Spare a thought for the asset manager responsible for putting together defined contribution investment strategies. At least, that’s what the Investment Management Association wants you to do.

April will bring not only fundamental retirement tax changes that as we all know have called traditional DC investment strategies into question, but also the charges cap for auto-enrolment default funds.

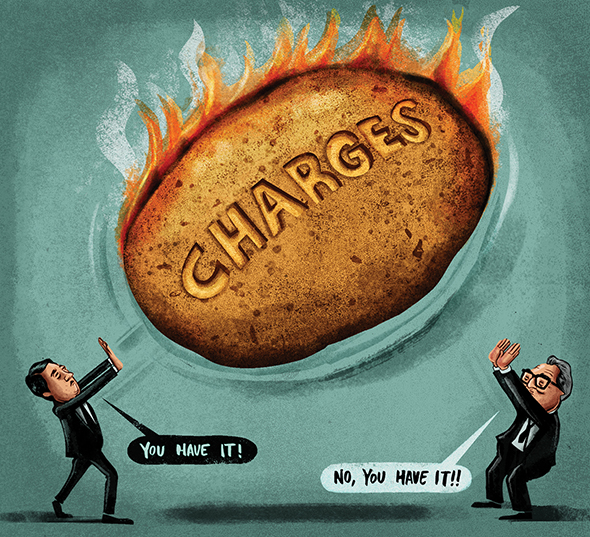

We have reported previously how the definition of ‘default’ in the draft regulations could mean the cap applies to more strategies at your pension scheme than previously thought, but this is not the only burning question for managers.

Illustration by Ben Jennings

The IMA’s director of public policy Jonathan Lipkin discusses among other things the challenges of the cap, in the latest edition of Policymakers and Decision-makers.

His contention, perhaps unsurprisingly, is that asset managers should not be involved in the compliance process, but that it should fall to the scheme.

This is not simply a case of avoiding extra homework. Compliance doesn’t come for free.

During their original consultation on scheme quality, the government received the following response from BlackRock: “By increasing the transparency obligations that are placed on unbundled trust-based arrangements, the compliance costs associated with that transparency would increase.

“This would be a result of the additional level of data collation which the administrator would need to perform in order to report on the transaction costs per individual member.”

The IMA’s own response? “Great care needs to be taken in getting the balance right between influencing behaviour and creating a complicated and onerous culture where there is an undue focus on compliance, rather than energy focused on delivering what is judged best for scheme members.”

Compliance does cost, but it is also necessary, otherwise there is no point introducing the cap in the first place (many managers would say there wasn’t). If you back the scheme quality requirements, the costs will have to sit somewhere.

Ian Smith is editor of Pensions Expert. You can follow him on Twitter @iankmsmith and the team @pensions_expert.