From the blog: “Annual income twenty pounds, annual expenditure nineteen pounds nineteen shillings and six pence, result happiness. Annual income twenty pounds, annual expenditure twenty pounds [n]ought and six, result misery.”

This observation from Wilkins Micawber, a character in Charles Dickens’ 1850 novel David Copperfield, is as true today as it was in Dickensian times.

There is a challenge ahead for UK pension schemes aiming to help their members achieve a happy and comfortable retirement.

Pensions can, of course, help to avoid misery in retirement. However, in a defined contribution world this is usually only the case if the contributions paid during membership are sufficient, and if all investments are carefully managed and pension or cash is drawn wisely.

Savings culture essential for income in retirement…

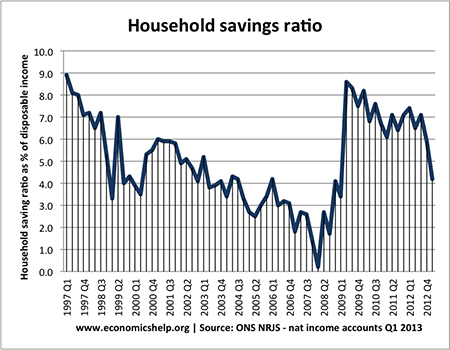

Michael Johnson’s study for the Centre for Policy Studies in 2012 shows that at that time, the UK’s household savings ratio was below 7 per cent. In comparison, rates in Europe were typically 11-15 per cent.

The returns on those savings in pension vehicles were lower than in Germany, Poland and even Chile.

While a savings culture will be encouraged by government, there are practical problems for those who feel they are in financial difficulty even while they are working, and therefore are unable to prevent misery in retirement by making extra provision now.

So, how can pension scheme trustees help?

Review AVCs

The first port of call is to make saving as efficient as possible by reviewing charges.

Generally speaking, additional voluntary contribution charges are not subject to the charge cap, so trustees’ review of the charges is very worthwhile.

Old AVC arrangements may well have penal charges. Also, unless there is a good reason for staying with the provider, a change or addition to the investment range for new contributions is likely to be worthwhile – as is consideration of a transfer to a specialist AVC vehicle or even a self-invested personal pension.

Secondly, of course, there is the need for pension scheme trustees to educate themselves and scheme members with the most up-to-date information on pensions.

The Pension Regulator’s code of practice 13 requires trustees to have the appropriate knowledge and understanding to enable them to carry out their role. This includes AVCs, even if they are within a defined benefit scheme.

It also remains the case that employees need to be educated about their legitimate options.

Where AVC arrangements are still open, they need to know how to make good investment choices; where AVC arrangements are closed, they need to know what alternatives are available for boosting their retirement incomes.

When it comes to drawing benefit from AVCs, the government-supported Pension Wise service may be useful.

After all, ‘happiness’ may depend upon how savers take their benefits – something that information from Pension Wise can help with.

Barbara Cole is technical consultant at Cartwright Group