Stay tuned for the latest news and chatter from the PLSA Annual Conference 2023, brought to you by the Pensions Expert Team

Day three

14:00

That’s a wrap, folks

Thanks so much for tuning in for the PE live blog. After a busy few days, your intrepid correspondents are headed home (wish us luck).

We hope you’ve enjoyed the blog, and we look forward to exploring many of the themes from the last few days over the forthcoming weeks and months.

12.25

Reflections on the LDI crisis

As we near the end of the conference, we catch an independent trustee in reflective mode. Melanie Cusack, client director at Zedra Governance speaks for many trustees (we suspect) when she discusses the changes she has seen in her world as trusteeship evolves and becomes more professional.

She says: “The pensions industry doesn’t seem to stop. It is getting worse and worse in terms of what we need to do as trustees - or better and better if you like to have a busy diary.”

There have always been spinning plates as a trustee, Cusack reflects. “But now it feels like we’re spinning plates, on a balance ball, with flying objects coming at our heads. And we are being told we are not doing enough. That is quite disheartening. At the centre of what you are doing is the members - we want to do the right thing by the members. Sometimes I think that’s missed.”

She gets an impromptu round of applause when she says: “There has been a lot of talk about endgame planning and whether we are doing a good job or a bad job. Shout out to the trustees, you are doing a great job!”

All the new duties and responsibilities could mean fewer trustees will step up, she muses. “Is that a bad thing diversity wise? If they are retiring, then maybe not. But we have a challenge to attract people with the right skillset - not just gender, age, skin colour - but the skillset. Because pension schemes are fundamentally small businesses now. So, we have to be professional. And we need a critical friend at the table. TPR should be a critical friend rather than someone beating us up with their powers that they’re not afraid to use.”

Trustees stepped up in response to the liability-driven investment (LDI) crisis in autumn 2022, says Cusack. She recalls a “frenetic” PLSA conference this time last year.

Ultimately, despite its horrors, the pandemic gave trustees the tools to move into the 21 century and be more responsive in a newly virtual world.

Cusack says: “Governance has changed, and that was demonstrated last year. We came out of it saying, ‘Blimey, we did do it.’ But did we do it well? We are revisiting it now.”

Decision-making structures proved critical in the crisis, with trustees with good governance faring much better, she says. “Trustees should have been familiar with their decision-making model and some of them weren’t. They should have understood LDI, and some of them didn’t.”

Fiduciary management relationships were put under the microscope, she adds. “Fiduciary managers say, ‘We are nimble and can respond really quickly’ but when it came to it, some said, “You need to call us at 6am because we need a decision and a signature,” and so on. I think the world is still unsure and we are still unravelling that in terms of what went well and what didn’t.”

Cusack’s point is echoed by her co-panellist Ed Francis, managing director and head of fiduciary management at Goldman Sachs Asset Management. “Post LDI crisis, the big issues we hear about and observe are clarity and responsibility about decision-making.”

Execution agents should be given the discretion to act in the right way at the right time in to maintain hedges and risk management positions, added Francis.

10:00

TPR trails ambitious new programme of change and enforcement

Good morning! Nausicaa Delfas, the chief executive of the Pensions Regulator (TPR), is taking to the stage here in Manchester and setting out an ambitious programme of change and enforcement. TPR is prepared to test its powers - and this could result in expansions of authority and remit.

Delfas says: “We are starting to stretch the limit of our powers. Last January, we started formally engaging directly with third party administrators, recognizing the critical role they play.”

Consolidation is a key focus for Delfas. “Too many trustees and administrators are failing in their most basic requirements, let alone harnessing the possibilities to drive real value for savers. Far too many remain in the market and don’t deliver for savers.”

Only the good schemes should remain in ten years’ time,” she says. “The biggest schemes with the biggest budgets tend to have the skills and capability to make investment decisions and can access a broader range of asset classes.”

Smaller DC schemes to look at whether they can offer the same value as a leading master trust, says Delfas. TPR is also keen to see a DB superfund market emerge. “We want models that offer better protection to DB members and enhance the likelihood of them receiving their benefits.”

Regulating these new superfunds is still an open question, she adds. “We at TPR are thinking about how we ensure our processes are not barriers to innovation, whilst still ensuring savers are protected.”

Testing the boundaries of where the regulator can intervene is a key theme for Delfas. She emphasises that TPR is prepared to do so, but will not be drawn on the detail in response to session chair John Chilman’s question as to how and whether the regulator will direct poorly performing schemes to better performing master trusts.

