London Borough of Havering Pension Fund has reversed its original decision not to join the London Collective Investment Vehicle, making it one of the last of the city’s schemes to take this route to reduce manager fees.

The £575m scheme signed up to the London CIV within the past few weeks, the latest of the 33 London local authorities to join.

The CIV was set up with the aim of achieving economies of scale and cost savings, while opening up opportunities to invest in alternative asset classes.

London’s councils manage around £24bn of assets and have 87 fund managers across 253 mandates, paying £72.8m in manager fees in 2012/13, according to the CIV.

London’s councils manage around £24bn of assets and have 87 fund managers across 253 mandates, paying £72.8m in manager fees in 2012/13, according to the CIV.

A spokesperson at Havering said the intention was to invest with its existing managers at a lower cost via the CIV if these become part of the CIV framework.

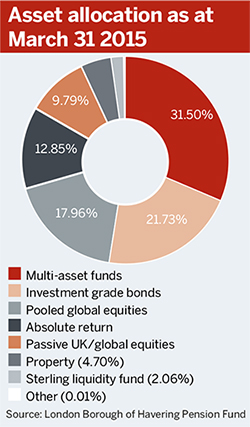

“[The] committee decided we didn’t want to join when it first launched,” the spokesperson said, adding it was later felt that the fund would “benefit from saving fees”. Havering pension fund has only recently finished implementing a new investment strategy, shifting the bulk of its assets into multi-asset vehicles.

The spokesperson said there was no intention to change the strategy to make use of other managers in the CIV.

Downside to pooling

Steve Turner, a partner in consultancy Mercer’s investment business, said there are many benefits to pooling assets including cost savings and improved governance, as officers’ and committee members’ time is freed up by no longer having to oversee investment managers.

But there could be unintended consequences, too. Lower performance could be one result, should successful asset managers decide not to work with the CIV or other investment pools.

Turner said some fund managers were taking a “proactive, positive position” with the CIV and putting forward attractive fee deals.

But he added: “There are fund managers who don’t have much incentive to work with them or offer deals. If you have a manager with a successful strategy that is capacity-constrained… why would they give that up?”

There could also be a negative impact on schemes if they are waiting until the new pools – including the CIV and the six British Wealth Funds announced by the chancellor – are in place to take investment decisions.

“It’s going to take a lot of time to get these arrangements in place… Until they’re fully up and running it might delay funds from making good investment changes,” Turner said.

It’s going to take a lot of time to get these arrangements in place… until they’re fully up and running it might delay funds from making good investment changes

Steve Turner, Mercer

Dave Lyons, a principal at consultancy Aon Hewitt, said the fact discussions to form a London CIV had been going on for some time put the London boroughs at the forefront of thinking on pooling, following George Osborne’s announcement.

“Of course I’d like to see the CIV broaden out its platform and make it available to all participants over time,” he said.

But Lyons added the creation of the six wealth funds for the LGPS could also mean the CIV loses significance when it comes to infrastructure.

He said: “In the long term, I would have expected the CIV to be looking to provide access to illiquid markets. Obviously that includes infrastructure.

“If the government is nudging funds nationally to local wealth pools it wouldn’t seem that there would be a role for the CIV in that.”