On the go: Investment management fees across some asset classes have moved upwards after years of decline, according to new research.

Private markets and active equity fees rose between 2019 and 2021, according to LCP’s findings, a move driven by the consolidation of asset managers and the maturing of pension schemes.

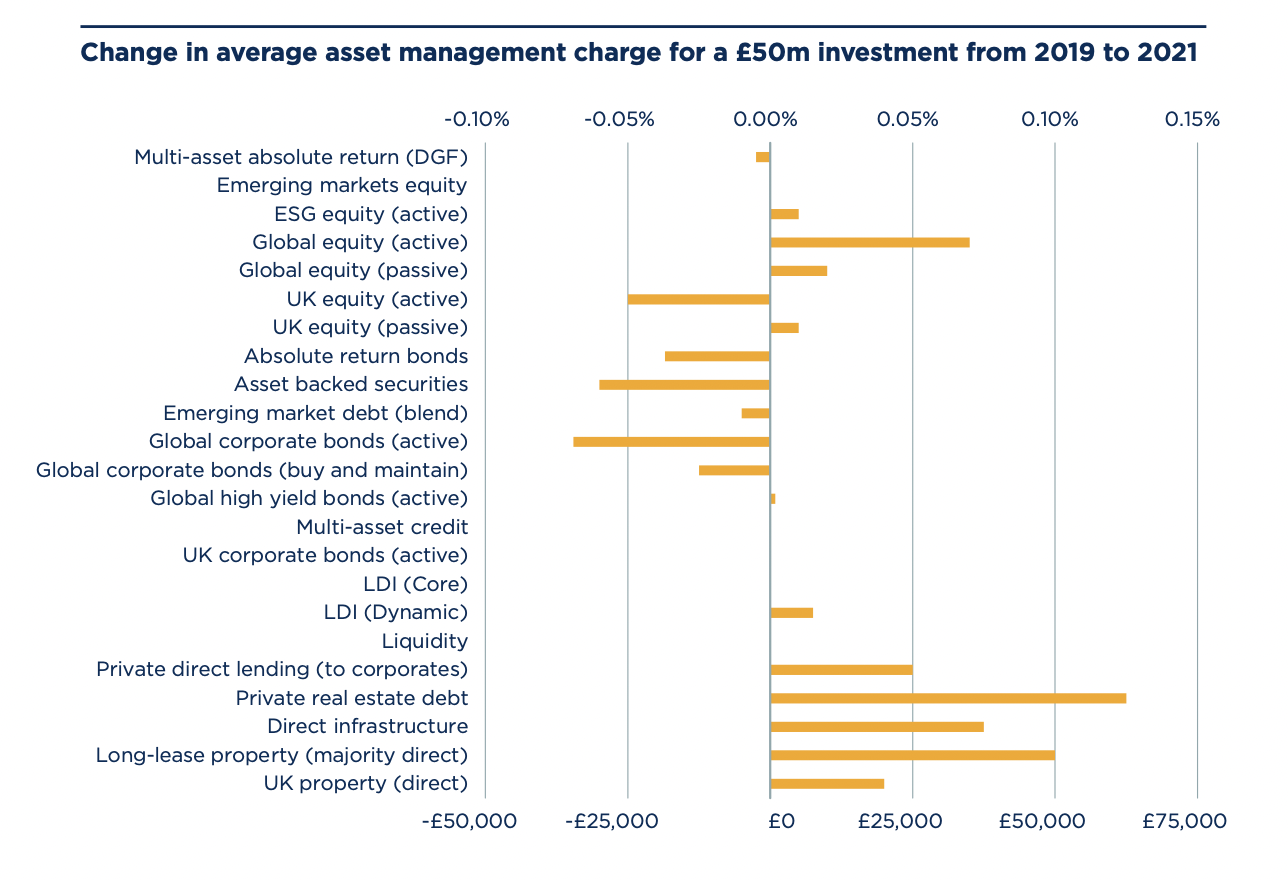

The consultancy’s research found that on a £50mn investment mandate, long-lease real estate fee rates increased at an annual rate of 0.1 per cent, which translates as a rise of £50,000.

Infrastructure fund fees rose by 0.08 per cent, or £40,000, while active equity fees lifted by 0.07 per cent, or approximately £35,000.

Source: LCP

Prior to this rise, fees across asset classes had gradually fallen during the past decade, a trend set against rising costs for managers.

New reporting regulations such as Mifid II, and changes to the ways managers can pass on third-party research costs, have pushed up fees.

Some asset managers have sought to rein in costs through mergers, which LCP’s paper hypothesised could be responsible for handing negotiating power back to managers and subsequently pushing up fees in various asset classes.

Notable mergers include Columbia Threadneedle’s acquisition of BMO’s Emea asset management business last year, and Franklin Templeton’s purchase of Legg Mason in 2020.

The changing profile of UK schemes has also played its part. LCP investment partner Matt Gibson noted that as pension schemes mature, “we’ve seen trustees derisking their asset portfolios by moving away from equities and towards asset classes which are seen as lower-risk sources of return and income generation”.

There is therefore rising demand for asset classes including private direct lending, long lease property and infrastructure.

Other asset classes continue to fall in costs, such as global active corporate bonds, which fell by 0.07 per cent a year since 2019.