AI is on TPR’s radar, says Delfas. “We must be truly data-led and digitally enabled, acting upon enhanced data insights to anticipate threats and opportunities to come.”

The much-trailed DB funding code is coming soon, she promises.

Finishing her speech, she tells the industry: “We will continue to listen to you and develop our regulatory approach in tandem with you. The pensions system is evolving – we want to evolve with you.”

Is TPR going to expand its resources to meet its growing remit, asks Chilman. Delfas replies: “In the past, perhaps we have been more enabling and educating whereas now we are looking at – if schemes are falling short – how do we use our powers to deliver better outcomes for savers? It is testing the boundaries of our powers. Perhaps we won’t always succeed. If we find we need new tools or powers, we will explore that route through legislation.”

Pushed by Chilman and questions from the audience in terms of what that will mean for TPR’s resources, Delfas says: “We are doing a lot of work internally to think about how we reorient ourselves to think about these new areas of regulation.”

TPR will be hiring digital and data specialists to bolster its expertise in that area, looking at its data strategy and getting more efficient where possible, as well as reorientating its people where needed, Delfas summarises.

Day two

15:10

Progress: Diversity, equality & inclusion in the pensions industry

In a challenging and highly uncertain macroeconomic environment, we need outstanding people and outstanding teamwork. The strength of your team is reliant on the diversity of the people within it.

You don’t get diversity without equity and you don’t get the benefits of diversity without inclusion, says Sarah Smart, chair of the Pensions Regulator.

However, many diverse individuals have spent most of their lives trying to fit in and minimise their differences rather than nurture the benefits that they bring, says Mitesh Sheth, chief investment officer for multi-asset, Newton Investment Management, who confesses that this has been him in the past.

From the audience is a question about mandation. Smart responds by saying that trustee boards should focus on fulfilling their responsibilities through inclusion, without mandation of what that board should look like as this doesn’t necessarily guarantee diversity of thought.

Another cracker from the audience: is it game over for the white male? Inclusion isn’t about exclusion, points out the panel.

Smart says if you’re in a position of advantage compared to relative disadvantage, you don’t have to be attacked, you can be an ally. We all still have work to do because diversity isn’t second nature, it’s not embedded into processes.

14:15

The future of retirement for the DC generation

Welcome to a packed breakout room at the PLSA; your correspondent was lucky to grab one of the last seats in the house.

Chair Ruari Grant, who is policy lead for DC at the PLSA, is delighted to see so many people here to solve one of the thorniest problems in finance: how to make retirement better for generation DC.

First up is the DWP’s head of policy for CDC and DC decumulation, Julian Barker, to update the audience on the DC consultation the DWP held earlier in the year. This is probably the largest session he has ever addressed, he says.

Auto-enrolment has transformed the pensions landscape. DC members need to make a lot more decisions than their DB predecessors, particularly the hardest decision: at decumulation when they need to decide how their pension pot will support them for the rest of their lives, observes Barker.

Last year, the DWP called for evidence on products and support available to DC members. In July 2023 it consulted on whether there should be more duties on trustees to support decumulation through providing products and services, and the potential role of CDC.

The consultation received over 70 responses, which the DWP is going through. To give the room a flavour of the responses:

Consensus in some areas…

There was consensus that placing responsibility on trustees to support decumulation through products and services was sound.

There was a common view that action was needed. We know there are lots of schemes doing good things in this area and new products and services being developed all the time. But coverage across the membership is very patchy. There was consensus that the government will need to take action to drive change.

…but disagreement in others

There was less agreement about defaults and the role of CDC. There were also practical concerns – for example, where liability lies if things go wrong.

The DWP will be publishing next steps in the next couple of months. They will be following up with a consultation on the communications journey that will support members.

It makes sense to first focus on schemes, products and services and then look at supporting members to get there. The DWP will consult on those other issues in the next few months.

Two pension schemes’ takes on DC savers’ retirement challenges

Donna Walsh, head of Standard Life’s master trust, is first to speak. Standard Life designed and launched investment pathways for its members in 2015; today, over 75% of members choose a pathway when they first access their retirement savings.

Walsh says: “That helps us to monitor their behaviour and see if they are withdrawing their savings at the rate they said they would. If they don’t, we can help and nudge them to review where they are.”

