TfL Pension Fund had its investment management expenses increase by almost a fifth in the year to March, partly due to a strategy shift that added eight investment managers.

Schemes adopting more diversified and liability-driven investment strategies have seen increases in these charges, but have judged them acceptable given the risk reduction and net value on offer for members.

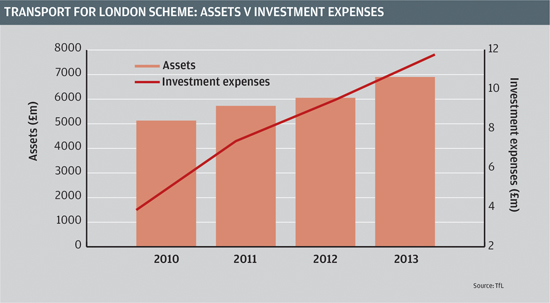

Transport for London's £6.9bn scheme had investment management costs of £11.8m in 2012/13, up from £9.5m in 2011/12 (see graph).

“Investment management expenses have increased following the implementation of revisions to the investment strategy which has resulted in an increase of managers and attributed fees and as a result of the increase in the value of investment assets,” reported the scheme’s 2013 annual accounts, released earlier this month.

In its latest published statement of investment principles in March, the scheme said it had worked in 2012 and would continue throughout 2013 to “introduce new asset classes to the alternatives portfolio”.

If an investment is made purely to enhance returns, it can be easier for institutional investors to judge value. But schemes choosing managers for diversification or risk reduction have more difficulty.

“You have to decide how much that risk reduction is worth in terms of management costs,” said Simeon Willis, principal consultant at KPMG. “That’s a much more subjective decision.”

This challenge increases as more alternatives are selected. A small amount of LDI is “unobtrusive”, Willis said, but more can start to have a bigger impact on your overall portfolio balance.

He added schemes need to weigh up this risk reduction with the increased cost and the so-called ‘opportunity cost’ – how the original or another strategy could have performed.

John Belgrove, partner at consultancy Aon Hewitt, said pension schemes had different philosophies as to whether they favour a simple or more complex investment management set-up, but added certain strategies demanded extra attention.

“By doing [LDI], you need to embrace a degree of complexity,” he said, adding it was the role of investment advisers to explain the costs that accompany these ideas.

“Usually, pension scheme trustees are pretty savvy when it comes to understanding the fee element of any proposition,” he added. "The concern for me is that sometimes the fee element gets in the way of the investment case.”

The Pension Protection Fund, which reported a much larger proportional increase in its investment costs in last year’s annual reports, has stressed the ‘value after’ investment.

Martin Clarke, executive director of financial risk at the pensions lifeboat, whose management expenses were up to £47.8m in 2012 from £19.5m in 2011, said in a video interview earlier this month that these charges should not be considered in a vacuum.

“Looking at fees in isolation is probably, in my opinion, not the best way to look at it,” Clarke said at the time, “and in many cases the large fees are associated with very active portfolios, and therefore it is best to look at them on a net basis.”

TfL did not reply to requests to comment further on the matter.