Data crunch: Only a third of defined benefit schemes extended their recovery plan end date in 2019, but pandemic storms are set to see pension funds entering choppy waters, with insolvency looming for some sponsors and trustees being asked to make tough decisions.

New analysis from Hymans Robertson looked in detail at 1,730 tranche 13 valuations — which occurred between September 2017 and September 2018 and submitted to the Pensions Regulator until the end of 2019 — concluding that only 32 per cent of schemes increased the length of their recovery plan, compared with 50 per cent in 2018.

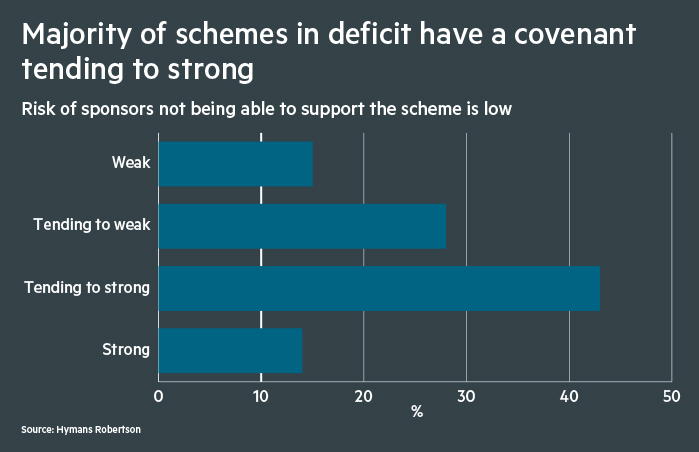

The actuarial company’s benchmarking analysis also revealed that 63 per cent of schemes were in deficit, with average funding on a technical provisions basis at 84.1 per cent, rising to 93.4 per cent when considering all pension funds.

This year has seen around 10 per cent of DB schemes look to defer deficit repair contributions, outside of the normal valuation cycle, via a variety of means including extending recovery plans

Jane Ralph, Barnett Waddingham

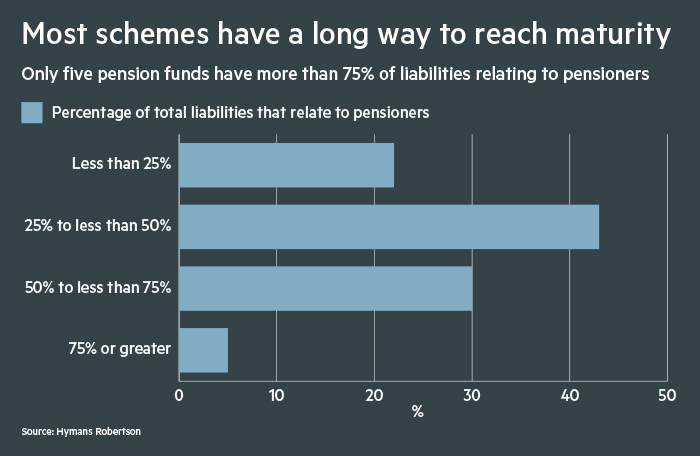

On average, technical provisions were 74 per cent of buyout liabilities — the higher the ratio is the closer the funding target is to the current cost of securing all members’ pensions with annuities.

The research also showed that 68 per cent of recovery plan end dates were shortened or unchanged compared with the previous valuation.

From the ones that prolonged these agreements, one in six (17 per cent) extended their recovery plan end date by up to three years, while 15 per cent did so by more than three years.

