Pension schemes with recent valuation dates are expected to achieve improved funding levels, the Pensions Regulator has predicted, while many schemes in deficit should be able to maintain or reduce deficit repair contributions.

TPR’s annual funding statement analysis for 2022, published on May 25, suggested that “schemes undertaking valuations at December 31 2021 and March 31 2022 will show improved funding levels from those reported three years previously, and the current recovery plan will be on track to remove the deficit by the end date”.

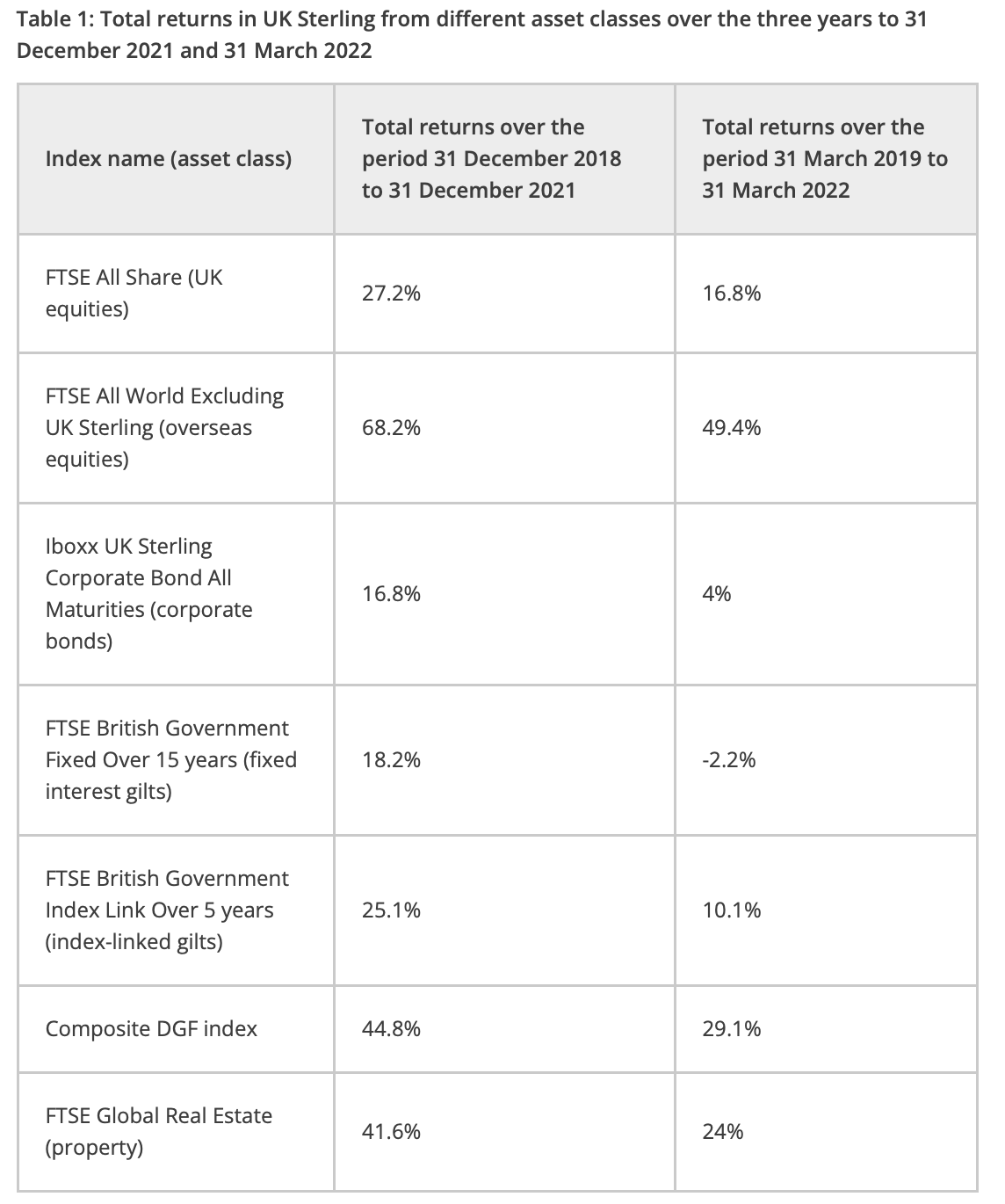

Most asset classes invested by UK schemes “achieved substantially positive returns” in the three years to both valuation dates, the watchdog noted.

