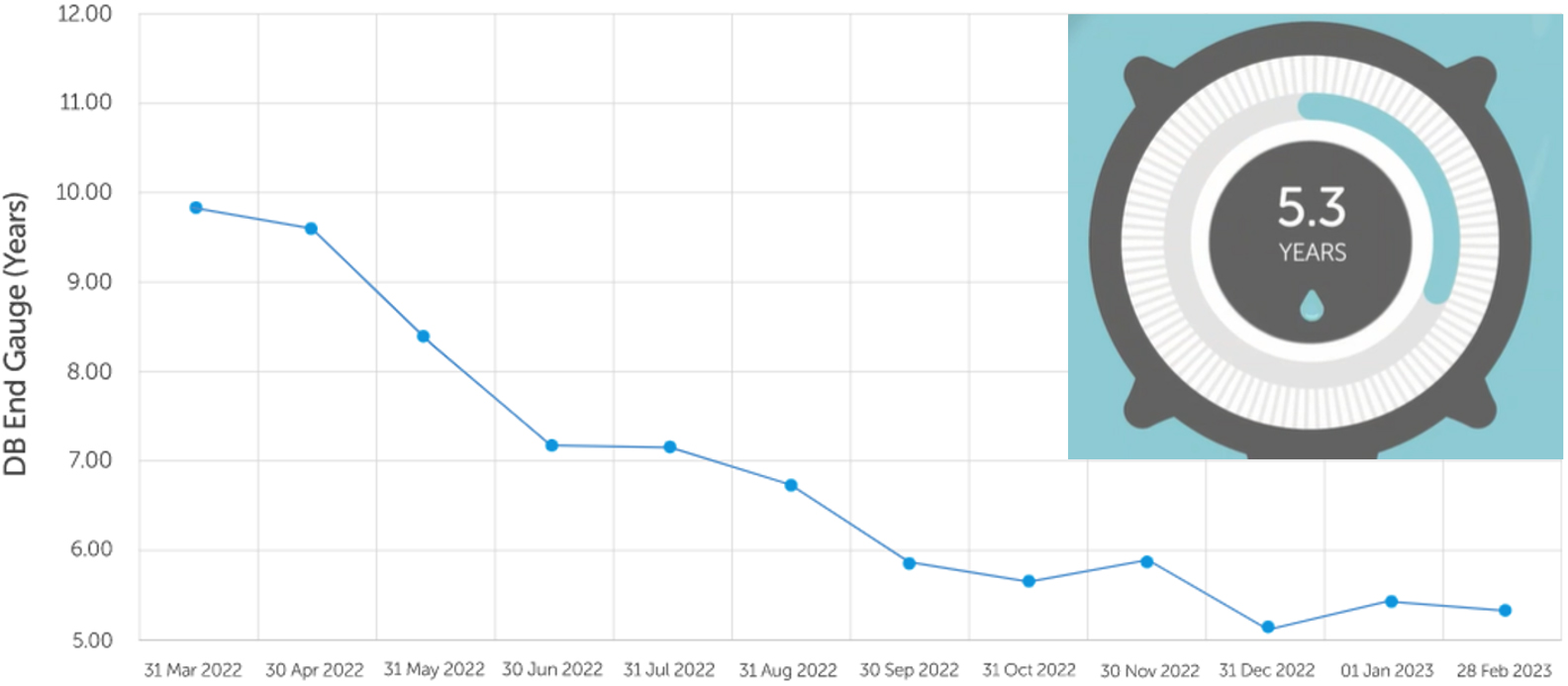

So it is not exactly five years, but 5.3 years to be precise. That is what Barnett Waddingham’s DB End Gauge index tells us is the average time for defined benefit pension schemes to be able to buy out their liabilities as at February 28 2023.

This is almost half the time estimated only 12 months ago.

Indeed, most of the 5,000 or so DB schemes left in the UK are now closed to both new entrants and active members, and due to significant rises in gilt yields and (potentially) falling future life expectancy, funding levels are at record highs, suggesting buyout is imminent.

But just how realistic is it for all of the DB schemes to be bought out in the next five years, or even the next 10 years, or 20 years for that matter?

