Essex Pension Fund has seen a 9 percentage-point jump in its funding level partly due to a change in how it calculates liabilities, as schemes shift towards valuation methods that avoid relying on historically low gilt yields.

UK government bond yields have been suppressed since the start of quantitative easing, prompting some schemes to change their discount rates to reduce the ballooning effect this has on liabilities – though such methods have come in for criticism.

Last year Tyne and Wear Pension Fund considered a similar change in discount rate to prevent a drop in funding level and the resulting increased employer contributions.

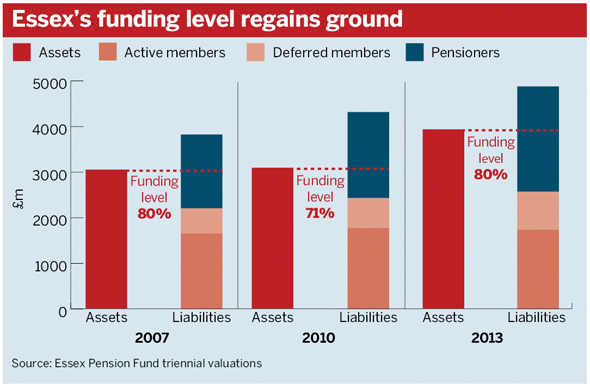

Essex saw its funding level increase to 80 per cent on March 31 2013 from 71 per cent in 2010. The rise was attributed largely “to higher than expected investment returns and a change in funding model”, its 2013 actuarial report stated.

Last year’s valuation calculated the funding level and liabilities using an economic equity return model, which based the calculations on equity dividends and performance.

The scheme did not comment on whether it was planning to implement a derisking strategy in response to the improved funding level.

“We’ll be considering the outcomes as we review our investment strategy,” said Kevin McDonald, director of the fund.

Graeme Muir, senior partner at consultancy Barnett Waddingham, which carried out Essex’s valuation, said: “It’s geared towards getting more stable valuation results.”

Muir added: “[Gilt yields are] a very volatile way of monitoring things,” he said.

Independent pensions consultant John Ralfe said the scheme’s deficit could be roughly £1bn larger if the valuation were carried out under IAS 19 rules, used by private companies to report scheme assets and liabilities in their accounts.

“Private sector companies have to tell their shareholders what the costs and deficit of their pension is on a consistent basis,” said Ralfe. “Why should local government schemes be allowed to use an Alice in Wonderland method?”

In response, McDonald pointed out IAS 19 was a requirement for employers, and LGPS funds were required to comply with IAS 26, adding: “IAS 19/26’s calculation of liabilities are based on long-dated corporate bonds, which in isolation do not reflect LGPS funds’ expected investment returns.”

Muir said mixing accounting and funding values was akin to “oil and water”.