Data crunch: Risk-averse pension schemes are going bargain hunting.

Over the past few years, demand for pensions insurance has swelled as schemes were enticed with cheaper and cheaper offers for offloading their liabilities.

Now this already booming market for buy-in and buyout deals has received a two-pronged boost from the coronavirus pandemic: the turmoil rippling through the economy is providing schemes with the best ever pricing for insurance, just as the demand for shedding investment risk is at its greatest.

“It’s the best buy-in opportunity we’ve seen in the market,” says Charlie Finch, partner at consultancy LCP. “This has probably been the best improvement I’ve ever seen, even going back to what we saw in financial crisis times.”

There is a huge pent-up demand for schemes to be transferred to insurers because corporations do not like the uncertainty of pension schemes on their books

Akash Rooprai, Independent Trustee Services

Year of the mega-deal

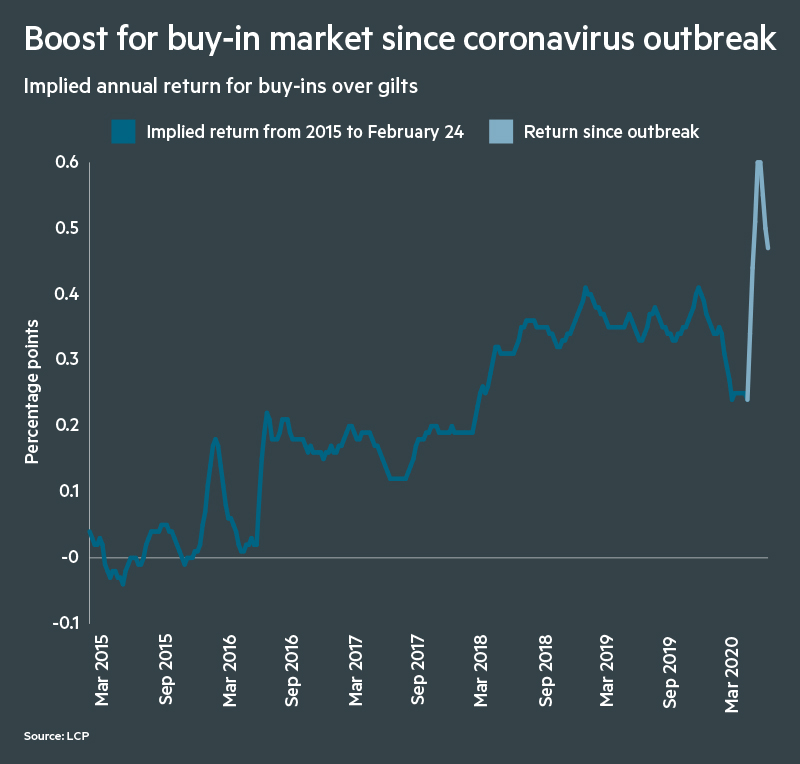

Since 2015, pension schemes have rapidly seen buy-in deals become more affordable than investing in government bonds, which they hold to cover payments to retirees, analysis by LCP shows.

