Variations in the levels of investment risk taken by life companies providing insurance for defined benefit pension promises could distort and disrupt the progress of the pensions derisking market, according to experts.

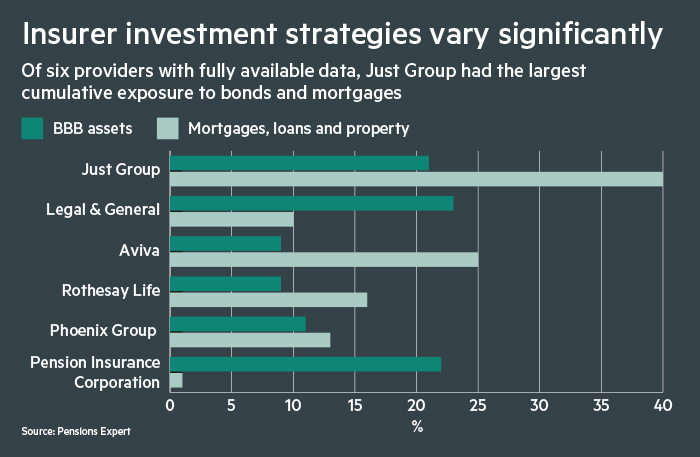

Pensions Expert analysis of bulk annuity insurers’ portfolios reveals that several of the eight UK providers have high exposures to BBB-rated fixed income assets, loans, mortgages and property.

Widening credit spreads, a result of the Covid-19 pandemic, are currently fuelling a buyout bonanza for well-positioned DB schemes and predictions of an enduring strong pipeline over the next decade. But a longer recession and credit downgrades could affect some insurers’ ability to sustain huge volumes of new business in the medium term.

Just 17 per cent of ratings agency Fitch’s sector outlooks are now set to stable, compared with more than three-quarters before the pandemic struck. Downgrades could cause ‘fallen angel’ companies to drop from investment grade to high yield, meaning insurers may have to divert new capital to maintain their position under the Solvency II regime.

Some providers may actually find that because they have historically run a very prudent investment strategy, they are in a position to write new business and use this as an opportunity to invest

Adolfo Aponte, Lincoln Pensions

The polarisation of the bulk annuity market could mean DB schemes in more niche corners of the market find it more difficult to access pricing, but also means schemes must be careful in their due diligence of providers, according to Adolfo Aponte, managing director at Lincoln Pensions and head of the company’s endgame practice.

While some investment markets have regained a sense of normality after their March crashes, Mr Aponte said that there is still “a lot of uncertainty” in credit markets, with questions hanging over the extent and length of the global recession to come.

Mr Aponte said trustees “are very focused on the short-term volatility that took place in March, whereas for life insurers investing for the long term, it’s that 18 to 24-month window that will dictate how they will perform”.

Measuring the exposure of insurers to BBB-rated bonds and property, mortgages and loans can only give a rough indicator of performance – a more detailed analysis might examine sector exposures and distinguish between property, loans and mortgages, for example. There are also key differences between monoline insurers and diversified businesses.

A recent note from Legal & General outlined the steps that insurers can take to mitigate these impacts, touting its low exposure to under-threat sectors. Chris DeMarco, managing director of UK PRT at the company's institutional retirement business, said: “At times like this, financial strength is especially important and alongside this, trustees should also be considering an insurer’s investment strategy. As a group, using our comprehensive range of in-house capabilities, we aim to avoid downgrades and defaults, and not simply to beat a benchmark. Our portfolio, for example, has very limited exposure to airlines, hotel, leisure and traditional retail, which may be particularly affected by current events.”

But with an air of uncertainty hanging over large swathes of the economy, the analysis does outline the idea that not all insurers are created equal. “There are providers in the market that are perhaps less exposed to some of the specific risks that we’ve been discussing,” Mr Aponte said.

“Some providers may actually find that because they have historically run a very prudent investment strategy, they are in a position to write new business and use this as an opportunity to invest,” he continued.

Due diligence to the fore

For DB trustees, the analysis has different implications depending on the stage of the derisking journey at which they find themselves.

Trustees of schemes that have moved to a full buyout have discharged their duties and ceased to be responsible for member benefits, although a 2019 High Court ruling blocking a back book transfer between Prudential and Rothesay Life upheld member concerns over the provider chosen from them by the exiting Pru. The decision is being appealed.

Buy-in investors are similarly powerless to redeem their arrangements, but may keep one eye on the strength of their counterparty if the country enters a severe recession.

Instead, the strength of the UK’s insurers is likely to be of chief concern for those boards planning to approach the market or in the process of seeking quotes, with Mr Aponte warning that the strictures of the UK’s insurance regulation do not absolve trustees of a responsibility to do due diligence.

“What we used to find, probably two or three years ago, was that the counterparty question only came in at the end of the process, which was when you had already selected a provider and the choice was this provider… or do I stay with my covenant,” Mr Aponte said.

Small schemes maintain traction

Another fear is that market stresses could temporarily shrink the bulk annuity market for its more niche clients, such as small schemes, as insurers pause to raise more capital.

But Adam Davis, managing director at K3 Advisory, said that smaller deals are attracting good levels of interest from providers. “I did a £9m scheme where we got three insurers to quote,” he said.

For larger deals such as the £66m buy-ins bought by the NG Bailey Scheme at the end of April, five of the eight providers active in the UK were able to quote.

This diversity of choice means that while worsening credit conditions could stop the bulk annuity market from reaching the £37bn of annual transfers predicted by Hymans Robertson in April, quotations are unlikely to freeze up altogether.

According to Mr Davis, insurers have so far found it easy to raise capital, owing to the profitability of bulk annuity business, making it “one of the main growth areas for insurers in the UK”. Several of the UK's bulk annuity providers have successfully completed debt issuances in recent months.

And while he said covenant analysis, along with member experience, is an important factor when considering insurers quoting at similar prices, for most trustees insurance will always be a relatively safe option.

“An insurer’s covenant strength dwarfs what most schemes have with their sponsor,” he said.