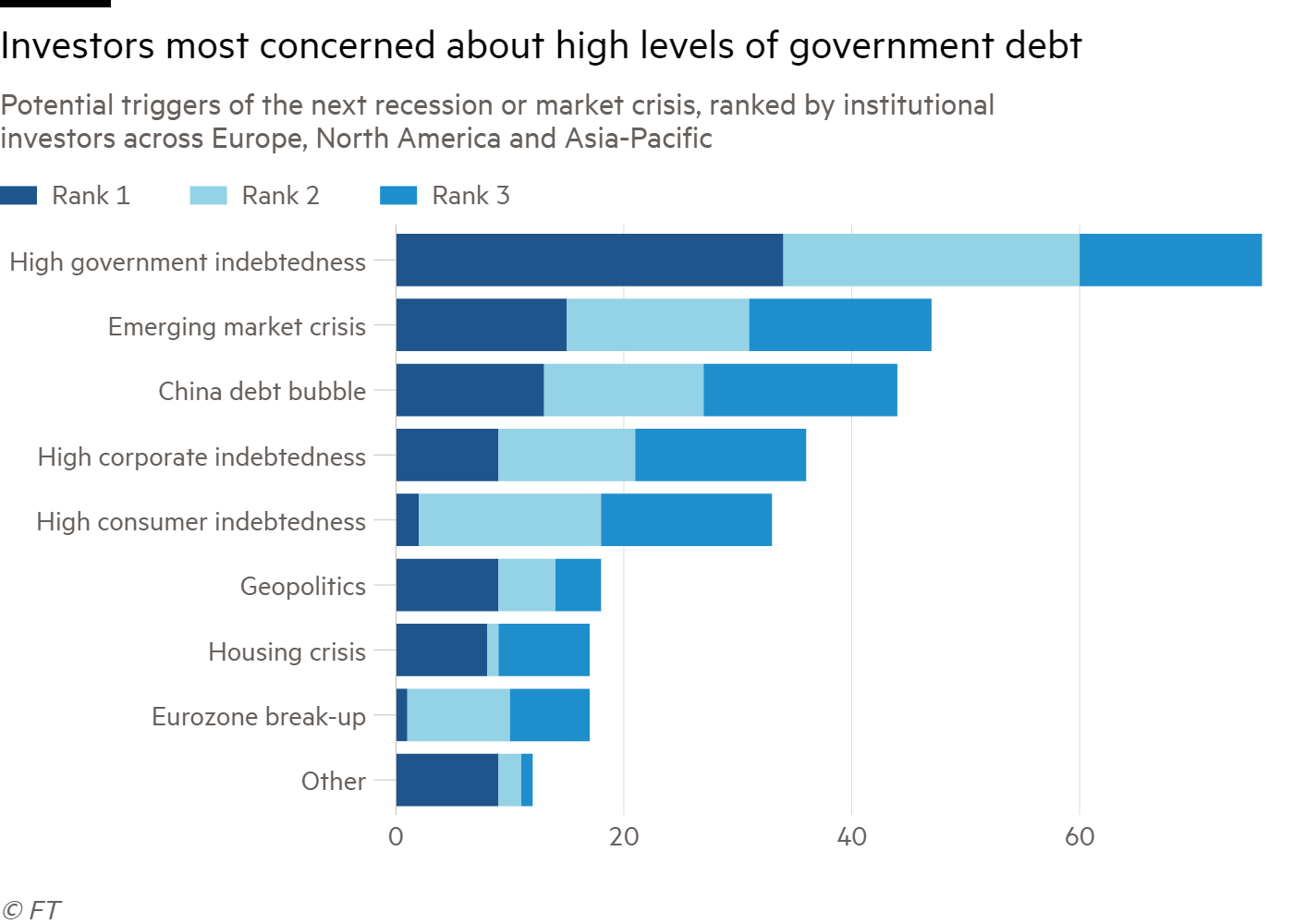

When asked about possible triggers of the next downturn, 106 respondents working across pension schemes, insurers, sovereign wealth funds and wholesale investors, said they were mainly concerned about high government indebtedness.

Nick Tolchard, head of Invesco’s Europe, the Middle East and Africa fixed income division, writes in the report that “respondents broadly view global economic conditions as being late-cycle – expecting an end to the long-running global expansion within one to two years”.

Govt indebtedness tops list of concerns

In particular, investors said they see high levels of government debt, brought on following the financial crisis and as a result of ongoing structural fiscal deficits, as the main risk.

Thirty-four respondents ranked high government indebtedness first as a potential trigger, while 26 ranked it second and 16 placed the issue third.

Ian Mills, senior investment consultant at Barnett Waddingham, says that government debt has skyrocketed, and a lot of it is sitting on central bank balance sheets.

“Through quantitative easing programmes that the developed market governments put in place as a response to [the crisis], we’ve had a very long period of very low interest rates across the developed world – remarkably low when you look back across history,” Mr Mills notes.

This means that when the next crisis hits, the ability of central banks and governments to respond is limited by the zero bound – “they used all their capacity back in 2008-09 and it hasn’t really been recharged”, Mr Mills adds.

Not normally the trigger

While levels of government debt have risen, Hemmo Hemmes, head of investment strategy at Cardano, says this is not normally the first trigger of a recession.

“Very often, if a government is relatively stable, then government debt itself is not the trigger to cause a recession, but it can amplify what’s happening,” Mr Hemmes says.

While government indebtedness keeps investors awake at night, they have also expressed concerns over consumer and corporate debt.

Nine respondents ranked high levels of corporate debt first when asked about potential triggers of the next recession. Twelve placed it second and 15 ranked it third.

While only two respondents ranked consumer indebtedness top of their list of concerns, 16 ranked it second and 15 placed it third.

The Invesco report notes that the focus on debt is not surprising in the aftermath of record low interest rates for an extended period.

It points out that supportive monetary and fiscal policies have helped investors, businesses and consumers in recent years in the form of strong economic growth.

However, the report adds: “Our respondents see a rising interest rate environment as being likely to have a significant impact on interest costs and default rates.”

While it seems that investors see a number of different issues as potential triggers of the next crisis, the most important consideration for pension funds is to make sure they are sufficiently prepared.

Mr Mills says: “Think about the different types of risks that you’re running, and try and quantify them in some way.”

Schemes should be comfortable that, should any of these risks materialise – potentially several of them at the same time – they can deal with it.