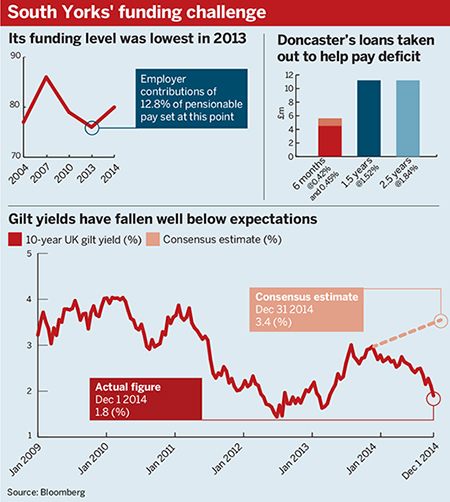

Doncaster council has sought to turn the low interest rate environment to its advantage by taking out £28m in short-term loans to help fund its employer contributions to South Yorkshire Pension Fund.

The employer said it saved more than £500,000 by paying the deficit contribution in a one-off lump sum, including the interest payments on the loan, compared with paying the same contribution in instalments.

Public sector pension consultants said they believed the move to be the first of its kind in the public sector, but added the terms of such loans were crucial to their adequacy for schemes. The risk of erosion of the capital value through market swings should also be considered, they said.

Doncaster’s loan, first reported in Sheffield newspaper The Star, will be broken down into four short-dated blocks, to be repaid by March 2017. “The decision to borrow this money was the result of a simple cost calculation,” said Doncaster council’s finance director Simon Wiles in a statement.

“The interest payments on a loan, added to the cost of a one-off lump sum payment allowed us to save just over half a million pounds, compared to the cost of paying back the sum in instalments.”

Barry McKay, partner at Hymans Robertson, said he had encountered discussions about local councils borrowing money to fund deficits but had never come across the practice in action.

“If the £28m put in will be invested in the main fund strategy, likely in equities, market risk means that the capital value might fall in the future,” he said.

Simon Kew, director of pensions at Jackal Advisory, said he thought the loan was a smart move for Doncaster, allowing the council to borrow on a cheaper basis than it would have to pay in instalments.

“Yes, [Doncaster] will have a slightly higher gearing, assuming the loan was secured, but the payment was due so they would have been a creditor in any event,” said Kew.

How the loan works

Doncaster put the cost of paying its deficit contributions in instalments at £29.48m across 30 monthly payments between October 2014 and March 2017.

In comparison, the total cost of the one-off lump sum payment was £28.8m, paid in October 2014.

This figure included the payment due of £28.01m, as well as £0.79m in interest payments.

Doncaster’s action is part of a wider effort by the four South Yorkshire boroughs to tackle their pension deficits.

The four local authorities – Barnsley, Doncaster, Rotherham and Sheffield – have all signed up to a plan to pay back their deficit over 21 years.

For Doncaster, this figure amounts to a £12m repayment a year. It explained the growing deficit as a result of changes in the tax position of pension funds, increased life expectancy of members and declining investment income, particularly as a result of falling gilt yields.

Kew said employers were currently under pressure from the local government pension scheme to increase contributions.

“We’re seeing commercial organisations with an LGPS liability facing unreasonable requests for foreshortened recovery plan periods,” he said.

Doncaster had already taken steps to increase employee contributions prior to taking out the loan. Employees earning up to £13,500 contribute 5.5 per cent of their salary while those earning more than £150,000 pay 12.5 per cent.

The employer said it saved more than £500,000 by paying the loan back in a one-off lump sum, with interest payments, compared to paying the same deficit contributions in instalments.