When people first start thinking about retirement, they are 36 on average, says Walsh, quoting Standard Life’s recent Retirement Voice 2023 report, which surveys over 6000 UK consumers.

We need to make sure we engage them in a way that resonates with them, says Walsh. What financial wellness support can you set up? How do you help build financial confidence for the future?

Finishing her reflections, Walsh cited a thought-provoking finding from the Retirement Voice report 2023. Nine in 10 people want both the security of a guaranteed income – and the flexibility to access some or all of their money.

Creating innovative solutions which allow people to have the best of both worlds is a central challenge for the pensions industry, she finishes.

Next, we hear from James Chemirmir, pensions director at Kingfisher. He explains: “Although we are a large scheme, we are a large scheme made up of very small pots.”

The average pension pot for people over 55 at Kingfisher is just over £10k, he adds.

Employees with small pension pots are more inclined to take them all as cash, believes Chemirmir. “When they receive their retirement pack, they will usually call up our helpline and say something along the lines of ‘show me the money’. The pension person will walk them through the tax implications, and how it might mean they will end up relying on the state pension - and then they will take their money.”

A central advantage of consolidation is that people will be less inclined to take one large pot as cash, he argues. “They are more likely to take some cash and save the rest.”

Kingfisher offers an impressive range of retirement support options to its members. Yet members are still more likely to approach someone they know to help them make choices.

Chemirmir finishes on this thought-provoking point: “If you look at the common thread running through these individuals, it is because they think you and I are people that they can trust. It seems there is a trust deficit within the pensions industry. That’s why we are being approached. Until we fix that, all our efforts around communication are going to be overlooked.”

14:15

DB pension risk evolution - global pension risk UK survey results

Welcome back after lunch. We’re here to get the results from Aon’s global pension risk survey. The survey looks at three broad areas of risk: Asset risk, liability risk and governance risk.

Matthew Arends, Aon’s head of UK retirement policy, Kate Yates, CEO of Plumbing Pensions and Simon Saekar, the PLSA’s head of research are here to present and discuss the findings.

There were over 200 participants, which were a range of trustees, pension managers and employers. Schemes ranged in size from from under £100m to over £10bn. Of the respondents, 60% of all schemes were closed to all accruals and 15% remain completely open. This make up hasn’t shifted from last year.

Once the scene is set Arends dives into what he refers to as the “most insightful” result from the survey in a freeform survey question that asked schemes to write their thoughts on risks: 44% said regulatory burden and political uncertainty was their biggest risk and 22% gave governance as the priority. The extent of regulatory change is a key challenge for the industry.

Arends then gives some takeaways from the survey.

-Respondents were asked to rank risks and gave investment risk as the biggest risk areas in the views of schemes. But a clear takeaway as he goes through the numbers is the disparity of how risks are seen between trustees and employers.

-Over ten years, the change in trends of schemes’ long-term objectives has changed. In 2013, 20% were aiming for buy-out, this is now at 55%. Successively since 2013, the timeframe for schemes to get to buy-out has reduced from 12.8 years in 2013 to 7.8 years in 2023.

When the survey delves into liability risk, the attention has switched to supporting members rather than managing liabilities, with 93% already taking action or planning to take action on scams and 50% planning to review member communication strategies.

Respondents were also asked about their investment intentions over the next 12 months - 39% intend to reduce equity investments and 30% intend to invest more in credit.

The number of schemes reporting a cyber incident is doubling every year. Yet only 50% of schemes have an incident response plan in place. The larger schemes are ahead with 64% having an incident response plan. By contrast, only 22% of smaller schemes have one.

In conclusion, there are more risks than ever before, the pace of regulatory change isn’t going away, but the resources available to schemes aren’t limitless. So schemes have to prioritise.

12:00

Putting common-sense back into pensions - innovation without any shiny gimmicks

David Bird, head of NOW Pensions’ DC platform, Stefan Lundberg, director at Cardano and the PLSA’s head of DC, platforms and lifetime savings Alyshia Harrington-Clark, are on stage to talk about putting common sense back into pensions.

How do we solve the right problem? To understand this, we need to put ourselves firmly in the shoes of our members, says Bird.

Now we’re witnessing a role play. Lundberg plays the role of the industry, whilst Bird is wearing the hat (literally) of the member. Going through a light-hearted role play they present the vast disconnects between what the industry sees and thinks and how that reaches members, from impact investing and risk profiling to education and nudges.

