Bring back annuities, target policy so that it reaches the right places, and think about a “rules of thumb” approach: lessons from more mature DC systems

Existential questions are being asked in the UK pensions industry about whether the DC system as it stands is going to be enough to serve future retirees.

So, what better time for the Pensions Policy Institute to release a report which looks at what the UK can learn from other countries’ experience of DC?

Although the UK had the second largest stock of pension assets in the world in 2021, only 19% of them are in DC. The UK is some way behind more mature systems like Australia, Canada and the US in its journey towards a DC system, the November 2023 report, What can the UK learn about other countries’ approaches to accessing DC savings? concluded.

Bring back annuities

To improve the UK pension system, the requirement to take an annuity should be restored and a higher level of minimum pension should be reached, the report recommended.

In the UK, the industry and policymakers have long pondered the issue of people not saving enough for retirement. One lesson from overseas is that, conversely, many retirees are reluctant to draw down their pension savings.

The evidence from Australia, the US and New Zealand is that, when DC retirees are not required to take their money as a lifetime income, they hesitate to draw down their capital.

The report noted: “Research in Australia finds that drawing down on a non-replenishing resource is a psychological challenge, particularly in the context of superannuation, which is primarily discussed in a savings rather than a consumption frame. Retaining a lump sum, rather than converting it into an income stream, may give people a sense of continuing financial security.”

Target policy efforts

DC policy should be focused on people who are most at risk of not being able to maintain their living standards in retirement with only the state pension, the report recommended.

In Australia, the state pension is subject to a means test, based on people’s income and assets. Pension assets are part of the test, but not residential homes.

The report noted: “Middle income earners, the primary target of compulsory superannuation policy, require a combination of superannuation, voluntary savings (mainly in the form of owner occupancy) and the Age [State] Pension to maintain their living standards in retirement.”

Think about “rules of thumb” approach

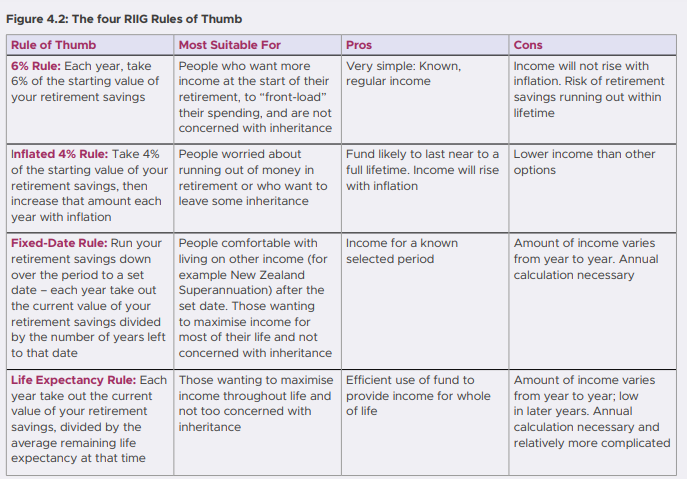

New Zealand takes a “Rule of Thumb” approach, setting out four different rules of thumb for savers with different income needs (see below image).

Source: What can the UK learn about other countries’ approaches to accessing DC savings? Pensions Policy Institute, November 2023

Research by the New Zealand Retirement Commission found that appropriate advice and guidance was critical. What does that look like?

Instead of asking members to decide once on an appropriate income strategy, they should reassess their approach at least every other year.

The financial services sector should work together to use consistent language, information and guidance about decumulation, the New Zealand Retirement Commission recommended.

The PPI’s report noted: “The New Zealand approach of consistent guidance and terminology and flexible, generic “Rules of Thumb” decumulation strategies suggests a promising and pragmatic line of policy intervention.”

Consider smoothing

Market volatility has created stark fluctuations in retirement income for Danish retirees. As a result, there have been calls by critics for some form of smoothing.

The PPI report observed: “Greater stability in pension benefits by smoothing payments in various ways could be created using investment-based smoothed income approaches without the need for individual or collective buffer capital.”

The full PPI report can be found here.