For example, if, as many predict, 2023 sees record buyout volumes similar to those seen in 2019 when £44bn of liabilities were secured, with more than £2tn of private sector buyout liabilities remaining in the UK, it would still take around 50 years to buy out all of these liabilities if record volumes are secured year after year.

The DB End Gauge index showing the average time for DB schemes to be able to buy out their liabilities over the past 12 months

Source: https://www.barnett-waddingham.co.uk/db-end-gauge/

Granted, overall buyout liabilities are shrinking, partly due to closed schemes getting smaller, but mostly due to yields rising, which reduces the value of a scheme’s buyout liabilities, reducing the amount of capital required to secure each transaction.

Indeed, estimates by Aon suggest that if yields had remained at the level they started in 2022, the UK bulk purchase annuity market may have surpassed £35bn in 2023 instead of just under £28bn – something it says has left insurers with “spare capital” for transactions in 2023.

The resource capacity crunch

In addition to this spare capital, insurer balance sheets proved resilient throughout the market turbulence of 2022 and solvency positions reached record highs in the second half of the year, providing ample capacity for the momentum to continue into 2023. This will free up capital for some of the mega-deals that many are predicting will come through this year.

The Pension Insurance Corporation has already completed the largest bulk annuity transaction to date in the UK, a £6.5bn buy-in of RSA’s two UK pension schemes.

New sources of capacity are emerging to lessen the burden on existing insurers and reinsurers. This includes “funded reinsurance”, drawing in new entrants such as asset management companies, hedge funds, private equity funds, etc, into the reinsurance market.

However, the “capacity crunch” does not just refer to insurers’ – and reinsurers’ – ability to provide the capital needed to support transactions, but also the “resource capacity crunch”. This is insurers’ ability to price and process transactions to meet the growing demand, which is likely to be the biggest constraint for the BPA market in the coming years.

This is exacerbated as buyout liabilities fall – and as the biggest schemes are bought out first, leaving only the smaller pension schemes left to insure – which means more transactions will be required to secure the same volume of overall buyout liabilities each year.

More transactions require more pricing and processing. To address this, most BPA insurers are recruiting right across the board, from the pricing side all the way through to post-execution teams.

Insurers are also turning to technology to improve efficiency and streamline the pricing process, but they are still being selective about which transactions to quote for. This often leads to challenges for the smaller deals to compete for insurers’ attention.

Comparisons with the US market

It is a similar story across the pond, with the US pension risk transfer market recording another record-breaking year in 2022.

It saw an estimated $53bn (£43bn) in total market volume, according to a report by Legal & General, easily surpassing the previous record of $38bn in 2021. This included the $16bn IBM mega-deal in the third quarter of 2022.

As in the UK, demand for PRT in the US is being primarily driven by improved funding positions as a result of rising interest rates. But there are other factors at play, including the per participant rate that sponsors pay to the US Pension Benefit Guaranty Corporation – the equivalent of the Pension Protection Fund in the UK – which has more than doubled from $42 in 2013 to $96 in 2023, encouraging plan sponsors to turn to PRT to mitigate these costs.

Additionally, the PRT market in the US has been playing catch-up with the UK over the past 10 years, with market volumes increasing and more transactions being announced publicly, fuelling interest among other plan sponsors.

Capacity will govern the BPA market

However, with more than $3tn of buyout liabilities across US DB corporate pension schemes, the record-breaking $53bn secured in 2023 represents less than 2 per cent of that figure. This means that as in the UK, it would take around 50 years to buy out all of these liabilities if record volumes are secured year after year.

Reinsurance barely existed in the US PRT market before 2017, and most PRT insurers in the US still do not use reinsurance. But this is changing and, just as expected in the UK, innovation and the emergence of new entrants in the US PRT market – both insurers and reinsurers – will help to provide more capital to meet the growing demand.

But new entrants bring their own recruitment needs, heightening competition for scarce human resources, and therefore it seems the resource capacity crunch will be a key factor in determining the markets’ ability to meet demand on either side of the Atlantic Ocean.

Rob Hammond is a client director in BWD’s investment, pensions and actuarial team, and the author of the Ask the actuary blog.