We invest your money so it does good for you and the planet, says Lundberg, as the industry.

We know members need to take risks, and we need to understand how they feel about risk, do risk questions really get to the right answer? Personas and personalisation don’t work for everyone, especially when they are based on demographics only. Video statements aren’t a replacement for education. How we frame all of these good things form relationships. Relationships are strongest when built on trust. Trust takes years to build, but just seconds to break.

What are the problems the industry needs to solve? We need to look at the problems from the view of the member.

Lundberg goes on to explain how we solve some of these. We are simply guardians of assets whose primary purpose is to help members save for retirement, he says. To do this, we should take ownership and help members to understand the impact of their actions; if you contribute one percent more, if you take maternity or paternity leave, if you go part time.

Investment choice is a red herring; the member can’t deal with that, says Lundberg.

Final thought - don’t just copy what everyone else is doing. Improving processes doesn’t fix the problem. So make sure you know what the problem is and walk in the shoes of your members.

10.50

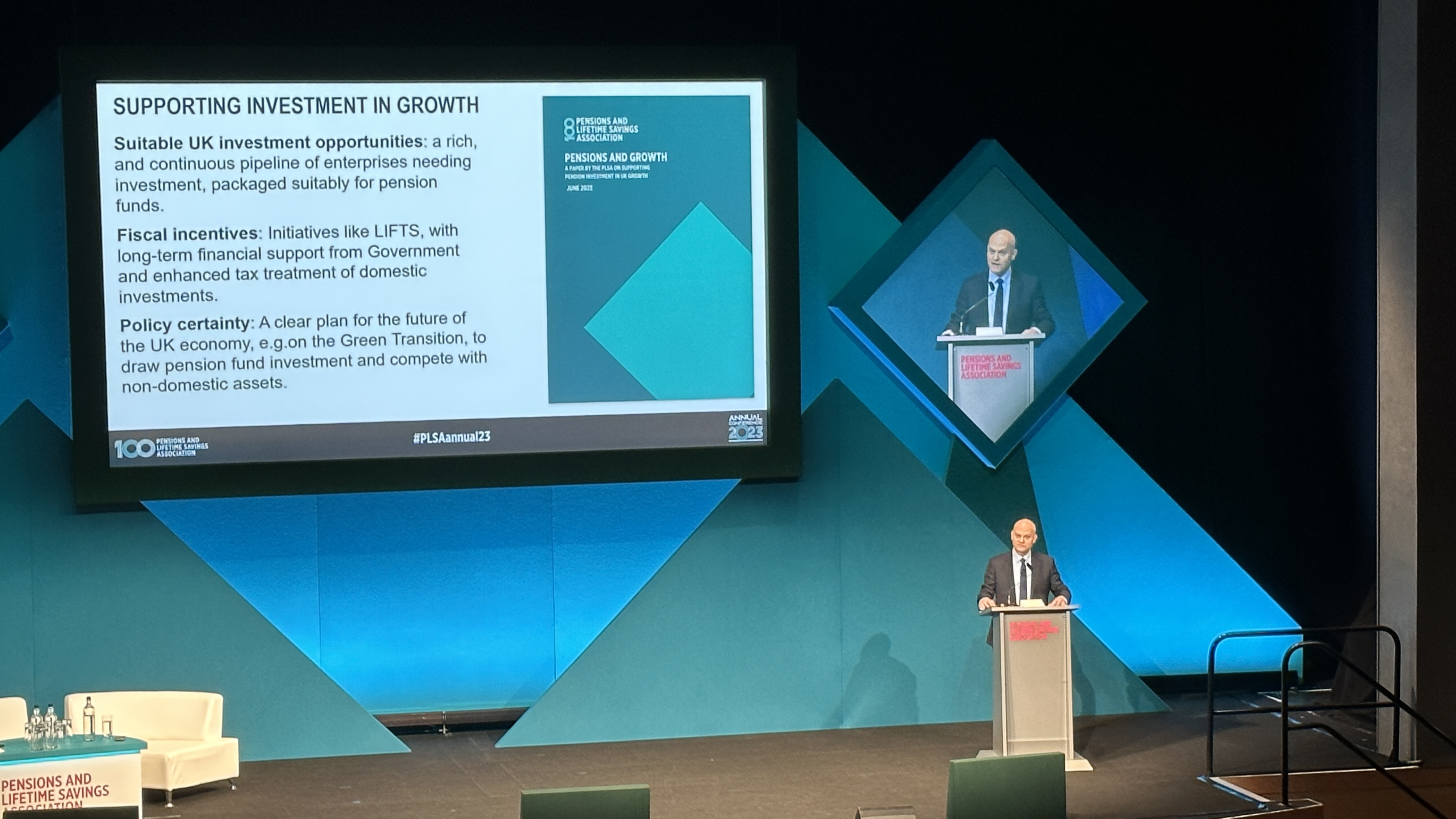

Post Mansion House: What Next for Pensions and Growth

In this morning’s panel, we heard that pension schemes would like more support from the UK government to help them invest in British companies.

