There is much to be positive about in DC pensions – but policymakers must be careful to avoid a multitude of pitfalls, writes Martin Willis.

I always have mixed feelings when I see pensions in the mainstream media as much as they have been the last few weeks - anything that raises awareness of, and demystifies, the critically important issue of saving for later life is a positive; but this is too often a precursor to yet more complexity being introduced.

One positive in the recent DC-related announcements is that they are clearly aligned: policymakers have a plan. The question, of course, is whether it´s a good one, and whether it´s practical.

For the industry, we may be in an inevitable position, given the journey started back in 2002. The Pensions Commission identified some critical challenges and a path to resolving them, although when it noted that the pensions system had become, in the words of the Daily Telegraph, “astonishingly complicated”, I don’t think it fully appreciated what was to come.

In auto-enrolment we got an undisputed success in terms of getting more people saving for the future. With this came the rise of the default, both contribution rates and investments, and following this soft compulsion for money in, we have seen ‘freedom’ in terms of money out. It feels that we are now halfway on the journey.

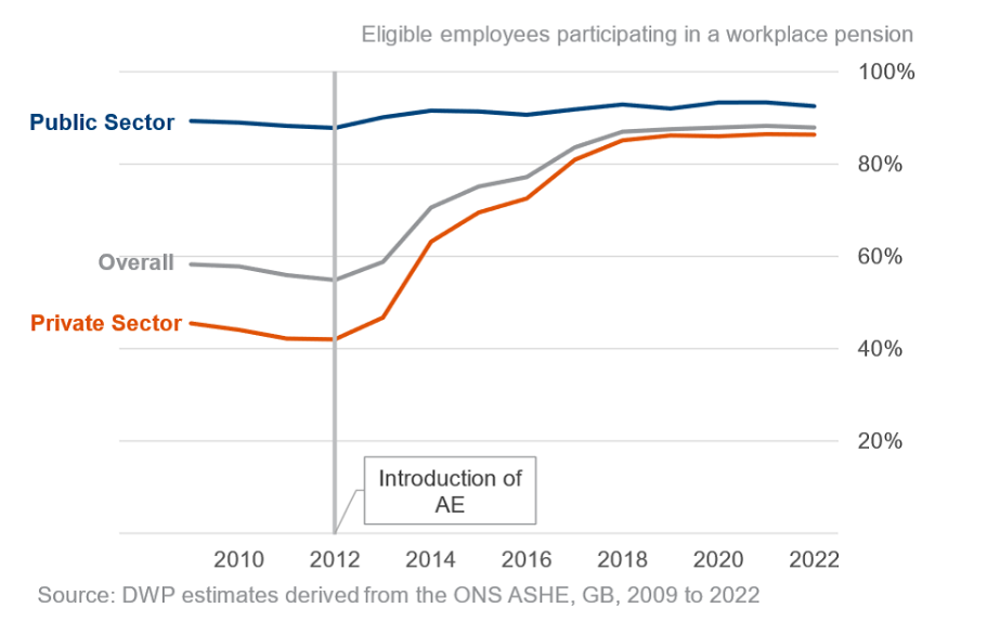

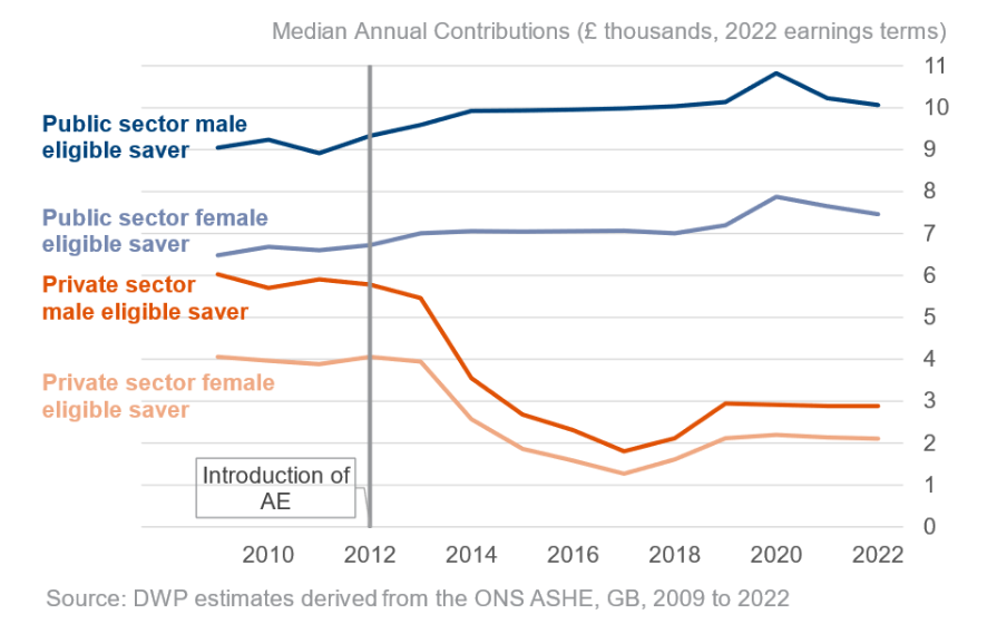

We have high levels of participation in a complex system generating outcomes that are arguably adequate for most. DWP’s recent report on workplace pension participation and savings shows that more people are saving (dramatically increasing 2012 – 2018), but contributions outside the public sector dipped in real terms.

However, gender disparity continues, with female savers consistently saving less. Gender pay gaps drive this, with contributions often defined as a salary percentage, and it’s a problem that needs solving.

We now have the opportunity to make this system more than adequate, which is where the current initiatives come into play.

The golden thread

The golden thread running through all current initiatives is improving outcomes for members through better ‘value’. The idea of consolidation is ever present, coupled with investing in alternative asset classes.

As per the Mansion House Compact, with consolidation members should gain greater economies of scale and exposure to investment classes that offer increased potential for growth and lower charges. The promoted ‘at-retirement’ solutions sit better in these consolidated structures and naturally align with these investment strategies.

