The BBC Pension Scheme has slashed its exposure to equity markets, in an attempt to lock in recent outperformance with liability-driven investment, private credit and alternative matching assets.

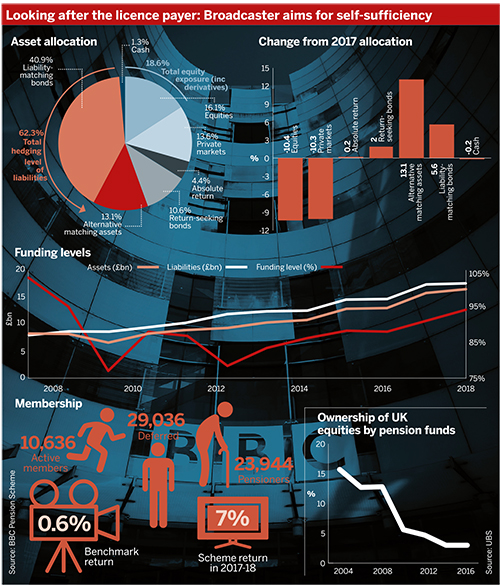

The broadcaster’s scheme delivered an annual return of 7 per cent to the end of March – comfortably ahead of its benchmark – which reflects movements in liabilities, and grew 0.6 per cent over the year.

Its technical provisions funding level was 94.1 per cent at April 1 this year, up from 90.8 per cent the previous year. Total liabilities stand at £17.6bn.

The outcome-oriented investment move mirrors a trend towards schemes reducing funding uncertainty by matching cash flows with yield-generating assets, driven in part by increasing cash flow negativity.

Broadridge Financial Solutions forecasts that by 2027, UK aggregate contributions of £7bn will be eclipsed by defined benefit pension payments of £53bn.

In response to the funding uplift, the BBC scheme has cut its total shareholdings from 26.5 per cent to 16.1 per cent of its portfolio. Equity derivatives have brought its total exposure to stock markets to 18.6 per cent of assets.

They’re probably looking to smooth the journey, equities as we know are quite volatile

John Belgrove, Aon

The resulting cash has been reinvested in a range of investments designed to lower the overall risk in the portfolio, according to trustees.

The scheme’s investment objective is to reach a funding and risk level that minimises the chance of the BBC having to pay additional contributions, an objective it currently expects to achieve by 2028.

“Following the completion of the 2016 valuation and significant improvements in the Scheme’s funding position, the future investment returns (vs liabilities) that are required for the Scheme to meet its objectives have fallen,” trustees told members in the scheme’s annual report.

“The Trustees have therefore been able to take further steps in 2017/18 to reduce the level of investment risk embedded in the Scheme.”

Alternatives provide rough matching

That risk mitigation has taken a two-pronged approach. The scheme’s use of traditional LDI has increased, with 40.9 per cent of the scheme’s portfolio leveraged to hedge 62.3 per cent of its liabilities. In 2017, LDI accounted for 35.3 per cent of assets.

But the scheme has also made new allocations to an infrastructure fund managed by Infracapital and purchased long-lease properties, which while not as accurate a hedge against liabilities, offer the possibility of upside against low-yielding gilts.

“We have used what we call ‘alternative matching assets’ as well as LDI,” explained James Duberly, the fund’s director of pension investments. “Over the years we have acquired assets that we think will improve the scheme’s risk-adjusted returns, as part of a diversified portfolio that also includes listed assets such as LDI (ie gilts and swaps), corporate bonds and equities.”

Rather than achieve the same risk reduction solely by using LDI and equities, the scheme has sought to diversify both its matching and growth assets. Alternatives provide regular cash flows and a return above gilts, while the scheme has also made allocations to a range of private credit assets.

“I don’t know where equity markets will go next, but it’s hard to imagine that global equities will do as well in the next few years as they have in the last 10,” said Duberly.

Beeb equity level low for active scheme

Derisking away from equities has often been seen as a consequence of DB scheme closure, with open plans tending to tolerate higher allocations to growth assets and equity volatility, given their long time horizons.

The Local Government Pension Scheme, for example, had an average 36.8 per cent allocation to stocks in 2016, with some funds significantly higher.