What could be a more apposite follow-up then than an interview with Andrew Griffith MP, economic secretary to the Treasury and city minister? Asking the tough questions was the PLSA’s director of policy and research, Nigel Peaple.

Griffith is optimistic that the government and pension schemes’ agendas can align. “Our objective is to support you in delivering great outcomes for members. I see no conflict whatsoever between unleashing productive capital into some of the fastest growing and scaling parts of our economy and delivering benefits to beneficiaries, both in terms of the certainty we can provide them in terms of retirement income, but also in terms of the growth and performance we can deliver along the way.”

He is bullish about the UK economy. “Nobody should talk us down - whether it’s our capital or the amazing infrastructure opportunities, we have a prodigious base in most of the fastest-growing industries, which will continue to grow. You really couldn’t be in a better territory than the UK to invest in those.”

However, he avoided being drawn on whether the DB funding code will change to give schemes more flexibility. “It is not something I can talk about today … It is important the whole range of choice is available to DB including continuing to invest, taking risk and driving forwards investments that members can benefit from.”

Peaple asks Griffith if he has thoughts on additional incentives to attract UK pension fund money into UK investments. UK pension funds are already advantaged, he replies, explaining: “There is a lot of support - we are looking at the ability for long term money to invest alongside patient capital and the British Business Bank. That could provide advantages to co-investing. Nothing is off the table.

“This is a very sophisticated audience, you understand the state of public finances as a consequence of the macro and geopolitical situation we are in. One of the things a responsible government can do for you - because it affects the cost of capital - is good stewardship of the economy and not being promiscuous with public money.”

Peaple asks about long-term policy stability. Given the government has scrapped HS2, is it committed to a long-term regime?

Griffith is not drawn on the HS2 issue, answering: “Big picture, I would say the UK has fantastic stability. We have to be very, very careful here not to look at the noise. This extends on a cross-party basis. There is a commitment to stable long term public finances. We are a top-tier nation, we are in all of the important global forums, the G20, OECD, but also at a geopolitical level, the UK is a cause for good on the world stage. We have the strongest relationships with Australia, the US, and partners around the world.”

He adds: “Point two is institutional stability, for which you can read commitment to the Bank of England; the OBR providing independent forecasts … the UK’s institutional stability is fantastic. Many people investing in capital from around the world see a real dearth of countries where they can look to a long-term commitment to values, institutions, peaceful transitions. It took Germany 11 months to form a government after the last election. Whatever happens in our elections, you get a government up and running the next day. Don’t underestimate that.”

The feeling in the audience after Griffith’s speech was that he had not addressed the challenges UK pension schemes have in investing in UK businesses. Griffith hinted there were more concrete details to come in the Autumn Statement. Let’s hope they are to come.

9.00

Introduction to biodiversity and natural capital

A very good morning from your bright-eyed and bushy-tailed PLSA correspondent. We were greeted on our way in this morning by some climate change protesters, which perhaps makes it even more apt that the first session we’re sitting in on this morning is about biodiversity and natural capital. The speakers are Anastasia Guha, global head of sustainable investment, Redington and Sylvain Vanston, executive director, climate investment research, MSCI. The chair is Marcin Stepan, events manager at the PLSA.

The panel reflects on TCFD and the perspective it might give schemes which are preparing now for TNFD.

Guha says: “Because TCFD came as such a surprise - we were the first country to make it mandatory and it seemed a bit arbitrary that pension funds had to do it which was very tricky - there is some PTSD as a result. People are already on their guard.”

There is some bad news as schemes prepare for TNFD. “The situation is severe. TNFD is a whole new piece of work, language, science to be learnt,” says Vanston. “There is only so much knowledge you can bring from the climate space into the biodiversity space. So there is more homework to do.”

