All Features articles – Page 31

-

Features

Lancashire increases employer contributions to mitigate maturing membership

Lancashire Pension Fund has added lump-sum payments to its annual employer contributions to make up for reduced cash flow from a declining active membership.

-

Features

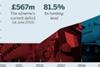

Regulator reports sharp rise in non-compliance as AE expands

The number of employers failing to comply with their auto-enrolment duties over two months to March 25 nearly matched figures for the entirety of 2013, as the amount of organisations auto-enrolling ramps up.

-

Features

NHS scheme moves to improve struggling employer comms

The NHS Pension Scheme will tailor its communication to different employer types to provide them with more support in fulfilling their obligations, after a survey revealed substantial criticism of its approach.

-

Features

FeaturesTfL faces fresh demands for contract worker DB membership

Transport union RMT has reignited calls for all Transport for London employees undertaking work on a contract basis to be allowed to join its defined benefit pension fund.

-

Features

IBM case a lesson to consider scheme history

Schemes must look at historical context when considering and communicating benefit changes, lawyers have urged, after the High Court ruled earlier this month that technology company IBM breached its duty of good faith with employees when closing its defined benefit scheme.

-

Features

LPFA boosts in-house investment team as it focuses on illiquids

The London Pensions Fund Authority is strengthening its in-house investment capabilities in order to reduce investment costs and diversify further into illiquid assets.

-

Features

Selex empowers members on AVCs with website add-on

The Selex Pension Scheme has extended the functionality of its online pensions software as it seeks to drive engagement among its members.

-

Features

BT suspends flexible retirement options during review

BT has suspended its flexible retirement option while it reviews the conditions under which it will consent to BT Pension Scheme members taking early payment of their pension while continuing to work at the communications company.

-

Features

FeaturesLafarge doubles contributions to cut deficit

Building materials manufacturer Lafarge has more than doubled its contributions to its UK pension fund after scheme and sponsor negotiated a beefed-up recovery plan to tackle the funding deficit.

-

Features

Schemes mull increased benefits for same-sex spouses

Schemes are considering whether to set benefits provided to same-sex husbands and wives at or above the statutory minimum, lawyers have reported, with the first marriages taking place last week.

-

Features

Local authority scheme members flock to beat AVC tax deadline

Local government scheme members are rushing to take their entire additional voluntary contributions as tax-free cash after widespread communication campaigns, before the option is expected to expire as LGPS reforms come into effect tomorrow.

-

Features

SME achieves almost zero opt-outs after enrolling early

Chartered surveyor Dalcour Maclaren has secured a virtually entire take-up of its defined contribution plan since it auto-enrolled its small workforce last year, and now the company is looking to streamline administration of the scheme.

-

Features

Budget prompts schemes to revisit lifestyle and annuity options

Schemes that default members into annuity brokerage services are considering the implications of last week’s Budget announcement, with calls for the rules around income drawdown to be simplified.

-

Features

FeaturesMineworkers scheme extends cash buffer to battle rising longevity

The Mineworkers Pension Scheme has secured a 10-year extension to the repayment deadline of its government-backed investment reserve, as it works to manage increased longevity among scheme members.

-

Features

Local authority schemes expect modeller to boost engagement

Scheme managers hope a new pensions modeller will stop members opting out as result of local government pension scheme changes by showing them how their benefits will be affected by the reforms.

-

Features

Solvency reform could boost cat bond value for schemes

Demand for insurance-linked securities such as catastrophe bonds has been rising even as yields have been decreasing, as consultants expect Solvency II to increase supply.

-

Features

SME says auto-enrolment a 'doddle', advice unnecessary

F2 Chemicals has become the latest employer to question the need for external advice and has offered staff a new defined contribution scheme paying in more than the statutory minimum, ahead of its 2015 staging date.

-

Features

FeaturesStrathclyde rebalances bond portfolio in drive for greater returns

Strathclyde Pension Fund has decreased its allocation to corporate bonds in favour of a wider absolute return bond strategy, to rebalance its portfolio as spreads tighten.

-

Features

AE non-compliance expected to increase as SMEs stage

News analysis: Consultants have urged employers auto-enrolling this year to ensure they are dedicating enough resources to the process, with the Pensions Regulator raising concerns about non-compliance.

-

Features

FeaturesRPMI ups emerging market exposure to drive returns

NAPF Investment Conference 2014: The Railways Pension Scheme aired plans to increase its exposure to emerging markets, including investment in alternatives, as it seeks further return drivers.