In numbers that will be pleasing reading for the pensions minister, Scottish Widows’ Retirement Report 2014 has found workers are saving more of their earnings for retirement. The average contribution for employees of companies with more than 250 staff is now 11.6 per cent.

The report found that on average British workers were contributing 10.2 per cent of their earnings to saving for retirement. This is an increase from 9.1 per cent last year and 8.9 per cent in 2012.

“In the private sector, the average savings ratio has increased from 9.6 per cent to 11.1 per cent but has reduced from 8.9 per cent to 8.7 per cent in the public sector,” the Scottish Widows’ report stated.

Private sector employers with more than 250 employees saw the proportion of earnings saved by employees increase to 11.6 per cent from 9.7 per cent.

Industry observers have largely attributed the rise in savings to to auto-enrolment, but warned of the shortfall for whom the reform is not hitting – which Labour has pledged to reduce by 1.5m people.

Click here for the full story

Industry observers have largely attributed the rise in savings to to auto-enrolment, but warned of the shortfall for whom the reform is not hitting – which Labour has pledged to reduce by 1.5m people.

The report found that on average British workers were contributing 10.2 per cent of their earnings to saving for retirement. This is an increase from 9.1 per cent last year and 8.9 per cent in 2012.

“In the private sector, the average savings ratio has increased from 9.6 per cent to 11.1 per cent but has reduced from 8.9 per cent to 8.7 per cent in the public sector,” the Scottish Widows’ report stated.

Source: Scottish Widows

Other findings included:

Private sector employers with more than 250 employees saw the proportion of earnings saved by employees increase to 11.6 per cent from 9.7 per cent.

This is about 4 percentage points above the long-term minimum required under auto-enrolment, the provider points out.

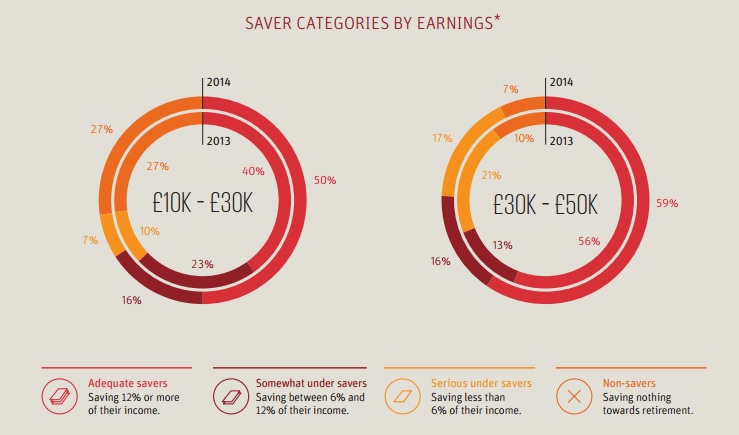

The research also found more than half of the UK population are now adequately saving for retirement (53 per cent) – this is up from 45 per cent last year and 46 per cent in 2012.

Scottish Widows characterises those saving 12 per cent or more of their income as "adequate savers".

The number of women saving has also increased dramatically, with 50 per cent now saving adequately, up from 40 per cent last year.

Malcolm McLean, senior consultant at Barnett Waddingham, said in a press-released statement that the report indicated more people are taking retirement planning and saving seriously.

“There are obviously a number of contributory factors at play here – the upturn in the economy, greater feelings of job security and, of course, the impact of auto-enrolment," he said. "There is also an acceptance that working longer beyond “normal retirement age” will be necessary for many more in the years ahead."

Tom McPhail, head of pensions research at platform provider Hargreaves Lansdown, also commented in a press statement: "We also know that the new pension freedoms announced in the Budget have rekindled investors’ interest in pension saving."

However, he pointed out there are still significant gaps. "The self-employed are excluded from auto-enrolment and due to the eligibility criteria, so far more people have missed out on auto-enrolment (3.9m employees) than have been brought into workplace savings (3.3m)."

According to the report 19 per cent of the UK population are not saving for retirement, and 20 per cent of those non-savers think they are preparing adequately for later life.

McLean said: “The only blot on the horizon in what is otherwise a most encouraging report is the suggestion that in many instances there appears to be a misalignment between expectation and reality, and that perhaps as many as 60 per cent of the population do not know what they need to save to secure their desired level of income in retirement."

Although auto-enrolment and in some cases changes from this year's Budget, have brought pensions front of mind for many, there is still a fear that large numbers of people are not preparing enough for the future.