While the state of data is improving, it is starting from a very low point, adds Vanston.

However, there is some good news, says Vanston. “Tools exist, regulation is coming, and it is going to be important to learn how to use those tools.”

Guha adds: “There is new information to understand, but you can use the same tools you have used before: engage, invest and exclude, if required.”

17:30

Harnessing the power of AI

Don’t be afraid of AI, urges Rahaf Harfoush, digital anthropologist, academic and consultant on technology and leadership.

Because AI is changing so quickly, it is pretty democratic, Harfoush says. “AI is changing so fast that nobody really knows what’s going on. Chat GPT launched a whole new range of features last week which means we have to almost re-learn it. You are never too late, you just have to get started. The more you engage, the better you will be at recognising the value of every new tool that comes out.”

She observed: “People talk about the tech - but the tech isn’t going to be about how we use these tools. It’s our humanness that will dictate how we use these tools.”

She gave the audience some key questions they should ask themselves:

-

Where are your customers gathering and are you there listening?

-

How do you ride each uncomfortable new transition of technology in a regular way so that you are constantly taking advantage of these opportunities?

-

If you are living in a world where the answers are always changing, the best thing you can do is get really good at asking questions. Every time a new technology comes out, you should ask yourself: How can we use this tool? Are we building intentional systems of expertise? Are we aligning our tech with our beliefs?

She finished with a very apt quote: “In a world of change, the learners shall inherit the earth, while the learned shall find themselves perfectly suited for a world that no longer exists” - Eric Hoffer

16.30

Pensions in 2035 - the future is now

Welcome back to the auditorium! We’re here with a distinguished panel of pensions folk. They’re being asked to gaze into the crystal ball and imagine where we’ll be by 2035. They are: Chris Curry, director of the Pensions Policy Institute; Steve Webb, partner, LCP; Emma Douglas, chair of the PLSA; Gregg McClymont, executive director, public affairs, IFM Investors; Sarah Smart, chair of the Pensions Regulator.

Let’s look into the crystal ball with them.

Gregg McClymont starts us off: “By 2035, I believe that the halving of private equity fees which was embedded in the Mansion House Compact will have been achieved. UK pension funds will come together having successfully created their own collective vehicle to invest across private markets, learning the lessons from the Pensions Infrastructure Platform.

“By 2035, the UK will have got closer to delivering its very ambitious emissions targets. UK pension funds will be working with government to invest across the UK energy transition, government having become more focused as the deadline for delivering the emissions targets has got closer.”

Carol Young, group chief executive of USS and a PLSA board member is next in the hotseat. “As I cast my mind forward to 2035, I believe we will have seen a real uptick in people relying almost entirely on DC. I hope by then we will see innovation in product design and the ways in which we can support people through that.

“In DC and DB, we will see consolidation, which will be a good thing. It has the potential to achieve economies of scale, giving schemes greater influence in ESG and allowing them to deliver better value for money. Stewardship will matter than ever.”

Steve Webb, partner at LCP identifies two big themes. Like Young, one of his themes is consolidation, both of schemes and of individual pension pots. “By 2035, pensions dashboards will be up and running. We will have proper effective consolidation and far, far fewer pots … We might need a smaller room in 2035 for the PLSA!”

AI is Webb’s second theme. “We haven’t begun to dream about the transformation it will create.”

Sarah Smart, chair of the Pensions Regulator, also picks out consolidation. “After 12 years, we will see the real impact of consolidation. There will be large DB and DC schemes, run by sophisticated and well-trained individuals, still supported by lay trustees. Those people will need to meet a high bar to demonstrate they can look after these significant sums of money. A small number of master trusts will be competing and appealing directly to consumers.

“As a result of the size of these schemes and, to some extent, the similarity of what they are trying to achieve, how they behave and manage those assets will be systemically important across the whole UK financial landscape. That’s why it’s important that the quality of people looking after those assets is high, and policy related to these schemes will be a key consideration across the whole of government.”

Chris Curry, director of the PPI is last to gaze into the crystal ball. “The two big challenges that will face the pensions industry are climate change. It is really important for the industry to embrace it. The pensions industry itself is one of the largest employers in the UK economy. How they work with their employees and how the landscape changes is going to be incredibly important. Pensions saving as a service - understanding what consumers want in relation to climate change - is incredibly important.”

Curry finishes: “Pensions dashboards will be incredibly important. Technology will change the way people interact with all their services. The pensions industry does not have a good track record of adjusting - they need to embrace the change and work in a way that customers want them to work.”