In this sense the BBC scheme, which continues to accrue benefits on a career average basis, might look unusual.

But Simeon Willis, chief investment officer at XPS Pensions, said the industry’s accepted wisdom here is based on a fallacy.

“People have traditionally associated an active scheme with taking investment risk and a closed, more mature scheme with one that takes away risk,” he said. “We’re moving towards a more considered approach that really aligns the level of risk that is being taken with the strength of the employer.”

That desire to avoid cash calls on the employer, and ultimately the licence payer, is evident in the BBC’s decision to derisk as its funding improves.

Using a funding trigger to reduce risk is a common move and is often the result of collaboration between trustees and an employer, said Willis, but he warned of the possibility that triggers might not be hit.

“That’s a mindset that can sometimes be appropriate, but it’s not always. Sometimes it’s much more appropriate for a scheme to take risk off immediately and maintain that over time,” he said.

LDI and CDI work together

Willis also welcomed the fact that the BBC has combined both LDI and alternative matching assets, arguably a form of cash flow-driven investment.

“They are a complete complement,” he said. “In fact LDI works even better when you marry it up with income-generating credit assets, because in the main you can’t get credit assets that have sufficient duration, or length until it matures.”

That poses a reinvestment risk, which Willis advocated mitigating by blending the two techniques.

That may be so, said Ajeet Manjrekar, co-head of River and Mercantile Solutions; but for schemes with less scale than the £16.5bn BBC plan, the use of pooled LDI solutions can create a headache when combined with CDI.

He said mismatches between the cash flows thrown off by alternative assets can be difficult to reconcile with off-the-shelf hedging strategies, but that this need not be the case even for smaller schemes.

“I make extensive use of segregated LDI mandates from very small schemes… upwards,” he said. “If you’re using pooled LDI funds it becomes quite complicated.”

Alts and private debt should smooth growth

Despite the derisking drive, the BBC scheme is still seeking growth, both from its new alternative assets and a range of private credit opportunities.

The scheme invested in a KKR opportunistic credit fund during the year, along with a Libremax Capital asset-backed securities product and insurance-linked securities managed by Securis Investments.

Diversifying this growth engine beyond equities looks a solid move given the length of the equity bull run, said Aon senior partner John Belgrove.

“They’re probably looking to smooth the journey – equities as we know are quite volatile,” he said. “At some point that steam is going to run out and maybe at some point in the not too distant future we might see a correction.”

If trustees decide that the case for diversification will be reaffirmed in the coming years, they must also be careful not to assume that an asset is uncorrelated with equities just because it is classed as an alternative.

Kent cuts passive equities for private equity and infra

The £6.2bn Kent County Council Superannuation Fund has moved capital from UK passive equities into private equity and infrastructure. The fund narrowly missed its benchmark for returns in the year to March 2018, after underperformance from equity and fixed income mandates.

Manjrekar illustrated this danger by pointing out the volume of bonds issued by real estate investment trusts recently, bringing the asset classes of corporate bonds and real estate closer together in correlation terms than might initially be assumed.

“What looks like a diversifier because it’s illiquid may have the same exposure,” he said, adding that advisers should help schemes assess how the different components of the portfolio interact as a whole in different situations.

Similarly, he urged trustees to ensure the extra yield they pick up from investing in private over public credit is adequate compensation for increased risk and illiquidity.

True diversification requires expertise

Experts said some of the assets chosen by the BBC appear to deliver this true diversification, noting the low correlation of insurance-linked securities, which pay a premium to the scheme to cover the cost of events like natural disasters.

Still, trustees will need expert advice in this area, said Belgrove.

“You’re getting paid a premium to a portfolio of assets to cover them, and in the event a disaster does happen that would represent a massive drawdown,” he said. Strategies should insure against a diverse range of risks rather than concentrating on one, and terms need to be carefully assessed to limit the scale of losses.

However, Belgrove said this complexity should not put schemes off, nor should scare-stories drive them away from rationally assessing products like asset-backed securities, which played a role in the last financial crisis.

“You need careful, deep research – you don’t want to go into any old investment,” he said, but added: “It’s often trading on the fear and greed aspects that you can profit on as long as your research is good.”