The Government may also envisage this ever-growing investment pool funding UK growth, and perhaps if these things are done right, with the interests of UK savers firmly at the centre, this could have wide benefits. But it’s a big if.

Consolidation isn’t always easy – many smaller schemes feature guarantees that are tricky to value, with trustees rightly cautious of ‘apples and pears’ comparisons (would a blanket indemnity assist?). The industry supports dealing with small pots, another auto-enrolment by-product, but does not yet agree on how to do it.

Now we have stapling of pots to members, to go with consolidating schemes, and pot follows member – it sounds painful and if not done right, it will be for employers trying to direct money to the right place.

More dilemmas ahead

Investments are equally tricky – with auto-enrolment, default investments became lower risk fearing that members without investment experience might be put off by fluctuations in value.

More focus is now on growth within the value equation, and with the new value for money proposals to provide members with past and projected performance, this will likely increase. This will influence decision-making by savers on which pension scheme to use, but, of course, past and projected returns are no future guarantee.

Then there is retirement, both the structures available to members and the engagement support to guide them. Finally, after eight years of ‘Freedom and Choice’, savers might get their desire for flexible income with some guarantees if schemes are compelled to offer a version of this.

That will depend on the industry building these solutions, in a world where the desire to draw income flexibly is high. In terms of engagement, advice is still the preserve of the few, but perhaps the AI revolution will help, overcoming regulatory challenges.

So, there is much to be positive about, but it comes with multiple challenges and potential pitfalls. Let’s approach these not as barriers, but rather as considerations for industry, policymakers and regulators to get things right, building successfully on existing foundations. Governance is key.

These matters are complicated, as much as we might like to simplify things, a ‘B-Day’ isn’t the answer. People and their circumstances are too complex for that. A maze is a lot easier to get through if you can see it from above.

With the right oversight (from providers, regulators and potentially employers), we can have complex systems with safeguards to protect against poor outcomes, defaults to generate good outcomes and engagement to promote great ones. This might even help with the current level of pension contributions, but maybe that’s one for another day.

Martin Willis is chair of the Society of Pension Professionals’ defined contribution committee