The Lehmans story has played out its final act, and the Pensions Regulator has come through battered, but vindicated.

The long-running, in-and-out-of-court battle – which at one point saw a High Court judge label his own judgment in favour of the regulator a possible "impediment" to the entire corporate rescue culture – is over.

It is difficult to overstate how much credibility hung on this outcome. There were a few in the industry that thought the regulator had overstretched itself in its pursuit of insolvent, high-profile targets.

The Supreme Court went the other way, in July last year supporting the efficacy of financial support directions against insolvent companies, and that the relevant liabilities rank as a provable debt under insolvency law.

Whether the regulator had stretched its powers beyond how they were originally intended, those powers have now been supported by the courts, and this settlement gives £184m worth of reasons why employers and schemes should take note.

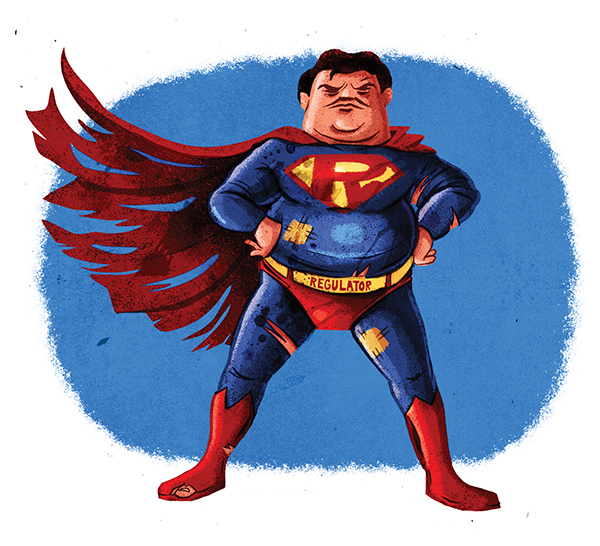

Illustration by Ben Jennings

Equally interesting – or terrifying, depending on which side of the corporate equation you sit – is the prospect that the regulator can recover more than the original shortfall.

This could bring the timing of the settlement into play, where companies are incentivised to settle if scheme funding is pushing the wrong way, or to hold on if the funding gap is closing.

As our story on page three demonstrates, the regulator is bulking up its anti-avoidance work. It seems the appetite is there for more long-running cases, but one questions how many of the larger, drawn-out battles can be fought at any one time. The Nortel Networks case, pulled into the same court battle as the Lehman subsidiaries, is still ongoing.

Only with greater hindsight will we be able to conclude how well the watchdog has picked its fights. Indeed, further legal protection for members will be seen by some as another incentive to close defined benefit.

But we should consider the 2,466 members of the Lehman Brothers scheme, for whom this is a handsome victory.

Ian Smith is editor of Pensions Expert. You can follow him on Twitter @iankmsmith and the team @pensions_expert.