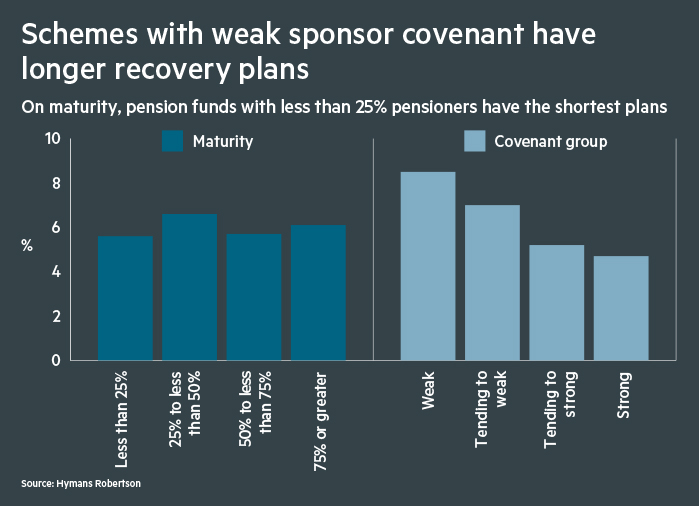

The average and median recovery plan lengths for tranche 13 schemes in deficit was 6.1 years and 5.2 years, respectively.

Reality is now very different

However, the rosy figures are not expected to be current reality, argues Kevin Wesbroom, professional trustee at Capital Cranfield.

He says: “2019 is a different country. Things had started to go rather well for UK pension schemes.

“Many had hedged their interest rate and inflation exposures, and so were not suffering from the crippling effect of reducing interest rates and ballooning liabilities.

“Growth assets were doing pretty nicely and so funding for many was on a positive track — a welcome change from the past decade. But then along came Covid-19.”

Indeed, it is a changed world, as Jane Ralph, principal at Barnett Waddingham, notes: “[This year] has seen around 10 per cent of DB schemes look to defer deficit repair contributions, outside of the normal valuation cycle, via a variety of means including extending recovery plans.”

Yet Mike Smedley, partner at Isio, believes “pension schemes as a whole have been resilient and weathered 2020 remarkably well”.

Even in 2019, the research showed 15 per cent of employers had weak covenants, with the sponsor unable to support the scheme.

However, Richard Farr, managing director at Lincoln Pensions, paints a bleaker picture, estimating that the figure “was nearer 20 per cent then and above 33 per cent now — albeit [comprising] mainly smaller schemes”.

Two-thirds of DB sponsors issue 2020 profit warnings

Covid-19 has had a devastating impact on companies in sectors such as aviation, aerospace, leisure, casual dining, some segments of the retail sector, and charities reliant on fundraising.

Donald Fleming, partner at RSM’s covenant advisory team, notes that the pandemic “has also exposed many whose business models had fundamental weaknesses”.

“Some of these will have fallen into the ‘weak’ category and may be ‘kicking the can down the road’; others will have longer-term recovery strategies and benefit, for example, from wider group support,” he adds.

Research from EY found that nearly two-thirds (61 per cent) of listed DB pension scheme sponsors issued a combined 228 profit warnings in the first nine months of the year, a new annual high.

In these circumstances, it might be tempting for trustees to reach for external covenant reviews, but Mr Wesbroom cautions: “In many cases, a covenant reviewer will not be able to offer much by way of insight, because of the fundamental uncertainly for the economy and individual businesses.

“Trustees will have to rely on their own judgments in a very uncertain world.”

With the spectre of insolvency looming for many, the trustees need to “ensure they have a seat at the table”, stresses Laura McLaren, partner at Hymans Robertson.

She says: “They need to work hard to protect the creditor status of the scheme, and ensure that the scheme is treated fairly relative to other stakeholders. Scheme restructurings or transferring to superfunds may be worth considering.”

There are also other operational steps trustees can take, Ms McLaren notes. These range from “addressing practical concerns, such as ensuring they have access to scheme data and records, through to agreeing how best to communicate with members without causing undue panic”.

“On investments, it is vital to ensure the scheme has sufficient liquidity to avoid running into cash flow difficulties,” she adds.

However, there are no easy answers, according to Mr Wesbroom. He notes that “life is going to be uncomfortable for many schemes as the world come to terms with life post-Covid”.

He says: “Trustees will need to be pragmatic in their dealings with companies — knowing when they need to press for more pension support, but also when to back off to allow the business to survive.

“They will need to be opportunistic, to see if other forms of support can be available, in whatever form is relevant to their particular sponsor.”

Nevertheless, it could be worse, argues Mr Farr. “The only positive news is that if this situation had happened five years ago, it would be much, much worse, [since] smart action by trustees and their advisers who hedged and derisked and diversified” mean many schemes are apt to face the current situation,” he says.