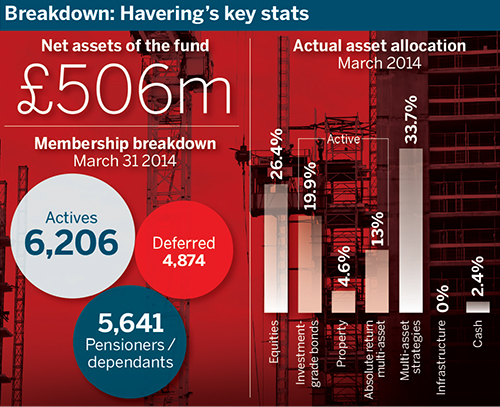

The £506m London Borough of Havering Pension Fund is looking to invest in local infrastructure projects, but the need to balance this with strong returns is hampering its search.

Local authority pension schemes are open to new members and ultimately backed by the taxpayer, meaning they have more flexibility to pursue long-term investments such as real assets. But experts warn focusing on localised investments could increase risk to their portfolios.

Havering Council injected an extra £11m into the scheme to invest in local infrastructure and property projects such as social housing and private rentals over a year ago, according to the scheme.

The big opportunity now is for funds to work together to invest in each others' areas

Mark Packham, PwC

“We’re looking to invest locally, so it’s been problematic to find a scheme that meets the returns we’re looking for,” said Debbie Ford, pension fund accountant at the Havering fund. She added the scheme was looking for growth qualities in the potential investments.

Ford said: “There are a number of housing projects in the pipeline. It’s something we’re positively looking at.”

Local authorities across the country have begun to look at investing locally through pension schemes.

Strathclyde Pension Fund has what it calls a “new opportunities portfolio”, which targets a range of investments not covered by other mandates. The portfolio includes investing in projects to renovate the Glasgow 2014 athletes’ village for residential use, providing affordable and socially rented housing.

“They do feel they have local knowledge,” said Mark Packham, director of pensions at consultancy PwC, adding that the knowledge advantage has to be balanced against the risk of becoming overly localised.

“You’re opening yourself to an investment that will do well if the local area does well, but does badly if the local area does badly,” Packham said.

The next step, said Packham, is for local funds to work together to invest in projects across the UK, maintaining local knowledge while mitigating risk.

“The big opportunity now is for funds to work together to invest in each others’ areas,” he said. “That creates the long-term real return you want from infrastructure.”

National investment

Local government pension schemes are already working on UK-wide infrastructure projects. Earlier this year, the Greater Manchester Pension Fund and London Pension Fund Authority announced a £500m programme to invest in UK infrastructure projects, balancing investment returns with benefits for the wider UK society.

Steve Simkins, head of public sector pensions at consultancy KPMG, said: “There’s a wider piece about LGPS funds across the UK investing in the UK… What we’ve got with Havering is a very local part of that.”

Simkins added constraining the search to local projects made finding the right investments challenging.

“It’s more difficult to find projects with the right returns,” he said.

Hans Holmen, principal at consultancy Aon Hewitt, said that schemes seeking infrastructure investments should look globally to maximise the opportunities, but added investing in the UK can have unique benefits.

“Some pension funds want a UK RPI linkage for an LDI strategy, so those would be more UK [focused],” he said.