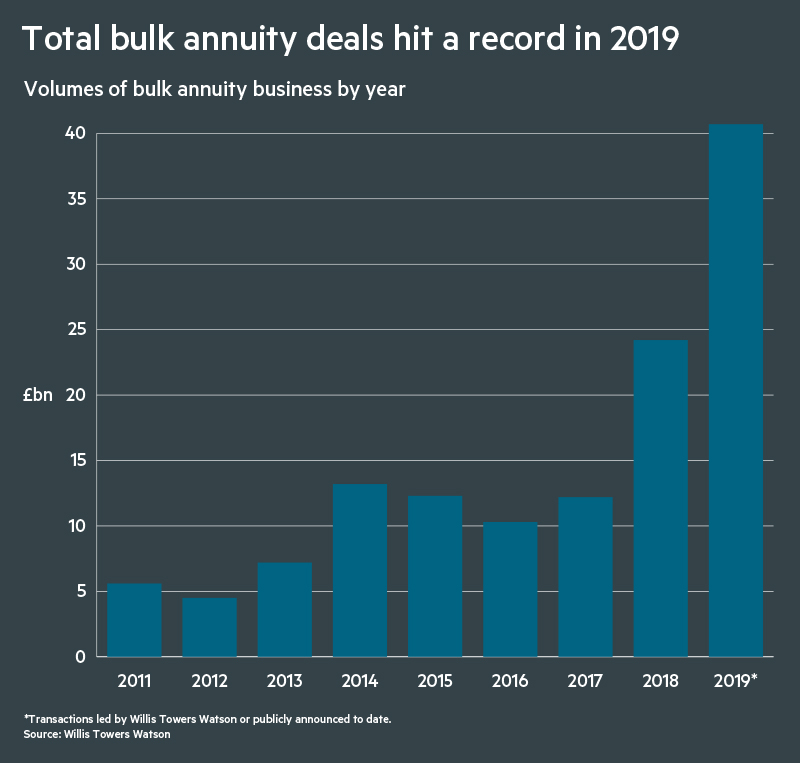

These lowering costs for offloading a portion of their liabilities, fuelled by greater competition between insurers, led to a boom for so-called bulk annuities in 2019, with a record total of more than £40bn in transactions.

“The bulk annuity industry has grown and grown over the years,” says Akash Rooprai, director at Independent Trustee Services. “In [2006 and 2007], we were getting 1bn, 2bn a year. Last year was the year of the mega-deal.”

Now, on the back of a landmark 12 months for the pensions insurance sector, the appeal of bulk annuities has spiked again as the yield on government bonds plunged while investors bought up these safe-haven assets and the Bank of England slashed interest rates amid the pandemic.

With falling demand weakening the value of the corporate bonds that insurers invest in, these cheaper investment costs have also been passed on to pension schemes, providing potentially millions in overall savings to those able to capitalise on the moment.

Looking for an insurance home

The attractiveness of this opportunity is only reinforced by the crisis looming over many companies in the UK. As balance sheets take a hit from the pandemic, businesses will find it harder to keep up their pension contributions and maintain their obligations to retired employees.

“There is a lot of money looking for an insurance home,” says Mr Rooprai. “There is a huge pent-up demand for schemes to be transferred to insurers because corporations do not like the uncertainty of pension schemes on their books.”

Mr Rooprai says he sits on the board of schemes that were previously planning to complete buy-ins within the next two years, but he is now encouraging them to shorten their horizons and take advantage of the record pricing opportunities.

The Co-operative Pension Scheme is one fund fast-tracking deals this year, completing more than £2bn in transactions and securing the retirement savings of nearly 20,000 employees of the retail group.

But with vast amounts of money chasing bulk annuities, pensions insurance has become a sellers’ market and schemes may have to compete to get the best deals.

“Being prepared and ready to transact before going to market for quotes is crucial,” says Mike Edwards, partner in the risk settlement team at insurance broker Aon.

“Due to increasing pension scheme demand, insurers can be selective about the schemes they choose to price and will prioritise those that they believe have the highest likelihood of completing.”

Derisking

Not all pension schemes will have the liberty to go shopping for bargains. Those with large allocations to equities may not be well funded enough to afford a buy-in, after stock markets were whipsawed by the pandemic.

With much of the economy still in lockdown, some of the more cautious insurers have also been unwilling to start flogging record low deals.

But on balance, 2020 should be another monumental year for the pensions insurance sector.

Hymans Robertson has estimated that an average of £37bn a year could continue to flow to insurers over the next decade, amid growing concerns around the strength of sponsoring employers. If recently observed market trends continue, the pensions adviser predicted that annual demand could soar to £54bn.

The uncertainty sparked by the pandemic could even inspire a widespread shift towards pension schemes offloading all of their investment risk to insurers through buyout deals.

More and more big schemes are considering this route, according to Mr Finch, rather than becoming self-sufficient enough to pay out their own liabilities, which has historically been the cheaper option.

“Even if you were on self-sufficiency it’s harder to find a strategy that is robust with such extreme market movements,” he says. “[The current crisis] has highlighted the risks of running a pension scheme.”