15:00

The Pensions Policy Landscape - What Next?

We’re still in the auditorium for a panel session chaired by John Chilman, chair of the PLSA Policy Board, with Zoe Alexander, director of strategy and corporate affairs at Nest, Neil Mason, chair of the PLSA’s local authority committee, Laura Myers, head of DC at LCP and Robert Orr, chair of the PLSA’s DB committee.

Small pots and decumulation options are a key focus for this year. Pot follows member is the solution for a more mature market, says Alexander. With default consolidation and the scale it would bring, investment and administration efficiencies will be achieved much more quickly.

Myers begins to tackle the decumulation issues. She sets her stall out straight away by calling for innovation. How would CDC work at the point of access. What is the default? Product is only one half of the battle. Knowledge, engagement and communication is the other half.

Now we hear from Robert Orr on the DB funding code. He explains how long we’ve been waiting for this and there’s still lots we don’t know, despite the implementation being scheduled for April 2024. Trustees and employees will need to work together to get to grips with it.

Mason covers the LGPS pooling consultation. The LGPS are looking to the government for clarity on what pooling should look like, he explains. He’s not sure they have that yet, but they do have an instruction to go faster. The message from government is clear: collaborate, accelerate and consolidate.

The panel changes tack a bit and starts talking about the Mansion House reforms. Myers explains how £400bn of assets are now committed to illiquids, after nine of the largest DC schemes committed five percent of their assets under management. This is a big shift from the one percent of DC assets which are currently allocated.

What’s on the panel’s wishlist for the next General Election?

“We need long-term stability and planning,” says Orr, adding the simple message: “I would like the government to pause and reflect. If it is of benefit to members, then they should do it. If it isn’t, then they shouldn’t.”

Inclusivity is top of Mason’s list: “We are servicing some of the lowest paid workers in society. Although it’s a great scheme, some people still can’t afford it. We need to find a way to be flexible enough to encourage people to be part of their pension scheme. Within our current regulatory landscape, that isn’t possible.”

Building trust among consumers is the priority for Myers. “If we are constantly changing regulation and moving the goalposts, we lose trust.”

As well as advocating for a long-term pensions commission, Alexander believes regulators must be more joined up. “The right people in the Department for Work and Pensions should come together with the right people in the Treasury and think hard about pensions. There is a real risk that pensions become an outpost which sits in DWP, and then when a brave idea comes, it is hard to get it through.”

14.15

Now we’re on to the first real session: Making Smart Decisions in Complex Times with Professor Noreena Hertz, Economist and bestselling author, chaired by Carol Young, board member, PLSA.

How will social and political forces change our world over the next 12 years? With the wars, climate change, political uncertainty and economic turmoil, we are in challenging times, says Hertz.

In challenging times, the need to make smart decisions is more important than ever, argues Hertz. And to make smart decisions we need cognitive diversity, built from different skills, different races, different thoughts, different generations. This diversity - bringing different people with different experiences and perspectives - is how we get the best results. Britain saw this first hand with the codebreakers at Bletchley Park in World War II. Abraham Lincoln famously built a team of advisers that would challenge his thinking.

Fact doesn’t give the whole story, because facts don’t account for feelings, argues Hertz. Qualitative insight is how we unlock the rest.

Now we’re hearing about Generation K - those born between 1997 and 2007. The generation born in the era of the iPhone, who socialise, game, get news, find dates, online. How do we interact with this generation?

Many international financial brands are reaching into the metaverse to engage with this generation in a virtual world, explains Hertz.

Despite this generation’s almost surgical attachment to their phones, spending around 8 hours a day online, they are incredibly lonely, she says. Eight out of ten feel lonely, we hear, meaning they are less productive, less engaged and crave connection.

She tells us that there are some big challenges that we all need to think about:

-

How to build teams that are diverse and different

-

How to incorporate qualitative, historical, and sociological insight

-

How to successfully engage Generation K

Her answer: Time to think.

We all need time to think to make smart decisions in challenging times.

14.00

And here we are in Manchester, the first time since 2019. Hasn’t the world changed since then?! Julian Mund, PLSA CEO, opens the conference, reflecting on annual conferences since 1934 in what is the organisation’s one hundredth year. The Pensions Archive Trust are exhibiting at this year’s conference bringing a sense of history and nostalgia to the proceedings!