It stressed, however, that individual schemes’ positions will vary significantly from its overall estimates.

Once your covenant goes, there’s so many other issues beyond ESG

Anne Sander, PTL

The benefits of inflation and interest hedging, meanwhile, are less clear for schemes as at March 31 2022 compared with December 31 2021.

The watchdog warned that Russia’s invasion of Ukraine, the coronavirus pandemic and Brexit may have affected the strength of the employers’ covenant, and this should be reflected in schemes’ technical provisions. This was not reflected in TPR’s analysis.

A helpful market backdrop

TPR expects deficits on a technical provisions basis as at December 2018 and March 2019 to have become small surpluses as at December 2021 and March 2022.

It attributed this switch to market changes and the pace of defined benefit schemes’ funding plans.

The watchdog indicated that if all schemes valued between September 22 2021 and September 21 2022 — known as “tranche 17” schemes — had March 31 2022 valuation dates and kept their recovery plan end dates, or if those near the end of their recovery plans were to extend theirs to three years, 68 per cent of those in deficit could maintain or reduce deficit repair contributions.

Just 1 per cent of these schemes, meanwhile, would need to increase contributions to more than three times their current level, with some of these schemes needing to raise contributions “by much more than this”.

Gilt yields have fallen since March 2016, with long-term real gilt yields having sat in negative territory since 2014, the regulator observed.

It said that using a discount rate to calculate liabilities with the same margin above gilt yields at their previous valuation will yield higher-than-expected liability values for most schemes as at December 31 2021, while liabilities will be similar as at March 31 2022.

Asset returns were strong in the three years to the end of 2021 and March 2022, however, with equities, bonds, diversified growth funds and property all generating positive returns.

Source: TPR

Most asset classes fell in value in Q1 2022

TPR estimates a small aggregate surplus across tranche 17 schemes as at December 31 2021. The average funding level at this date was higher by 9 per cent compared with three years earlier.

This aggregate surplus is because the additional return on assets, along with deficit repair contributions, have outweighed increases in liabilities and inflation, the regulator said.

Asset returns leading up to March 2022, deficit repair contributions, and a smaller increase in liabilities will have also seen funding positions improve for schemes at March 31 2022.

“During the first quarter of 2022, most asset classes fell in value,” TPR said.

“This included falls in the value of bonds and gilts, and consequently the yield on gilts has risen (and to a lesser extent so have the inflation expectations of investors in the gilts market).

“We expect aggregate funding levels as at March 31 2022 to have increased proportionally less than those at December 31 2021.”

Strong covenant needed to properly engage with ESG

Improved funding forecasts are encouraging given the apparent apathy among the majority of trustees towards covenant risk, with just 12 per cent identifying covenant risk as material to their endgame, according to research from Janus Henderson and Mallowstreet published in March.

Meanwhile, TPR warned in its own analysis that the war in Ukraine, coronavirus and Brexit may have impacted employers’ abilities to make deficit repair contributions.

“For some employers, affordability will have been significantly reduced and will be the limiting factor for DRCs, at least in the short term,” it said.

Speaking at the Pensions and Lifetime Savings Association’s investment conference, PTL’s Anne Sander said in response to Janus Henderson’s findings that covenant risk sits on the agenda of every scheme meeting she’s involved with.

Pension fund focus on ESG opens questions over insurer back books

Billions of assets purchased by insurers to back UK retirement promises have the potential to drive corporate progress on issues such as climate change, and pension fund trustees are now indicating a willingness to pay extra for better stewardship.

“It may be a light touch, but it’s still on the agenda. It does surprise me that they’re not thinking about it,” she said.

Only 3 per cent of schemes think climate change will have a material impact on their ability to pay pensions, meanwhile, according to Janus Henderson, which suggested that a weaker covenant prevents focus on environmental, social and governance issues.

While maintaining that ESG remained an investment risk in the event of a deterioration in covenant, “once your covenant goes, there’s so many other issues beyond ESG”, Sander said.